It's odd to say it, but 2026 is right around the corner. It's time for investors to start thinking about what 2026 will bring and position their portfolio appropriately. Although the artificial intelligence (AI) boom has driven the market higher since 2023, I think it will persist throughout 2026 and beyond. As a result, some of the best investments over the past few years will continue to be leaders.

At the top of my list of stocks that will perform well throughout 2026 are Nvidia (NVDA +1.23%), Taiwan Semiconductor Manufacturing (TSM +1.77%), and Alphabet (GOOG 2.79%) (GOOGL 2.78%). All three have been successful stock picks over the past three years and will continue to be outperformers during 2026.

Image source: Getty Images.

1. Nvidia

Nvidia has been one of the most obvious stock picks in the AI arena. Its graphics processing units (GPUs) are the most popular computing devices to run AI workloads on, and this has caused the stock to become the world's largest company. While Nvidia is seeing rising competition, it's still the top choice in the industry.

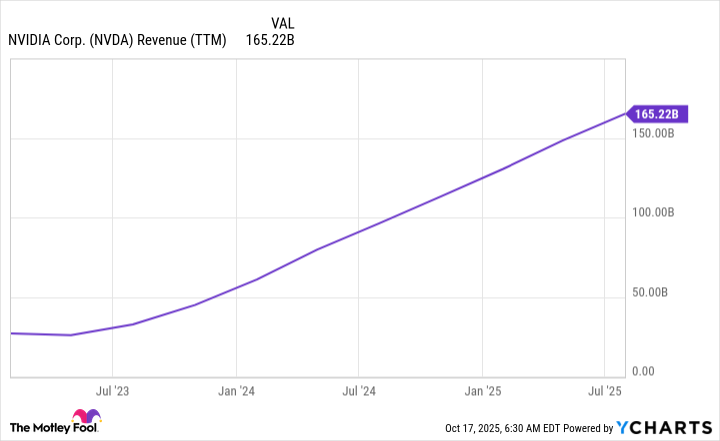

For 2025, Nvidia expects the global data center capital expenditure total to be about $600 billion. However, management expects that figure to rise to $3 trillion to $4 trillion by 2030. That's monstrous growth, and shows that we're still in the early innings of the AI infrastructure buildout.

NVDA Revenue (TTM) data by YCharts

Even after the initial buildout is done, GPUs are being run aggressively to meet AI demand, and the life expectancy of a GPU ranges from one to three years. As a result, some of the GPUs that entered service during the past few years will need replacement, leading to increased Nvidia revenue.

This will translate into further success for Nvidia, making it a top stock to buy and hold for 2026.

2. Taiwan Semiconductor

Nvidia and its competitors don't have the ability to manufacture their own chips. They design them, then send those designs off to Taiwan Semiconductor for production. This places TSMC in a strong neutral position and allows it to benefit from the best computing unit provider at any given time.

Additionally, Taiwan Semiconductor has a new technology entering production that could be a massive revenue driver throughout 2026. Its new 2nm (nanometer) chip node is a massive improvement over the previous generation, and consumes 25% to 30% less power when configured to run at the same speed. This is an important breakthrough, as power consumption is becoming a huge topic in the AI realm.

NYSE: TSM

Key Data Points

This new technology will help drive TSMC's growth throughout 2026 alongside the general rising chip demand. This makes Taiwan Semiconductor a no-brainer buy now, and investors should consider adding shares before 2026 arrives.

3. Alphabet

Last is Alphabet, a company that many assumed would be a victim of the generative AI rollout. However, Alphabet has fared quite well, and its pivot in how its Google Search engine operates is a key part of the sentiment change.

Google has integrated AI search overviews, which combine a traditional web search with a generative AI-powered summary. This is an incredibly popular feature, and it's one that management is continuing to invest in due to its popularity. While most assumed that generative AI models would replace Google, this could help it survive for years to come.

NASDAQ: GOOGL

Key Data Points

Its cloud computing wing, Google Cloud, is also seeing a ton of momentum. It has signed a few key customers (like OpenAI and Meta Platforms), giving it credence in the space. AI workloads are a huge growth driver for cloud computing, as is the general migration to off-premise computing. This is a key division to watch for Alphabet, and with all of the momentum in the industry, I'd expect it to post a phenomenal 2026.

With the market recognizing Alphabet as an AI leader, it's starting to get the respect it deserves. Alphabet also has several strong growth divisions, making it a great stock to buy now and hold throughout 2026.