I think something big is happening in the quantum computing industry. I have kept my hands off pure-play quantum stocks like Rigetti Computing (RGTI 8.46%), IonQ (IONQ 7.54%), and D-Wave Quantum (QBTS 8.61%) so far because they look so risky. But they are getting a helping hand from financial juggernauts this week. Maybe it's time to take another look at this exciting technology?

NYSE: IONQ

Key Data Points

The standard quantum stock story

You know the drill, right? Every step a quantum computing specialist takes forward must inspire as many risk warnings as growth projections.

-

D-Wave did something cool, but it burned $35.8 million of cash in the first half of 2025. You should buy Alphabet (GOOG 0.02%) (GOOGL 0.05%) stock instead, because that's arguably who started the quantum computing boom in 2024 anyway.

-

Rigetti landed a great system sale, but it spent $13.5 million on research and development (R&D) in the last quarter while collecting just $1.8 million of revenues. IBM (IBM 0.82%) is flush with cash and has worked on quantum computing for decades -- try Big Blue's stock instead.

-

IonQ launched a federal contracts division and acquired several smaller quantum technology companies. Honestly, where is the cash coming from? Even Microsoft (MSFT 0.83%) is developing quantum computing systems. Any tech titan worth its name must be a better investment than IonQ.

Yeah, you've seen these headlines over the last year and I probably wrote some of them. And to some degree, I still think that's the right idea. The Rigettis and IonQs of the world face more risks than opportunities if you ask me. I'll lose less sleep over the quantum computing progress or missteps of Alphabet, Microsoft, or IBM, because they can afford to run billion-dollar R&D programs without risking their financial future.

