Intuitive Surgical (ISRG 1.51%) is a growth stock, hailing from the medical-device segment of the broader healthcare sector. It makes the da Vinci surgical robot system, which is one of the leading choices for surgical robotics.

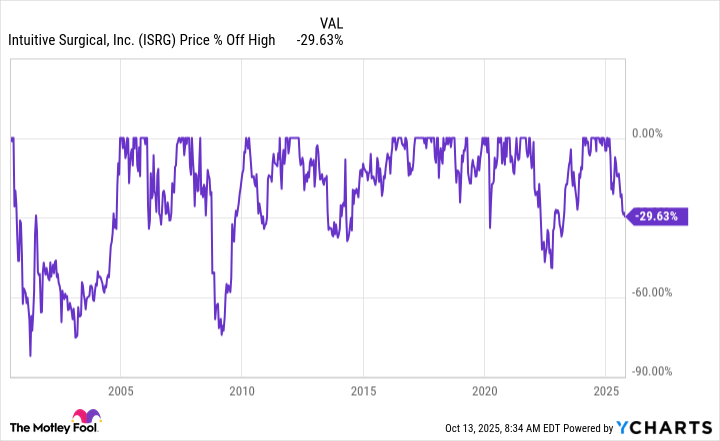

The company's stock price is down around 30% from its 52-week high, so now could be a good time to consider buying Intuitive Surgical. Here are three things to know if you're looking to add it to your portfolio.

Image source: Getty Images.

1. Intuitive Surgical is at the cutting edge (and growing)

Using the words "cutting edge" is a bit of a pun, but given Intuitive Surgical's focus on surgical robots, the subhead above is true. The medical-device maker was one of the first to commercialize this technology.

Surgical robots make surgery safer, but they also can allow for better patient outcomes because they're often less invasive than other options. The technology has interesting long-term appeal, as well.

For example, a robot could be located in one country, while the operator could be located in another. That would give the healthcare industry the ability to provide world-class care anywhere a surgical robot is located. This is why, despite Wall Street's currently dour view of the healthcare stock, Intuitive Surgical is still selling plenty of da Vinci systems.

For example, in the second quarter of 2025, the company placed 395 new systems into service, up from 341 in the year-ago period. The total number of da Vinci systems is now 10,488, up 14% from a year ago, and the number of procedures the company's surgical robots performed increased 17% year over year.

In other words, there's still a growth story here. Sure, it gets more difficult to grow the installed base as more and more da Vinci robots get deployed -- that's just how things work. However, the growth story isn't over, even though Wall Street is downbeat on the stock.

2. The big money isn't in the robots

The installed base of da Vinci robots is really important, and it's good that the numbers keep rising. But the real business here isn't actually selling the robots anymore. In fact, robots make up a little less than 25% of the top line of the company's income statement. That's not really surprising when you consider the way the robots are used.

Surgery requires the use of many consumable items that have to be replaced after every procedure or at least regularly. That's not any different because a da Vinci robot is being used. That's why parts (the line item on the income statement is technically "Instruments and accessories") make up roughly 60% of Intuitive Surgical's sales. The rest of the top line is services, which is basically installation and maintenance of da Vinci systems.

NASDAQ: ISRG

Key Data Points

Both of these revenue sources are like annuities for Intuitive, because they generate recurring income. It's important to monitor the growth in the installed base, but the real story is the beneficial impact it has on the parts and services revenue that Intuitive Surgical generates over time.

3. The stock is cheaper than it has been

A value investor isn't likely to find Intuitive Surgical attractive, noting that its price-to-sales ratio (P/S) is a lofty 17x or so and the price-to-earnings ratio (P/E) is also high at nearly 60x. On an absolute basis, Intuitive Surgical is a pricey stock. However, if you have a growth stock bias, you might still want to take a look.

Data by YCharts.

The company's five-year average price-to-sales ratio is around 18.6x. The longer-term average price-to-earnings ratio is roughly 72.5x. The recent pullback in the growing business has left the stock's valuation lower than it has been in a while. It isn't cheap, but it is cheaper, which might interest more aggressive investors. If you look back historically, a drawdown of the current size (roughly 30%) isn't actually all that unusual (see chart above).

Not for the squeamish, but a potential opportunity

A stock with a 60x P/E ratio is going to be appropriate for a relatively small set of investors. You'll need to believe that Intuitive Surgical's business is still growing its installed base -- which it is -- and that the installed base will lead to material recurring revenue -- which so far it has.

You'll also need to believe that a 60x P/E ratio is attractive, which the five-year average 72.5x P/E ratio suggests it may be, relatively speaking. All in, for more aggressive growth investors, Intuitive Surgical could be worth a deep dive right now.