BigBear.ai (BBAI 7.90%) is a popular pure-play AI stock. Investors focused on it because it has the potential to skyrocket if everything goes right. Currently, it trades between $6 and $7, so for it to reach $10 in 2026 would be a huge deal.

However, BigBear.ai isn't your typical artificial intelligence software company, and there are some nuances that investors must be aware of before taking a position. Do any of those hamper BigBear.ai's pursuit of a double-digital stock price?

Image source: Getty Images.

BigBear.ai reminds investors of an early-stage Palantir

BigBear.ai is focused on providing AI solutions to government and government-adjacent businesses. Its biggest contract is with the U.S. Army to develop its Global Force Information Management-Objective Environment (GFIM-OE) system. Essentially, this platform will ensure that the Army has the proper manpower, training, and resources available wherever they are deployed. This is a huge contract for BigBear.ai and is valued at $165 million.

NYSE: BBAI

Key Data Points

With BigBear.ai developing custom AI solutions for government clients, it reminds investors of another successful AI software company: Palantir Technologies (PLTR 3.49%). However, the difference between these two is that Palantir has a software platform for the government to build products on. BigBear.ai is developing a custom solution for the Army that may not be able to be used elsewhere. This makes BigBear.ai more akin to a consulting business -- it's still a good business to be in, but not as good as providing a modular software platform.

Another sizable area where BigBear.ai is running into similar issues is airport security. BigBear.ai's software has been deployed to multiple international airports in the U.S. and outside our borders. However, there isn't a huge market for this software outside of these applications, which means it will need to develop another software application to grow its business.

BigBear.ai's business is closer to a consulting one, which negatively affects its margin profile.

BigBear.ai's margins leave a lot to be desired

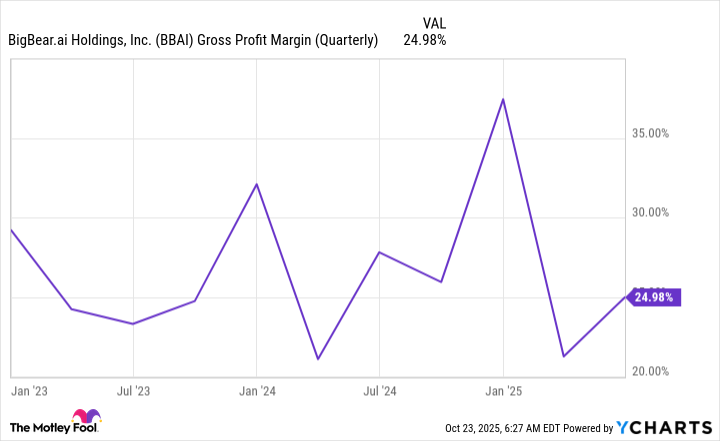

BigBear.ai isn't a profitable company, so investors need to look at its gross margin to get a better idea of what is possible in the future. While most software companies (like Palantir) are posting gross profit margins between 70% and 90%, BigBear.ai's is far lower.

BBAI Gross Profit Margin (Quarterly) data by YCharts

BigBear.ai's gross profit margins hover in the 20% to 30% range, which is far less than most of its software peers. This is a big concern for me, as there are some assumptions investors make with software companies that aren't applicable to BigBear.ai.

One of the biggest is the potential profit margin. Most software companies producing gross profit margins in the 70% to 90% range have the goal of eventually producing a 30% net income margin. That's impossible for BigBear.ai to do with its high input costs, and should cause the market to value the stock at a much lower price tag.

BBAI PS Ratio data by YCharts

Most high-profit margin software companies trade for 10 to 20 times sales. With BigBear.ai trading in that range despite a low gross profit margin, it's a huge red flag.

BigBear.ai isn't growing its revenue

To put a final nail in the coffin of BigBear.ai's investment thesis, it isn't growing its revenue right now. With how competitive the AI arms trend is, anybody involved should be growing their business. However, BigBear.ai's revenue fell 18% in Q2 due to lower work volume from the Army contract. Companies like Palantir are still seeing strong government growth, so this is another huge red flag for BigBear.ai.

There are far better options out there to invest in than BigBear.ai. Although the stock could be volatile over the next few months and randomly reach $10 per share, I think there are far better AI investment opportunities that have a strong business behind the stock that investors should consider first.