Earnings season is upon us, and it's possible that some stocks could make some large movements following their quarterly announcements. One that I've got my eye on that has significant momentum is Alphabet (GOOG 1.11%) (GOOGL 1.07%). Since reporting Q2 earnings on July 23, Alphabet has received several positive developments, including a judge's decision not to seek a breakup of Alphabet's core business.

The good news sent shares soaring, with the stock up over 30% since reporting Q2 earnings. That's a monstrous move for a large company like Alphabet (it's currently the fourth-largest company in the world and recently crossed the $3 trillion valuation mark for the first time), but can it continue?

I think management's Q3 outlook could be another catalyst for the stock to go higher, and buying it before it reports earnings on Oct. 29 is a smart move.

1. Persistent advertising growth

Throughout most of 2025, the consensus is that Alphabet's primary property, the Google Search engine, was in trouble. Everyone was worried about how it would fare against generative AI competition, but it turns out it will be just fine. Google's revenue growth has been resilient even in the face of rising competition from generative AI models, with its revenue growing at a 12% pace in Q2.

NASDAQ: GOOGL

Key Data Points

Part of the reason for this growth is that Google has incorporated AI search overviews into every Google search. This results in a hybrid search experience, combining traditional search with a generative AI-powered one. Management also commented that the AI search overview has about the same monetization as a standard search, so it's not losing any money on this switch either.

If Alphabet reports growing Google Search revenue during this quarter, it will confirm that Google is continuing to excel even when everyone assumed that it couldn't. With Alphabet's core business doing well, I think it makes the stock a great buy.

2. Rising cloud computing demand

Another exciting area for Alphabet is its cloud computing division, Google Cloud. Cloud computing is one of the fastest-growing industries around, and is benefiting from a general migration to the cloud alongside rising AI demand. Google Cloud has become a great partner in this realm and has won business from OpenAI (the makers of ChatGPT) and Meta Platforms (META +0.79%).

While Google Cloud isn't as large as some of its competitors, it's growing at a healthy rate, with revenue rising 32% year over year in Q2. It's also dramatically improving its operating margin, increasing from 11% last year to 21% this year. Investors are going to want to see this trend continue, and if it does, the stock could respond positively as a result.

3. Alphabet has a reasonable valuation

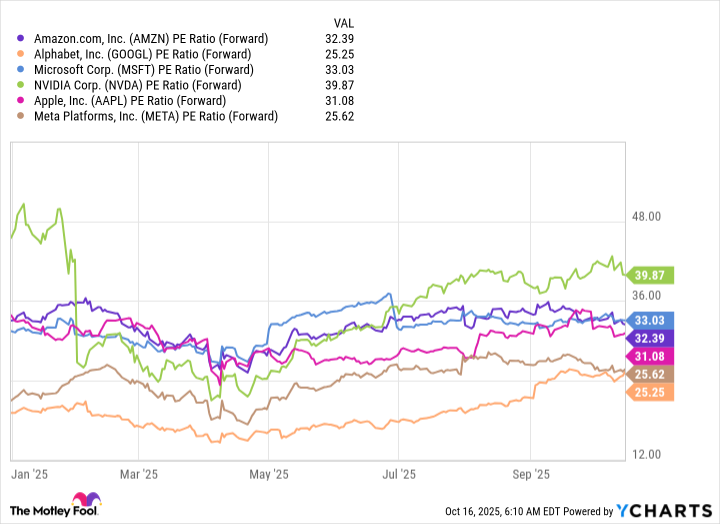

Lastly, Alphabet is still valued at a discount to its peers. Despite having an impressive run over the past few months, Alphabet still trades at a discount to all of its big tech peers from a forward price-to-earnings (P/E) standpoint.

AMZN PE Ratio (Forward) data by YCharts

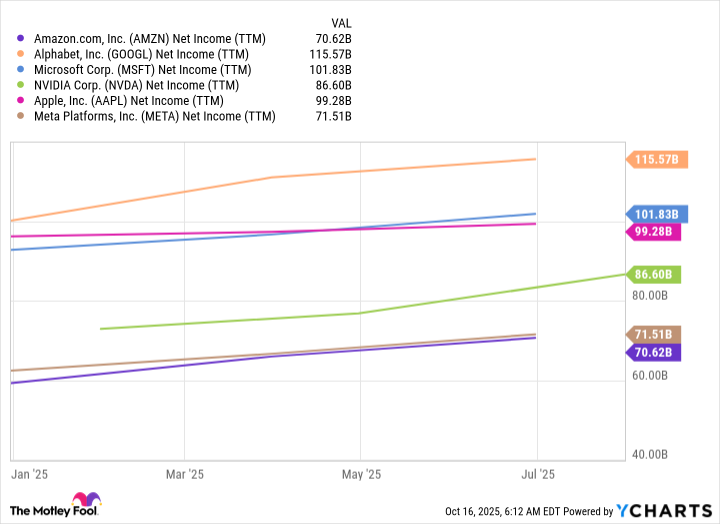

However, after its monstrous run, it's extremely close to swapping places with Meta Platforms. Still, Alphabet is trading at a discount to others like Microsoft (MSFT 0.59%) and Apple (AAPL 0.73%). If all companies had an equal valuation, Alphabet would actually be the world's largest because it generates the most net income out of all of them.

AMZN Net Income (TTM) data by YCharts

However, that's not the way the stock market works, but it does give Alphabet an edge in future investments, as it has significant cash flows that it can buy back stock with, invest in AI, or potentially acquire a business.

Regardless, Alphabet is a highly profitable business with a reasonable valuation that's growing at a healthy pace. I still think there's plenty of room for the stock to run, and another catalyst could arrive when it reports earnings on Oct. 29. By buying now, investors can ensure that they get in on a potential pop following the earnings announcement.