Over the last three decades, investors have pretty consistently had a game-changing innovation or next-big-thing trend to pique their interest. Examples include the advent of the internet, genome decoding, nanotechnology, 3D printing, blockchain technology, the metaverse, and most recently the rise of artificial intelligence (AI).

But in rarer instances, multiple next-big-thing trends have coexisted, such as we're witnessing now with the AI revolution and the emergence of quantum computing.

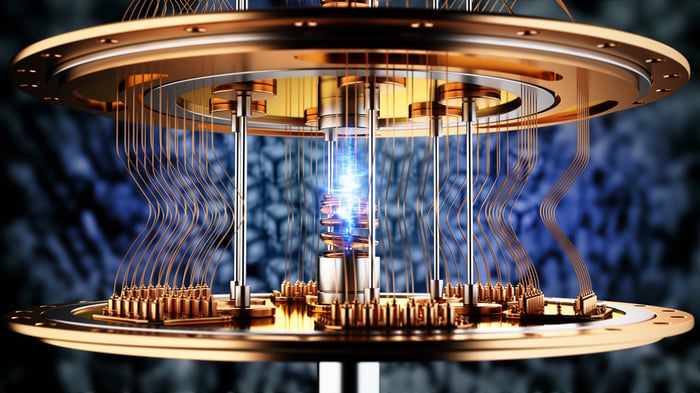

Quantum computing relies on quantum mechanics and specialized computers to solve complex problems that traditional computers can't perform. Quantum computers can potentially speed up drug discovery, kick the learning aspect of AI algorithms into overdrive, and have the ability to make cybersecurity platforms more secure, among other real-world use cases.

Image source: Getty Images.

Although addressable opportunity estimates vary wildly for quantum computing, some see this technology approaching or reaching $1 trillion in added global economic value by 2035 to 2040. This is a big enough number to support multiple winners, and as well as entice growth-seeking investors.

Wall Street's most popular quantum computing pure-play stocks have absolutely soared over the trailing year (as of the closing bell on Oct. 10):

- IonQ (IONQ -6.04%): 620% gain

- Rigetti Computing (RGTI -6.00%): 5,710% gain

- D-Wave Quantum (QBTS -1.58%): 3,600% gain

- Quantum Computing, Inc. (QUBT -2.30%): 2,780% gain

Though gains of this magnitude tend to attract investors, they can also expose the hype and monumental risks facing the quantum computing revolution. The following four headwinds all have the potential to derail the parabolic ascents IonQ, Rigetti, D-Wave, and Quantum Computing, Inc. are enjoying.

1. History is no friend of early-stage innovations

The first undeniable issue for Wall Street's four quantum computing pure-play stocks is that history hasn't been wrong about hyped technologies and next-big-thing trends in over three decades (if not longer).

Specifically, hyped technologies and innovations have always endured an early innings bubble-bursting event. This is to say that investors have predictably overestimated the utility and/or adoption of a newly introduced technology or trend, which eventually leads to lofty growth projections not being met. We witnessed this pattern play out with the proliferation of the internet, genome decoding, the rise of China stocks, nanotechnology, 3D printing, blockchain technology, cannabis, and the metaverse.

Nothing about the rise of quantum computing suggests it's going to be the exception to this unwritten rule. While there's plenty of real-world promise with this technology, businesses aren't anywhere close to optimizing its solutions or generating a positive return on quantum computing investments.

All the hallmarks of a bubble are firmly in place, based on what history tells us.

2. Capital-raising efforts are likely to dilute existing shareholders

A second significant risk for IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing, Inc. is the very real possibility that they'll need to dilute their shareholders (on numerous occasions) to raise capital and keep the lights on.

In spite of substantial sales growth potential for all four companies over the next couple of years, they're collectively losing a boatload of money from their operations and burning through what cash they have on their balance sheets. Operating losses through the first six months of 2025 are as follows:

- IonQ: $236.3 million

- Rigetti Computing: $41.5 million

- D-Wave Quantum: $37.8 million

- Quantum Computing, Inc.: $18.5 million

With these companies unproven from an operating standpoint, traditional credit and debt solutions may be limited. In other words, issuing stock and increasing their outstanding share count may be the only surefire method of raising capital in the coming years, which would be expected to adversely impact shareholders.

Image source: Getty Images.

3. Historically high valuations can't be justified

If you think the stock market is historically pricey, take a closer look at Wall Street's pure-play quantum computing stocks!

Keeping in mind that "value" is a subjective term with no perfect blueprint on Wall Street, the time-tested price-to-sales (P/S) ratio leaves little room for error or ground to stand on when attempting to justify the existing valuations of IonQ, Rigetti, D-Wave, and Quantum Computing, Inc.

Following the advent and proliferation of the internet, leading businesses, such as Cisco Systems, Amazon, and Microsoft, peaked with trailing-12-month (TTM) P/S ratios in roughly the 30 to 40 range. Historical precedent has repeatedly shown than P/S ratios of 30 or greater aren't well tolerated or sustainable on Wall Street.

On a TTM basis, the stock market's quantum computing darlings are sporting respective P/S ratios of (rounded to the nearest whole number):

- IonQ: 308

- Rigetti Computing: 1,406

- D-Wave Quantum: 379

- Quantum Computing, Inc.: 8,965

Even if we look at Wall Street's consensus sales estimates for 2029, four years from now, we're still talking about projected P/S ratios of 30 to 90, which is historically unsustainable.

4. The deep pockets of the "Magnificent Seven" are an undeniable threat

The fourth and final monumental risk for quantum computing's Fab 4 pure-play stocks is the Mag 7.

Wall Street's "Magnificent Seven" stocks represent its most influential businesses in AI, cloud computing, and advertising, among other ventures. These are seven of the 10 U.S.-traded stocks to have ever reached the trillion-dollar market cap plateau. Most importantly, with the exception of Tesla in recent quarters, the group's members are all generating boatloads of operating cash flow. So much, in fact, that mammoth share buyback programs and/or dividend payments have become commonplace.

Currently, Amazon's quantum computing service Braket is giving clients access to specialized computers from IonQ and Rigetti Computing. But it seems unrealistic to expect Amazon and its Mag 7 peers to outsource their quantum computing infrastructure needs when they have more capital than they know what to do with and a desire to be the on the leading edge of every next-big-thing innovation.

While there's little doubt that IonQ, Rigetti, D-Wave, and Quantum Computing, Inc. have first-mover advantages within this arena, the considerably deeper pockets and influence of Mag 7 companies give them a longer-term edge.