As legendary investor Stanley Druckenmiller often says, a big part of investing involves understanding the macroeconomic environment. A big part of the macro environment is driven by monetary policy led by the Federal Reserve, which has the power to increase and decrease interest rates and influence the money supply in the economy.

When the Fed is easing monetary policy by lowering rates and increasing the money supply, that's often a signal for investors to buy stocks. When the Fed is increasing interest rates and tightening the money supply, investors should be wary, although nothing in the stock market is black and white. This is why you'll often hear strategists say, "Don't fight the Fed."

In a recent speech, Fed Chair Jerome Powell indicated that the Fed is thinking about spiking the punch bowl in the coming months. It could trigger a big move for stocks.

Image source: Getty Images.

Preparing to spike the punch bowl

In 1955, Fed Chair William McChesney Martin said during a speech that the Fed "is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up."

The expression would go on to stick and serve as a way to describe monetary policy. When the Fed "takes away the punch bowl," that refers to the agency tightening monetary policy through higher interest rates or quantitative tightening (QT), which is when the Fed reduces the bond holdings on its balance sheet and effectively removes money from the economy. "Spiking the punch bowl" is the opposite, when the Fed lowers rates and pumps money into the economy through quantitative easing (QE).

While you wouldn't know it by how strong the market has been, the Fed has been taking away the punch bowl -- or at least removing some punch -- over the past few years. This includes an intense interest rate hiking campaign starting in 2022, and QT to reduce the Fed's balance sheet after it swelled up due to all the actions the Fed took during the pandemic's height.

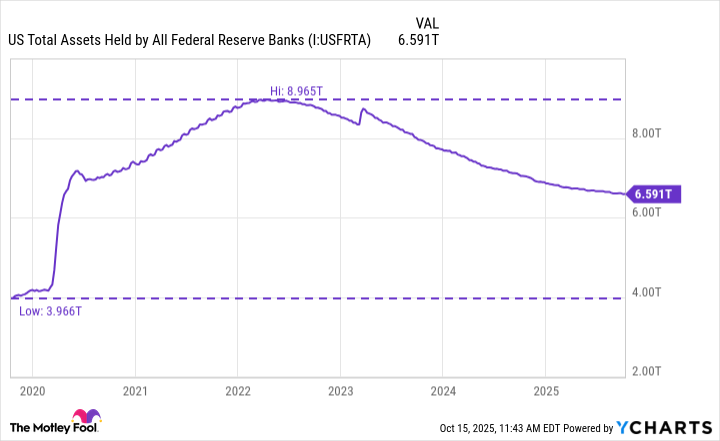

Data by YCharts.

As you can see above, the Fed had about $4 trillion of assets on its balance sheet right before the start of the pandemic, which was mostly due to all the QE that occurred after the Great Recession in 2008-09. That number more than doubled in early 2022 after the Fed took significant actions to shore up the economy, which essentially closed for several months during the worst of the pandemic, and briefly experienced a surge in unemployment.

However, the Fed eventually began QT and has made significant progress in lowering assets on its balance sheet to about $6.6 trillion. Also, keep in mind that the Fed began lowering interest rates in 2024. The agency went on pause for most of this year, due to uncertainty about elevated inflation, but resumed cutting in September.

While many still debate whether or not the Fed actually needs to be cutting rates, and how many times going forward, Powell seemed to surprise investors in a speech on Oct. 14 at the National Association for Business Economics Conference in Philadelphia when he suggested the Fed may soon pause QT:

Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. We may approach that point in coming months, and we are closely monitoring a wide range of indicators to inform this decision. Some signs have begun to emerge that liquidity conditions are gradually tightening, including a general firming of repo rates along with more noticeable but temporary pressures on selected dates.

While the Fed's balance sheet is still roughly $2.5 trillion above pre-pandemic levels, Powell made it clear that normalizing the Fed's balance sheet does not necessarily mean returning to pre-pandemic levels. The Fed also wants to avoid an incident like what happened in 2019 during the Fed's first go at QT. Bank reserves got too low, and yields in the short-term repo market, which banks use to effectively manage short-term liquidity, spiked significantly. This forced the Fed to revert to QT and inject tens of billions into the repo market.

Why it could trigger a big move in stocks

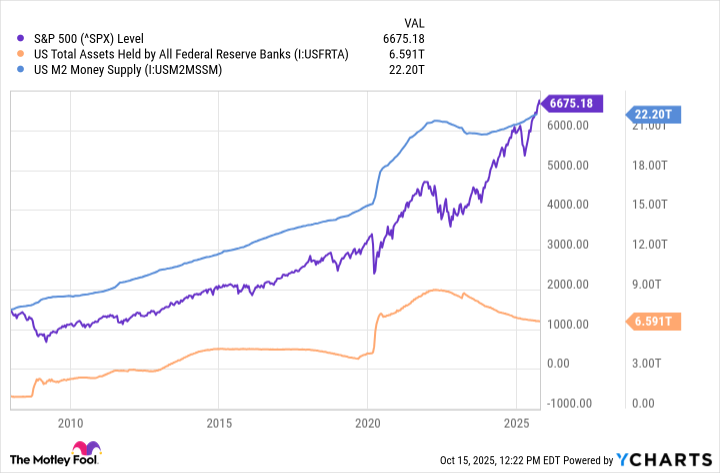

The simple way to think about it is that the more money there is circulating through the economy, the more likely it is to work its way into financial assets. Many experts attribute the epic amounts of QE over the years to the surge in housing prices and the stock market, among other assets.

While it's not perfect, there definitely seems to be some correlation in the broader benchmark S&P 500 index, the Fed's balance sheet, and M2 money supply. M2 is a measure of total U.S. liquid assets, including cash on hand, checking and savings account balances, and other short-term accounts like money market funds and certificates of deposit.

It's important to understand that the Fed is not restarting QE, at least not yet. But if the agency winds down QT, that will leave more money in the economy. Combined with interest rate cuts, the Fed would be spiking the punch bowl, which has historically been good for stocks.

Of course, there are other factors investors must consider as well, including the market's elevated valuation and whether the artificial intelligence sector can continue to run. That's why investors may want to continue with dollar-cost averaging for now. Regardless, the end of QT should create a more favorable environment for stocks to make the next leg higher.