CoreWeave (CRWV 8.76%) has been one of 2025's most successful IPOs, with the stock tripling over its launch price when it went public in late March. That's an impressive run, but CoreWeave is also more than 30% off its all-time high, making investors wonder if now is a good time to buy.

Any company in the artificial intelligence (AI) investing realm is going to be compared automatically to Nvidia (NVDA 3.18%). Nvidia has been the gold standard of AI investing since the AI race kicked off in 2023, and investors have made a ton of money from buying Nvidia shares and staying patient with it. To add another twist to this analysis, Nvidia is actually an investor in CoreWeave itself, holding nearly 4 million shares.

Of these two, is there one that stands out as the better buy?

Image source: Getty Images.

It's better to own the product supplier than the end user

Nvidia's business is simple: make the best graphics processing units (GPUs) possible, and develop supporting software and hardware to maximize their potential. Nvidia has excelled at that, although its competition is starting to become a bit stiffer. Still, Nvidia is the go-to company in the AI computing market, and its GPUs remain the gold standard by which every other chip is compared.

NASDAQ: NVDA

Key Data Points

CoreWeave's business is more akin to a cloud computing product. Essentially, CoreWeave purchases computing devices from Nvidia, places them in a data center, and then rents out that computing capacity. This business model has already been widely successful for the handful of companies that have cloud computing products. With CoreWeave specializing in AI-focused data centers and hardware, it's thriving in today's environment.

NASDAQ: CRWV

Key Data Points

Although both companies have legitimate business models, I prefer Nvidia's, as it's supplying the hardware to many clients as opposed to CoreWeave's smaller customer base. Additionally, there are many offerings similar to CoreWeave's, but there's only one Nvidia.

Winner: Nvidia

CoreWeave's growth is superior

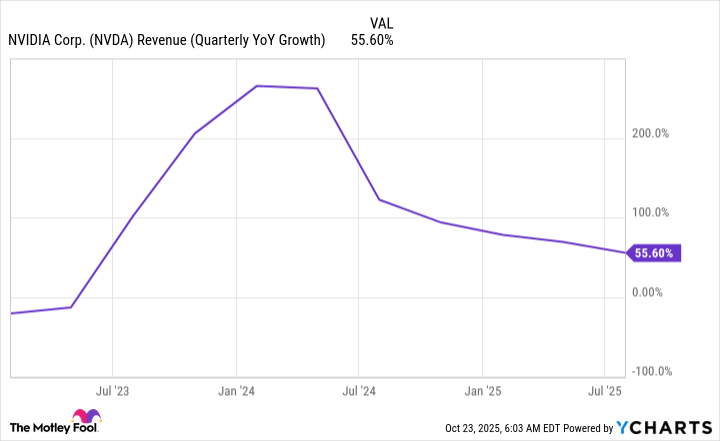

Nvidia's growth rate has slowed over the past few quarters. While it was posting incredible 200% or greater growth rates just last year, it has now settled into posting about 50% growth.

NVDA Revenue (Quarterly YoY Growth) data by YCharts

That's nothing to be disappointed in, as that's still faster than nearly all companies in the stock market.

However, CoreWeave's growth rate is far greater than Nvidia's. In Q2, CoreWeave's revenue reached $1.2 billion, rising 207% year over year. Furthermore, its revenue backlog increased 86% year over year to $30.1 billion, so it has a ton of future growth already contracted out. This bodes well for CoreWeave and gives it the edge in this comparison.

Winner: CoreWeave

Nvidia is making a profit

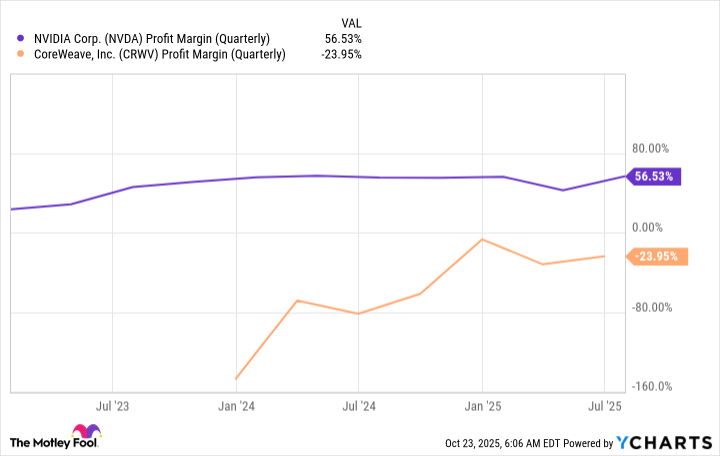

Moving to the bottom line, it's clear that Nvidia is going to swamp CoreWeave in this category.

NVDA Profit Margin (Quarterly) data by YCharts

Nvidia has consistently maintained an impressive net profit margin of 50% or greater during its run, while CoreWeave has struggled to break even. While I'm normally OK with fast-growing companies staying unprofitable to capture market share, it isn't applicable for CoreWeave.

CoreWeave's computing units will burn out in a few years and then need to be replaced. With CoreWeave operating at a loss, it's not going to have the funds to replace these and will either need to take on debt or issue more shares. CoreWeave's operating losses are a huge concern of mine, and start to skew the analysis heavily in favor of Nvidia.

Winner: Nvidia

Nvidia is the cheaper stock

Lastly, let's look at valuation. Because CoreWeave isn't profitable, we'll have to use the price-to-sales (P/S) ratio to compare the two.

NVDA PS Ratio data by YCharts

Nvidia is valued at nearly double what CoreWeave is, which may cause investors to lean in CoreWeave's favor. However, at the end of the day, investors care about profits, not sales.

Nvidia is posting a profit margin above 50%, while the best cloud computing businesses post operating margins (not profit margins) in the 30% range. By the time taxes are paid, that knocks the best cloud computing businesses down to around a 25% profit margin.

If we factor that into the P/S ratio analysis, these two are priced at nearly the same hypothetical price-to-earnings ratio, resulting in a tie.

Winner: Tie

That leaves Nvidia as the ultimate winner of this analysis, but CoreWeave could become a far more attractive stock if the company became profitable.