The artificial intelligence (AI) megatrend has lifted several companies to values above the trillion-dollar mark. The most prominent is Nvidia (NVDA 0.32%), but another one investors should keep an eye on is Broadcom (AVGO +0.26%) -- a rising star thanks to its custom AI accelerator chips.

These products have a relatively small customer base now, but could see more adoption in the years to come. This could allow Broadcom to cut into Nvidia's market share dominance and allow it to grow at a quicker pace. Broadcom is currently valued at around $1.7 trillion, making a $2 trillion valuation easily within reach. In fact, I think Broadcom could easily grow to that level next year if it continues to capture market share at its current pace. And that could just be the beginning.

Image source: Getty Images.

Broadcom has some big-name clients

Broadcom isn't solely focused on AI, or even on computing hardware. It has a sprawling business that ranges from virtual desktop software (via its acquisition of VMware in late 2023), mainframe hardware and software, and cybersecurity. In fact, its AI revenue was $5.2 billion during its fiscal 2025 third quarter, which ended Aug. 3, compared to $16 billion in revenue overall. However, Broadcom's AI revenue is rapidly growing, and it recently got another boost.

Broadcom's AI revenue comes from two categories of hardware: connectivity switches and custom AI accelerators. The connectivity switches help data centers stitch information back together after it has been processed across multiple computing units. These are important devices and are already in widespread use, but the value of that market pales in comparison to what custom AI accelerators, which Broadcom calls XPUs, could be worth for the company.

NASDAQ: AVGO

Key Data Points

Broadcom designs its XPUs in collaboration with the end user that's buying them, tailoring their designs to suit the workloads that they will see. This is a major advantage compared to graphics processing units (GPUs). Nvidia and its peers design those processors along more general-purpose lines, so GPUs are more flexible overall. However, when a GPU is only destined to see one type of workload over its lifespan, this flexibility is a wasted expense. In the early days of the artificial intelligence trend, companies didn't know what their workloads were going to look like, which made Nvidia's GPUs the best product to go with. Now that workloads are more established, demand for Broadcom's XPUs could increase significantly over the next few years.

Does that mean Nvidia and its GPUs are doomed? Absolutely not. A huge part of the AI computing market still prefers the flexibility of Nvidia GPUs, and most companies that need parallel processors cannot afford to partner with Broadcom to design specialized chips. Currently, Broadcom is only shipping chips to five XPU clients, although there are a handful more in its development pipeline. One major client that recently came on board is generative AI powerhouse OpenAI, which plans to buy 10 gigawatts (GW) of computing power. That makes Broadcom's deal larger than the 6 GW deal that OpenAI struck with AMD (AMD +0.07%) and equal to its 10 GW deal with Nvidia.

Nvidia is already enormous -- indeed, it's the biggest company in the world -- and the OpenAI partnership is a big deal for it. Broadcom's similarly sized deal will provide the smaller company even more of a boost.

Even better, it could be the deal that spurs increased consideration of Broadcom's products by other tech players. This may be the spark that helps lift it above the $2 trillion market cap threshold in the near future.

Broadcom stock's premium price tag

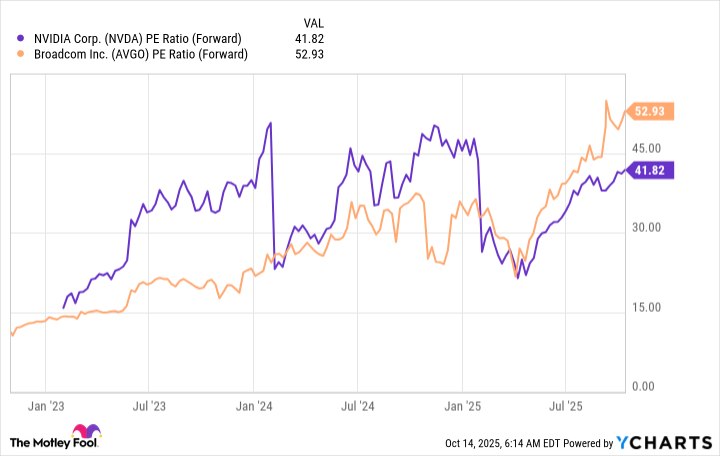

One issue Broadcom could have is the stock's expensive valuation. The market has already baked a lot of expected future earnings growth into the current share price, which is why it carries a premium valuation compared to market leader Nvidia.

NVDA PE Ratio (Forward) data by YCharts.

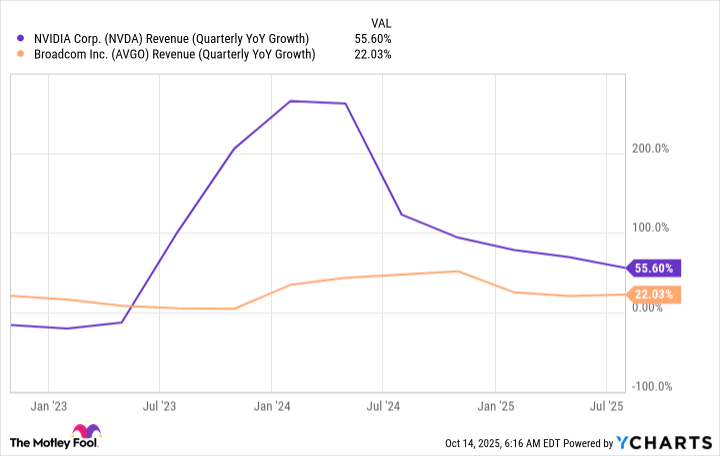

A forward price-to-earnings ratio of 53 isn't cheap, but neither is Nvidia's ratio of 42. Additionally, investors must factor in that Broadcom isn't as heavily AI-focused as Nvidia is. This means that Broadcom's growth rates will remain slower than Nvidia's, even if its AI-related revenue is growing at a faster rate. (Broadcom's AI-related revenue grew at a 63% pace in its fiscal Q3.)

NVDA Revenue (Quarterly YoY Growth) data by YCharts.

If the valuation for Broadcom has gotten a bit frothy, it will need to deliver solid growth just to make its current share price more reasonable. Time will tell if that occurs, but with the growing productivity of its XPUs, I think it will easily deliver the growth required to make its valuation acceptable.

I think Broadcom will continue to soar in popularity as an investment, and that its market cap will cross the $2 trillion threshold as soon as next year, but it will need to deliver multiple years' worth of earnings growth for even its current share price to make sense.