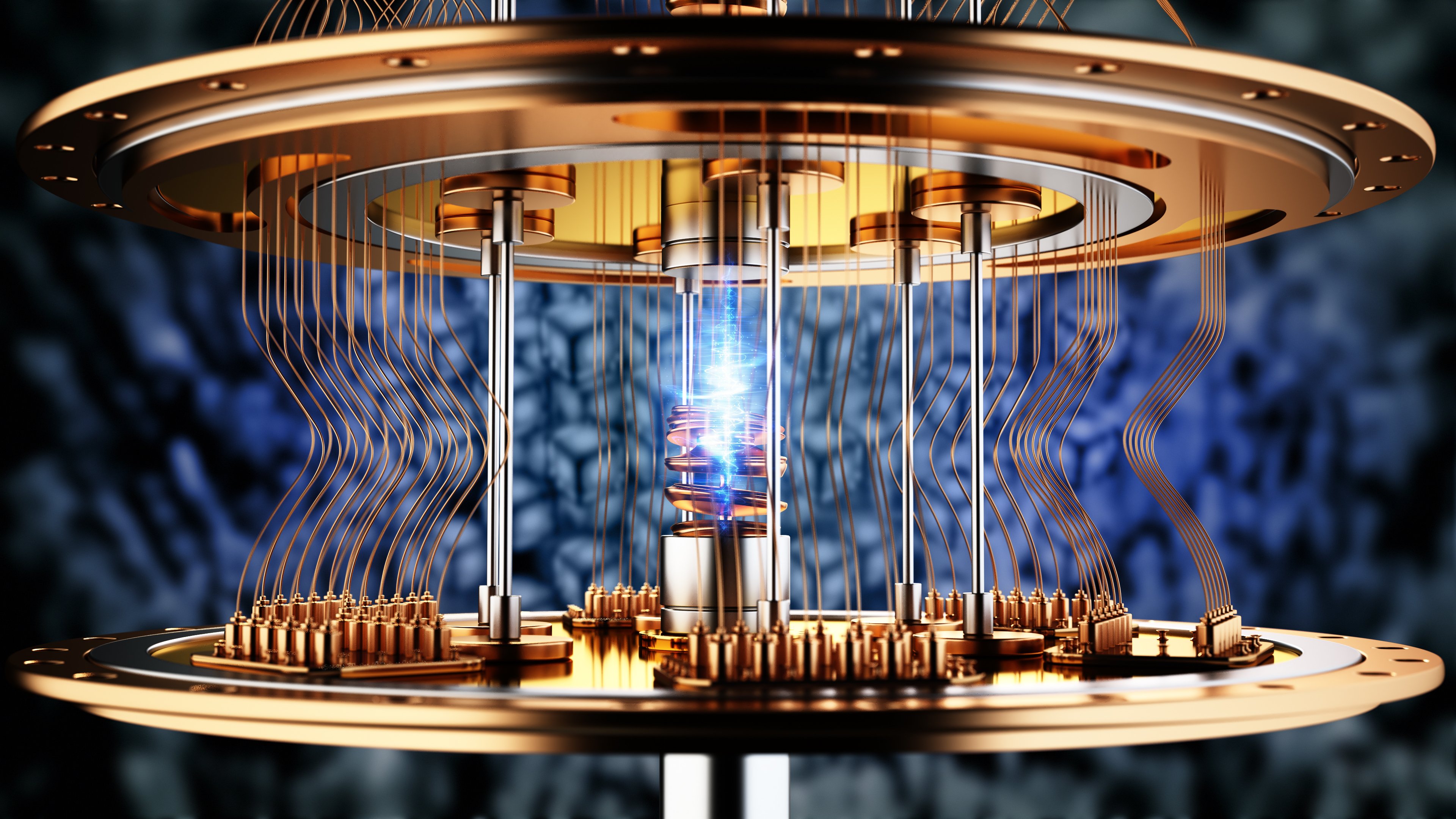

Image source: Getty Images.

Follow the money!

Well, maybe I should reconsider that attitude.

You see, the quantum experts are raising lots of cash right now, with the help of some sophisticated institutions. IonQ is selling 16.5 million new shares to a unit with ties to financial services giant Susquehanna. It's not even a sweetheart deal at a deep discount -- Susquehanna's Heights Capital arm is paying $93 per share, which is a 20% premium over IonQ's share price when the stock sale was announced.

Digging deeper in that press release, you'll also find that JPMorgan Chase (JPM 0.31%) played the underwriter role in this deal. It's a fairly low-risk move when setting up a stock sale between a public company and a deep-pocketed investment firm, but I still see a giant seal of approval behind the scenes. $2 billion isn't pocket money, even for financial titans like Susquehanna and JPMorgan.

But wait -- there's more. JPMorgan's helping hand may be related to the other big news in quantum computing investments. JPMorgan had already committed to investing $1 trillion in "security and resiliency" technologies over the next decade. The funding rose to $1.5 trillion this week, along with a more precise list of target industries. Yep, the bank highlighted quantum computing as an area of specific interest.

Mind you, it's a $1.5 trillion investment plan over 10 years, with just $10 billion set aside for direct JPMorgan investments in the near future. That's still a lot of money, but not in the eyebrow-raising trillion-dollar range.

NASDAQ: RGTI

Key Data Points

Banks can help, but risk remains

One quantum-related move from JPMorgan would be a big deal, and this pair of headlines could indicate a game-changing interest. Getting big banks into the quantum computing effort is a promising strategy, shoring up those rickety balance sheets in a clever way. Now that JPMorgan is getting some skin in the quantum computing game, I'd be surprised if the bank allowed IonQ to run out of cash in the long run. It would take a dramatic failure of IonQ's R&D direction, focused on room-temperature trapped ions rather than superconductors at ultra-cold temperatures.

And now that IonQ has a big-name backer, smaller names like Rigetti and D-Wave could follow along. JPMorgan has plenty of cash to spread around, and other banks are probably watching this move closely. One large bank's involvement should add life-saving amounts of cash to the whole industry.

That being said, I'm still not betting the farm on IonQ (or any other pure-play quantum computing stock). They are all incredibly expensive today, and that's not even the whole story. Access to richer cash reserves will certainly help, but doesn't guarantee long-term success. If I sink my whole nest egg in IonQ stock, maybe D-Wave turns out to have the best system design. The original skepticism may also still be absolutely right, making someone like IBM or Alphabet the best investment after all.

So maybe I'll add a speculative little batch of quantum computing experts to my portfolio at this point. My Alphabet and IBM holdings will still be at least 10 times larger. Your appetite for risk is probably different, but that's my advice -- you should keep your D-Wave, IonQ, and Rigetti bets fairly small.