New artificial intelligence (AI) computing deals seem to be announced each week. This is a great sign, as it shows that the demand is there for increased AI investment. However, it's an even bigger deal for the computing suppliers, as it allows them to map out production to meet this demand.

While OpenAI has made some sizable and notable deals, Elon Musk's xAI is also making waves. xAI and Nvidia (NVDA 0.56%) are reportedly signing a $20 billion deal to provide xAI with its graphics processing units (GPUs) for its Memphis Colossus 2 data center.

This is another huge deal that cements Nvidia's place as the top option on which to build AI models. However, after Nvidia's remarkable run, is it still worth buying?

Image source: Getty Images.

Nvidia still has plenty of growth left

Although $20 billion sounds like a massive deal, it's not as big as you may think. During Q2, Nvidia's data center revenue totaled $41.1 billion. xAI is unlikely to spend all of that $20 billion during a quarter, so it will be spread out among many quarters.

As a result, this deal only amounts to a few percentage points of growth for Nvidia. However, it signals an even bigger trend.

Recently, OpenAI, the makers of ChatGPT, announced several computing deals. Two of the biggest announcements were with Broadcom and AMD, two competitors of Nvidia's.

While AMD directly competes with Nvidia with a GPU design of its own, Broadcom is taking a different approach. It's designing computing units in collaboration with the end users; that way, it's streamlined for whatever workload is processed through it. This makes Broadcom's chips cheaper and more powerful than Nvidia's options at the cost of flexibility.

xAI is one of the leaders in the generative AI megatrend, so it's another vote of confidence for Nvidia's dominance. Even though OpenAI has signed deals with some of Nvidia's competitors, it's still a large Nvidia client.

NASDAQ: NVDA

Key Data Points

OpenAI and Nvidia announced a partnership in September where Nvidia will provide 10 gigawatts of compute in exchange for up to a $100 billion investment in OpenAI. While there are some concerns about this becoming a circular economy, where resources are recycled to reduce waste, OpenAI's subscriber figures are still growing at an unbelievable pace, which makes this a legitimate investment.

It also backs up a bold claim Nvidia made during its Q2 conference call. CEO and co-Founder Jensen Huang stated that the company believes global data center capital expenditures will reach $600 billion by the end of 2025, with that figure rising to $3 trillion to $4 trillion by 2030. This would lead to even more growth for Nvidia, making it a smart investment option now.

Nvidia's stock isn't as expensive as you may think

If Nvidia is correct in its projection, AI spending will increase at a compounded annual growth rate (CAGR) of 42% over the next five years. However, Wall Street analysts only expect 33% revenue growth for FY 2027 (ending January 2027). Analysts have consistently underestimated Nvidia's expected growth, and this time is likely no different.

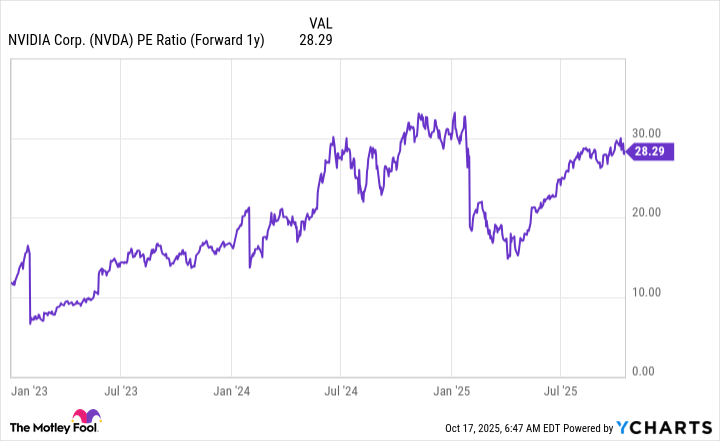

Should Nvidia be able to grow its revenue above a 40% pace again during 2026, the stock is likely undervalued at its current 28 times next year's earnings mark. Additionally, if Nvidia can grow at that long-term CAGR of about 40% over the next five years, today's stock price will look incredibly cheap five years later.

NVDA Price-to-Earnings Ratio (Forward 1y) data by YCharts.

Nvidia's position in the AI industry has been solidified, thanks to the announcement of all these AI deals, making it one of the top stocks to buy and hold. I think 2026 will be similar to years past, making Nvidia an excellent stock to buy now.