Shopify (SHOP 4.16%), an e-commerce specialist, has been a market darling since its 2015 IPO. And over the past decade, the company has crushed broader equities, despite a slump it experienced a few years ago.

Shopify is now seeing significant momentum that could carry over into 2026, hopefully allowing it to deliver market-beating returns once again. And even beyond next year, Shopify's prospects look very attractive.

Here's what investors should know.

Image source: Getty Images.

Consistent profitability is in sight

Shopify has established itself as a leader in e-commerce, providing merchants with all the tools they need to set up and run an online storefront. Shopify makes the task easy without sacrificing quality. No expertise in coding is required, although it is at the discretion of each merchant to use their skills in this arena if they so desire. Shopify, though, offers basic, highly customizable templates even a newbie can manage.

Shopify also provides services that make merchants' lives easier, including marketing, sales data analytics, inventory and fulfillment management, and more.

The surge in online retail has been a powerful tailwind for Shopify. And over the past few years, the company has proven that it can overcome challenges. Shopify saw revenue and earnings growth decline significantly due to economic issues. It made changes that allowed it to bounce back, including eliminating its expensive (and low-margin) logistics unit and raising prices.

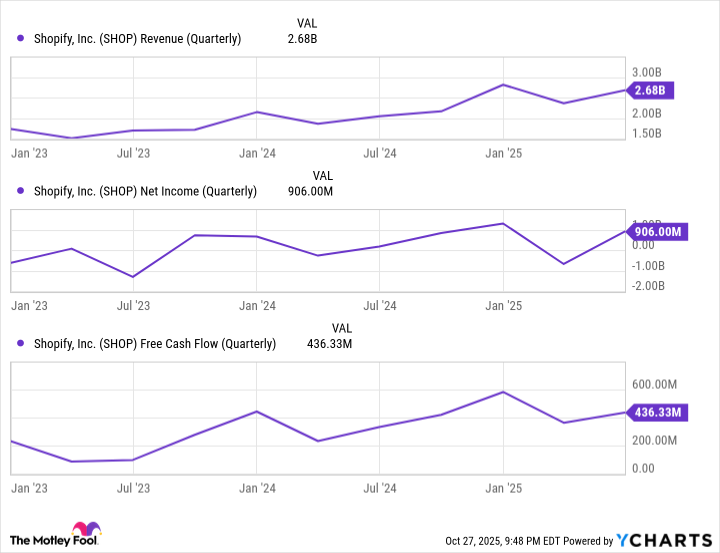

These have paid off and pushed Shopify closer to consistent profitability than ever, as free cash flow also continues to move in the right direction.

SHOP Revenue (Quarterly) data by YCharts

The company could maintain that momentum over the next 12 months, especially as recent developments could help boost gross merchandise volume (GMV) on its platform, leading to higher revenue for Shopify.

The company made a deal with OpenAI that will allow merchants to sell items directly on ChatGPT. Beyond the impact on Shopify's financial results, it once again shows its focus on finding more ways to make its ecosystem even more attractive to its clients by giving them another channel to reach customers.

That's what has helped Shopify reach a more than 12% market share in the U.S. by GMV.

NASDAQ: SHOP

Key Data Points

The long-term view

Plenty of things could happen in the next few months that would disrupt Shopify's business and sink its stock price. It's always challenging to predict which way the market -- or any specific corporation -- is going to move over a short period. So, Shopify might not crush broader equities next year.

But even if it doesn't, the stock remains a buy, as it is poised for enormous long-term growth. Though e-commerce seems ubiquitous by now, it has captured only a modest share of the U.S. retail market, just 16.3% as of the second quarter.

Where will that peak? It's hard to tell, but the world is increasingly going digital for many reasons. For one, it's better for businesses. They can reduce overhead costs by maintaining a strong online presence and passing those savings on to customers through lower prices. Consumers benefit from a larger pool of options, not to mention the convenience of buying items with a few clicks while sitting on the couch at home.

In other words, the e-commerce industry is on a long-term growth path. Shopify should benefit from it, having built a strong brand and high switching costs.

Merchants who have spent time and money building online storefronts with Shopify won't be inclined to jump ship to a competing provider. So, Shopify should retain most of its clients. Shopify's footprint spans more than 175 countries, the overwhelming majority of which have e-commerce markets that are far less penetrated, granting it attractive worldwide growth prospects.

The company is racing toward profitable growth while tapping into a massive whitespace and expanding its competitive advantage. Shopify has the qualities of a stock likely to deliver superior returns to patient investors.