When Ken Griffin moves, Wall Street listens. The billionaire founder of Citadel isn't known for emotional investing or chasing hype. Rather, his trades are guided by data, risk models, and a relentless pursuit of alpha.

So when recent filings revealed that Citadel trimmed nearly half its stake in Palantir Technologies (PLTR 1.14%) while increasing its position in Chipotle Mexican Grill (CMG 0.93%) by roughly 167%, it caught investors' attention.

At first glance, this rotation seems puzzling: Why move away from an AI darling like Palantir and into a restaurant chain whose fortunes rise and fall with burrito demand?

Beneath the surface, I think Griffin's trades may reflect something deeper -- a master class in valuation discipline, portfolio balance, and long-term positioning in a market where narratives often outrun numbers.

NASDAQ: PLTR

Key Data Points

Why Ken Griffin trimmed Palantir: Valuation, risk, and rational profit-taking

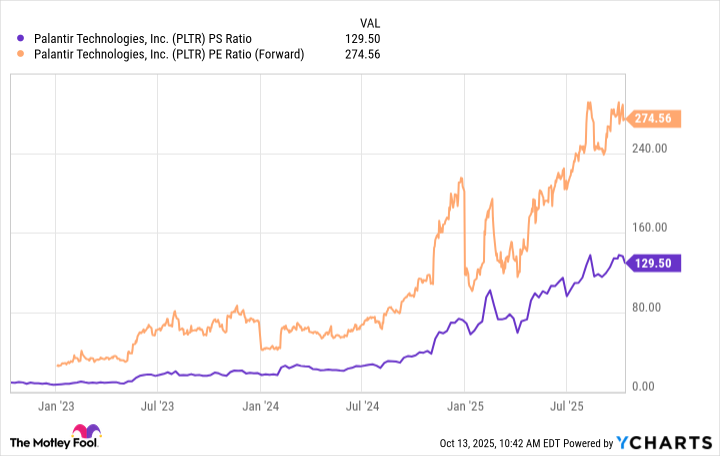

Palantir has been one of Wall Street's most polarizing stocks throughout the artificial intelligence (AI) revolution, with its valuation soaring to dizzying heights. The company's forward price-to-earnings (P/E) and trailing-12-month price-to-sales (P/S) multiples remain steep by virtually any standard.

PLTR PS Ratio data by YCharts

From a hedge fund's perspective, unloading a sizable portion of a high-flying growth stock isn't necessarily a bearish signal. Griffin's move likely reflects disciplined portfolio management -- the kind that locks in profits while the broader market continues to price perfection into every AI-related name. In other words, trimming a position that has already multiplied in value is the professional version of "selling high."

This isn't a rejection of the AI thesis; it's an acknowledgement that valuation fundamentals still matter, even in the midst of technological paradigm shifts. For funds that thrive on quantitative data, Palantir's cocktail of premium pricing and early stage growth can justify a measured pullback.

In short, Griffin's decision to reduce Citadel's stake in Palantir isn't contrarian -- it's classic. When markets reward narratives faster than sound fundamentals, the smartest money quietly takes some chips off the table.

Image source: Getty Images.

Why Citadel might favor Chipotle now: Buying quality into weakness

In June 2024, Chipotle executed a 50-for-1 stock split that initially fueled a surge of investor enthusiasm. Like many companies that split their shares, the stock rallied in anticipation -- but the euphoria was short-lived.

After the split, Chipotle's shares plunged and remained volatile for months. A major driver of that instability was an executive shakeup: longtime CEO Brian Niccol left to lead Starbucks, creating uncertainty about Chipotle's direction.

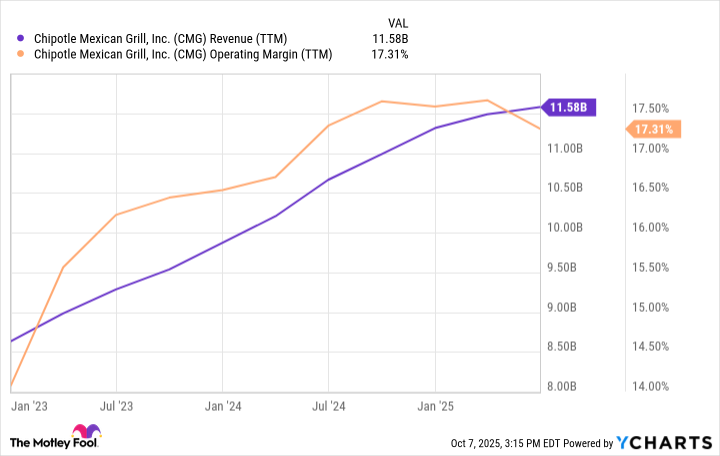

For several quarters now, Chipotle has left plenty to be desired. Revenue growth plateaued, the operating margin is under pressure, and same-store sales have turned uneven.

CMG Revenue (TTM) data by YCharts

The market noticed -- shares now trade at a forward P/E of just 33, hovering near a five-year low.

On the surface, that may look like a disaster. But taking a step back -- and perhaps thinking like Griffin -- the picture becomes more nuanced.

From a macro standpoint, inflation continues to erode consumer purchasing power. Menu prices across restaurant chains and fast-casual dining venues hit a psychological ceiling, with peers like Sweetgreen and Cava echoing similar headwinds. This slowdown may appear discouraging, but it's precisely the kind of setup that can attract savvy investors.

My view is that Citadel sees an inflection point -- a moment when the market prices in stagnation just as the fundamentals are quietly bottoming and preparing for recovery. Griffin's accumulation of Chipotle stock isn't a blind vote of confidence in burrito demand; it's a calculated bet that a best-in-class restaurant brand is facing temporary margin compression, not irreversible structural decline.

While headlines fixate on sluggish growth, Citadel is likely looking a few quarters ahead -- toward easing input costs, improving operational leverage, and a normalization in foot traffic as consumer spending stabilizes.

Against that backdrop, I do not think that Griffin knows anything that the rest of Wall Street does not. Rather, I think Griffin appears to be trimming exuberance where valuations are running hot, and adding exposure where sentiment has turned cold.

Palantir may continue to capture imaginations, but Chipotle is capturing institutional cash flow -- and for long-term investors, that may prove to be the more profitable ingredient.