Broadcom (AVGO 3.26%) is playing a key role in supplying data centers with custom chips and networking products. Strong revenue and free-cash-flow growth have pushed the stock to new highs this year, with shares up 54% year to date through market close Oct. 13.

The stock is up more than 500% since the end of 2022, when the artificial intelligence (AI) boom started. However, there are important reasons why the stock will likely climb higher in 2026 and beyond.

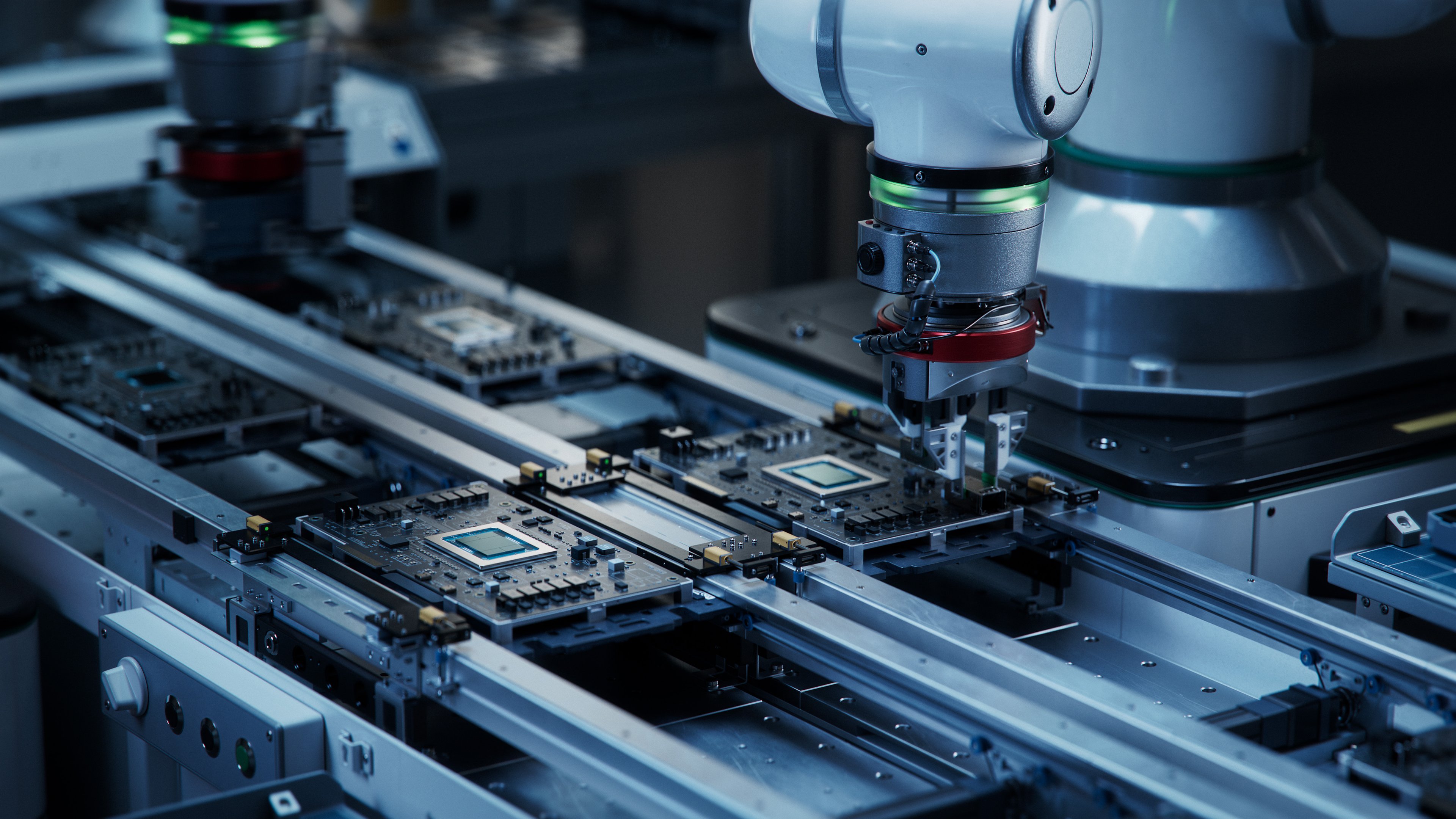

Image source: Getty Images.

Broadcom is printing cash

Broadcom has a long history of delivering profitable growth, which has led to market-beating returns. Its free-cash-flow growth has accelerated over the last year. Free cash flow through the first three quarters of fiscal 2025 was 40% larger than the year-ago period. This shows Broadcom's margins expanding from higher sales of custom AI accelerators and strong growth from its software business.

NASDAQ: AVGO

Key Data Points

Its order backlog hit a record $110 billion, which is significantly higher than its trailing-12-month revenue of $60 billion. Spending on AI infrastructure by hyperscalers is expected to reach $350 billion this year, meaning more money could be headed Broadcom's way. Data center spending is expected to grow into the trillions by the end of the decade.

Broadcom's cash-rich business should fuel investment in more innovation that rewards shareholders. This is a quality semiconductor stock to profit off of the AI boom.