Low-yielding growth stocks have been market leaders for an extended period of time. But if investors are going to quibble about anything, it's that many of today's glamor growth names don't deliver much in the way of dividends, if they sport payouts at all.

The outsize weights commanded in the S&P 500 by the "Magnificent Seven" stocks go a long way toward explaining why the index yields a paltry 1.16%. That's reason enough for investors to consider pairing income-generating assets with exposures to growth stocks and basic broad market funds.

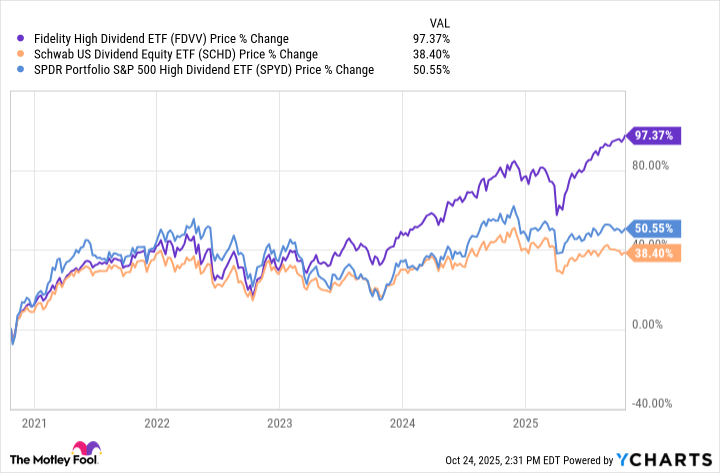

High-yield dividend exchange-traded funds (ETFs), or those funds with noticeably higher yields than broader benchmarks, have been favored destinations for investors looking to enhance their income streams. However, not all ETFs with "high dividend" in their titles are comparable, and those differences can create noticeable performance gaps. The Fidelity High Dividend ETF (FDVV +0.24%) proves as much.

Fidelity High Dividend ETF does things differently -- and that's good

It stands to reason that a high-yield dividend ETF earns that status by holding stocks with yields that are noticeably higher than the broader market. That often means shopping in defensive, slow-growth sectors such as consumer staples, healthcare, and utilities.

Image source: Getty Images.

This ETF's approach is starkly different. Those three sectors combine for just 23% of the fund's weight. This is where the fun really starts with FDVV. This is a high dividend ETF with a 26% weight to tech stocks -- a group with notoriously small yields. Want to find a high-yield dividend ETF featuring Nvidia (NVDA +0.74%), Microsoft (MSFT +1.53%), and Apple (AAPL +0.28%) as its top three holdings? Look no further than Fidelity High Dividend ETF.

In the pantheon of dividend "stars," Nvidia isn't one of the residents. It yields a scant 0.02%, but FDVV investors aren't complaining. The ETF has turned $10,000 into more than $23,000 over the past five years, sharply outperforming some well-known high-yield dividend ETFs in the process.

Don't be hasty in assuming Fidelity High Dividend ETF's tech exposure is a yield headwind. It's not. The ETF's trailing 12-month yield is 3.08%, or more than double what's found in a basic S&P 500 ETF. Plus, the technology sector is an increasingly credible source of reliable payout growth.

NYSEMKT: FDVV

Key Data Points

Fidelity High Dividend ETF is fantastic for another reason

There's a rub with high-yield dividend investing, whether it's with individual stocks or ETFs. Since yields and prices move inversely, some stocks with tempting dividend yields arrive there because share prices declined. In some cases, that's because markets priced in potential dividend cuts.

Said another way, high-yield dividend investing can expose investors to some dividend offenders. FDVV provides protection on that front. The Fidelity High Dividend Index, the ETF's underlying benchmark, weeds out the securities with the highest payout ratios, a red flag signaling concerns about payout sustainability.

That's not a 100% guarantee that an FDVV holding here or there won't cut dividends. But that screening process diminishes the odds of bad dividend news, while enhancing the odds that the ETF is largely composed of financially healthy companies.