When Netflix (NFLX 0.28%) reported third-quarter results last week, the market reaction was swift and brutal. The stock closed 10.1% lower the next day and continued trending lower for a few days after that plunge.

Was the market panic the start of a lasting downturn for Netflix, or an invitation to start new Netflix positions at a lower price? Check out these two essential facts about the Q3 report, and then you can decide for yourself. Spoiler alert: I'm tempted to double down on my Netflix investment right now.

NASDAQ: NFLX

Key Data Points

1. This huge price drop is "business as usual" for Netflix investors

Netflix stock is no stranger to volatility. Its beta value is a lofty 1.59, where 1.00 means you're matching the daily moves of the S&P 500 (SNPINDEX: ^GSPC) with predictable precision. The earnings reaction on last Wednesday was an extreme example and the deepest dip of 2025, but far from the only big move on the calendar.

Three of the four earnings reports in 2025 have inspired some kind of swing, for instance. The last two reactions were negative, but January's Q4 2024 report was met with a 9.9% single-day jump.

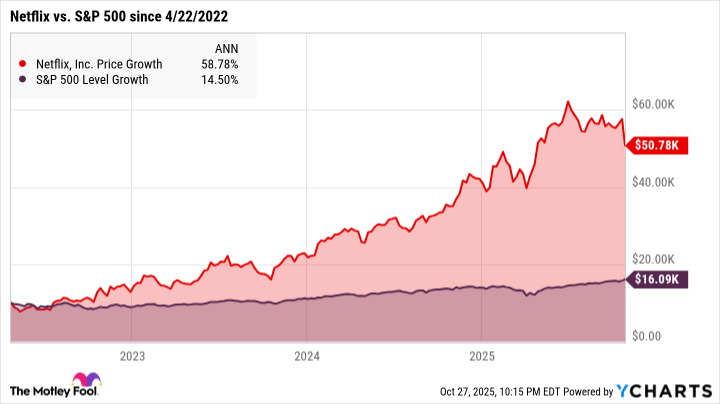

And Netflix's fast-moving history goes much deeper than that. Just three years ago, the stock fell 21.8% after the January 2022 report and an even scarier 35.1% three months later, as investors faced a new era of slower subscriber growth. But if you invested $10,000 in Netflix stock at that point, your position would be worth $50,780 as of Oct. 27. That old adage about buying when there's blood in the streets seems to make sense for Netflix investors.

2. Wall Street overreacted to a controversial Brazilian tax bill

Things could be different this time if there's something seriously wrong with Netflix's business. When an earnings report reveals truly structural business flaws, the most appropriate market reaction is a deep price cut.

However, that's not the story this time. If anything, I see a massive misunderstanding playing out, kind of like the Qwikster rout at the very start of Netflix's digital video-streaming business.

The company met Wall Street's revenue expectations with 17% year-over-year growth. Bottom-line earnings fell short of analyst targets due to an unexpected Brazilian tax charge.

Image source: Netflix.

Netflix (and many other companies doing significant business in Brazil) has been fighting this tax for years, and thought the threat had gone away after winning a legal verdict in 2022. A Brazilian Supreme Court ruling overturned that legal win in Q3 2025, so Netflix set aside $619 million to account for that liability in the long term. No cash payments have been made yet -- Netflix's Brazilian lawyers are getting back to the courtroom to find ways around this charge. So the stock lost more than $46 billion of market value due to a single noncash charge for potential legal bills of $619 million.

Right now, Netflix stock trades 18.4% below June's all-time high. That looks like an overreaction to me, similar to the old Qwikster situation. In my view, this price drop opened a buying window for opportunistic investors.