This is an uncertain world and there are very few sure things. As Ben Franklin once observed, "nothing is certain except death and taxes." But I think investors can almost add a third thing to that item -- the trusty real estate dividend stock Realty Income (O +0.59%) and its ability to keep paying investors, no matter what the market looks like.

Realty Income is perhaps the most reliable dividend stock you can find. And it's a well-deserved mantle. Realty Income just declared its 664th consecutive monthly dividend since the company was founded in 1969 -- a streak that goes back more than 55 years. The company has also increased its dividend 132 times in that period, giving Realty Income shareholders a rare blend of growth and income.

This California-based real estate investment trust (REIT), is a no-brainer dividend stock to buy, and is a perfect investment for anyone looking to build their dividend portfolio over a long period of time.

NYSE: O

Key Data Points

About Realty Income

Realty Income is based in California, but it has a massive presence. The company has 15,600 commercial properties, located in every U.S. state and much of Europe. Realty Income's customers represent 91 separate industries and include more than 1,600 clients.

And most importantly, the company's portfolio has an occupancy rate of 98.5% -- meaning that Realty Income is assured of a consistent revenue stream. That's how it can afford to pay a consistent, reliable monthly dividend. Industries the company leases property to include grocery stores, convenience stores, home improvement stores, dollar stores, restaurants, drug stores, health and fitness centers, and more.

The company also diversifies its portfolio, which means a catastrophic failure in an industry or by a single business won't hurt its operations. Convenience store chain 7-Eleven is the biggest tenant for Realty Income, and even then it's only a 3.4% weighting.

|

Top 10 Clients |

Portfolio Weighting |

|---|---|

|

7-Eleven |

3.4% |

|

Dollar General |

3.2% |

|

Walgreens |

3.2% |

|

Dollar Tree |

2.9% |

|

Life Time Fitness |

2.1% |

|

EG Group Limited |

2.1% |

|

Wynn Resorts |

2% |

|

B&Q |

2% |

|

FedEx |

1.8% |

|

Asda |

1.6% |

Data source: Realty Income. Data as of June 30, 2025.

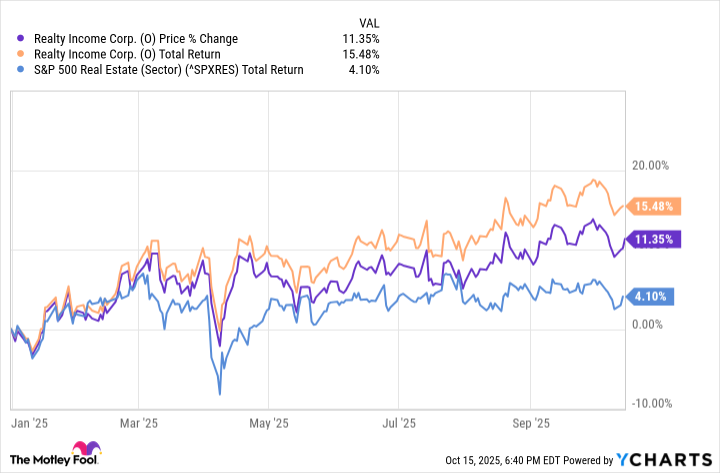

Realty Income stock performance

Unsurprisingly, real estate stocks haven't done well for much of the year. The S&P 500 real estate sector as a whole is up only 4%, thanks to the weak housing market and high interest rates that make borrowing more expensive. But Realty Income has been able to shake off those pressures. The stock is up 11% on the year, and when you calculate the total return of reinvesting dividend payments, the return is more than 15%.

The company recorded $1.41 billion in revenue in the second quarter, up from $1.34 billion a year ago. Income was down, however, thanks to borrowing costs -- the company recorded $196.9 million and $0.22 per share versus $256.8 million and $0.29 per share a year ago.

Realty Income lowered its full-year guidance, with net income now expected to be $1.29 to $1.33 per share, from previous guidance of $1.40 to $1.46 per share.

Image source: Getty Images.

The case for Realty Income

There's nothing flashy about this stock. But that's fine -- not everything in your portfolio needs to be a shiny new toy. Realty Income's strength comes with its consistency and long-term growth window.

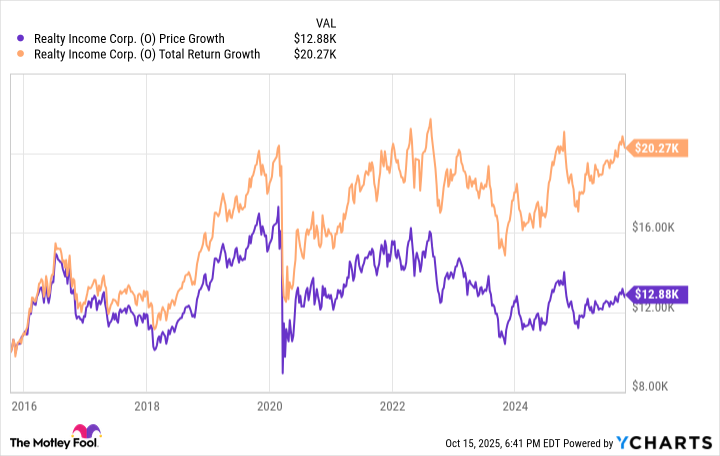

An investment 10 years ago in Realty Income would give you $20,270 today, assuming that you reinvested all those dividends back into your stock. Had you pocketed the money, you'd still have $12,880 -- which all goes to show the power of compound interest.

And remember, because Realty Income is a REIT, it's required by law to disburse 90% of its profits back to shareholders (the current yield is 5.4%). Because it's a monthly payout instead of a quarterly check, investors get the proceeds quicker, and those funds can work for them rather than working for Realty Income.

If you are an income investor, you really can't beat Realty Income for its business plan, diversification, and combination of growth and income. If you are a patient investor with a long-term view, Realty Income is a perfect dividend stock.