If I had $100 for every time I've read in the last three years that Nvidia (NVDA +1.09%) stock is "overvalued," I would be swimming in some big bucks.

The artificial intelligence (AI) chip leader's stock has run-up big following OpenAI's release of its ChatGPT chatbot in late 2022. (It's returned 1,350% over the three years to Oct. 28.) This event has sparked a rush among the big techs and other companies to obtain generative AI capabilities. But a big run-up in stock price alone does not necessarily mean a stock is overvalued.

To be clear -- I'm not saying that Nvidia stock is immune to a big decline. Indeed, it could suffer one if some other company's technology replaced its graphics processing units (GPUs) as the gold standard for training AI models and deploying AI applications. I'm just saying that based on the data available, the "Nvidia stock is overvalued" argument is not a good one, in my view.

Below I look at two common arguments by Nvidia stock bears for calling Nvidia stock overvalued.

Image source: Getty Images.

There is no "correct" stock valuation

First, keep in mind that there is no "correct" way to do a valuation analysis for a stock. So, when anyone says a stock is "overvalued," that is just their opinion, not a fact.

That said, it's widely accepted that there are certain valuation metrics that are better suited than others for specific situations.

"Nvidia stock is overvalued because its price-to-sales (P/S) ratio is higher than that of X Company"

I cringe whenever I see the price-to-sales (P/S) ratio used in relation to Nvidia stock. The P/S ratio is the lowest on the usefulness totem pole of valuation metrics because, at least over the long term, earnings and cash flow growth drive stock prices, not sales growth.

The P/S ratio should only be used when earnings-based or cash-flow-based valuation metrics can't be used. In other words, it should only be used for stocks of companies that are not profitable on a net income (or earnings) basis and have negative cash flows.

The fact that Nvidia converts such a big portion of its sales to earnings and cash flows will unfairly hurt it in a valuation analysis using a P/S ratio.

NASDAQ: NVDA

Key Data Points

"Nvidia's price-to-earnings (P/E) ratio or forward P/E ratio of X indicates it's overvalued"

A variation on this theme is comparing Nvidia stock's price-to-earnings (P/E) ratio or forward P/E to that of the stock of another company and declaring the stock of the other company a better buy because it has a lower P/E. The big problem here? There is no earnings growth context.

The stock of a company with better earnings growth deserves to have a higher P/E. All other things being equal, investors will naturally pay more money for a stock of a company that's growing earnings at an average annual rate of, say, 40% than they will for one growing earnings at a 10% average annual pace.

Here's an analogy: The statement in my subhead is like saying that "Person X weighs 225 pounds, indicating they are overweight." This is a ludicrous statement, right? In this case, the major context (or variable) that is missing is height. If the person here is the 6-foot, 4-inch former NFL quarterback Tom Brady, then I don't think anyone would consider that 225-pound person as being overweight.

Getting back to the P/E and forward P/E. These valuation metrics should be used in combination with a company's trailing-12-month earnings growth or projected earnings growth, respectively. While no valuation metric is perfect, some variation of a PEG (P/E divided by earnings growth) is a much better valuation metric than a P/E or forward P/E.

Many factors come into play, but a rough rule of thumb for companies that are at least fairly well-established is that a PEG of 1.0 implies that a stock is about fairly valued. Though PEGs will sometimes go notably higher in strong bull markets and when investors expect future earnings growth to be stronger than past growth.

(One big exception to this rule of thumb are dividend-paying utility stocks, which will almost always have high PEGs. This is because investors will usually pay up big for companies that have predictable earnings and dividend growth.)

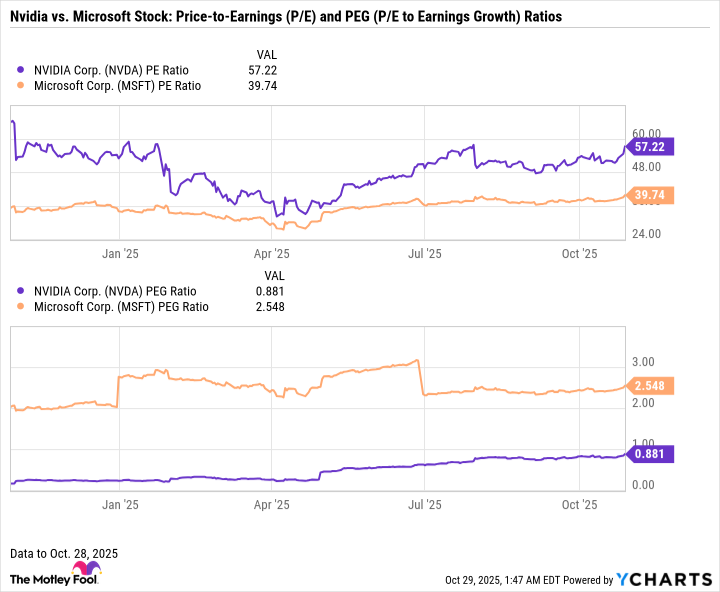

Below is a simple example involving Nvidia stock and Microsoft stock.

Data by YCharts.

Here are the exact year-ago numbers: Nvidia's P/E and PEG were 66.0 and 0.16, respectively. Microsoft's P/E and PEG were 35.2 and 2.0, respectively.

Let's say that one year ago, you read "Nvidia stock's P/E of 66 is so much higher than Microsoft's P/E of 35.2. Therefore, Microsoft stock is currently the better buy." This is a poor statement just like my body weight statement above, in my opinion.

Of course, Nvidia's P/E would be higher! Nvidia was growing earnings like gangbusters a year ago, and so naturally investors would pay up more for its blazing earnings growth than they would for Microsoft's more moderate earnings growth.

If we consider the PEG -- the better valuation metric -- rather than the P/E, the situation reverses itself with Microsoft having the much higher value. The PEGs from a year-ago suggest (valuation metrics just "suggest," they do not indicate anything for certain) that Nvidia stock was very attractively valued on an absolute basis, as well as more attractively valued than Microsoft.

An investor who was debating between buying the two stocks would likely have bought Nvidia if they were giving more weight to the PEG than the P/E. And that would have turned out to be a good decision, as Nvidia stock has outperformed Microsoft stock over the last year. (Nvidia 43.1% vs. Microsoft 28% return through Oct. 28.)

Turning to now, Nvidia stock's current PEG of 0.881 suggests it is still attractively valued. So, my answer to my headline question is no, Nvidia stock does not appear to currently be overvalued.

Caveat

I was overly simplistic for the sake of article length. An ideal valuation analysis would be more involved and too lengthy for one article.

That said, the topics covered here should still hopefully prove helpful when you're reading opinions on stock valuations and considering buying a stock.