Nvidia (NVDA +2.42%) stock has been going like gangbusters for the last few years. The company's dominant position in making graphics processing units (GPUs) to power data centers and run high-level artificial intelligence (AI) programs allowed Nvidia to become the biggest company in the world by market cap.

Nvidia stock is up 1,390% in the last three years alone. An investment of $10,000 in October 2022 would have given you a balance of $148,800 today.

I expect Nvidia to continue to do well, but it's going to face pressure. Competitor Advanced Micro Devices is pushing to get market share in the GPU market as well. It just signed a deal with OpenAI to provide several generations' worth of GPUs. Alphabet, Amazon, Microsoft, Meta Platforms, and Tesla are all working on in-house chips of their own. And Chinese companies are working on their own chips.

Image source: Getty Images.

So, while Nvidia has more than a 90% market share in the GPU market today, that may not be the case for long. But I see another company that I think has a great chance to outperform Nvidia over the next three years. And it's not a Nvidia competitor. It's a partner.

The company that could outpace Nvidia

Taiwan Semiconductor Manufacturing (TSM +0.64%) holds a place similar to Nvidia -- it is the leading fabricator for semiconductor chips. Essentially, Nvidia and its competitors design GPUs and other products, and TSMC builds them. Nvidia's CEO, Jensen Huang, calls TSMC's fabrication process "magic."

TSMC produced more than 11,800 different products in 2024, using 288 separate processes. Sixty percent of the company's revenue comes from making 3 nanometer (nm) and 5 nm chips, which are essential to semiconductor manufacturing. Semiconductor makers, like Nvidia and AMD, value smaller and smaller circuits because the more a company can put on a chip, the more powerful it is. TSMC is one of only a handful of fabricators making 3 nm chips at scale, and it's planning to mass-produce 2 nm chips this year.

Statista reports that TSMC has about 70% of the semiconductor fabrication market today. And the best part? That will likely not change substantially. TSMC makes Nvidia chips, but they also make chips for AMD, Amazon, Apple, Alphabet, and Qualcomm, among others.

So, no matter what company bites into Nvidia's dominant market share, they will likely be coming to TSMC to fabricate the chips.

NYSE: TSM

Key Data Points

Trade issues and other barriers

There's been a lot of talk this year about trade barriers, tariffs, and other headwinds that can potentially damage the semiconductor market. President Donald Trump, like his predecessor, has been firm on wanting to encourage semiconductor development and fabrication in the U.S. If you remember, it was during the Biden administration that Congress passed the CHIPS act to spur development on U.S. soil.

That's why its significant that TSMC is diversifying its fabrication locations, investing $165 billion into adding capacity in Arizona where it's currently making Nvidia Blackwell chips. TSMC is building six fabrication plants in the north Phoenix area.

Fabricating chips in the U.S. will be important as U.S. companies look for ways to avoid tariffs -- and White House difficulties -- by manufacturing chips on U.S. soil. CEO C.C. Wei said in October the company will continue to invest in Taiwan but would speed up its production expansion and technology upgrades on U.S. soil.

TSMC's dynamic growth bodes well for the next three years.

Another reason I like TSMC stock: Taiwan Semiconductor's revenue is already on a sharp upswing, holding steady at 36% year-over-year growth.

|

Month |

Net Revenue |

Year-Over-Year Change |

|---|---|---|

|

January 2025 |

$9.59 billion |

39.5% |

|

February 2025 |

$8.50 billion |

43.1% |

|

March 2025 |

$9.35 billion |

46.5% |

|

April 2025 |

$11.43 billion |

48.1% |

|

May 2025 |

$10.48 billion |

39.6% |

|

June 2025 |

$8.63 billion |

26.9% |

|

July 2025 |

$10.57 billion |

25.8% |

|

August 2025 |

$10.98 billion |

33.8% |

|

September 2025 |

$10.10 billion |

31.4% |

|

Total |

$90.42 billion |

36.4% |

Source: TSMC. Revenue converted from New Taiwan dollars.

The company is consistently hitting $10 billion per month in revenue, and issued guidance for the fourth quarter to bring in $32.2 billion to $33.4 billion in revenue, with an operating margin of about 50%.

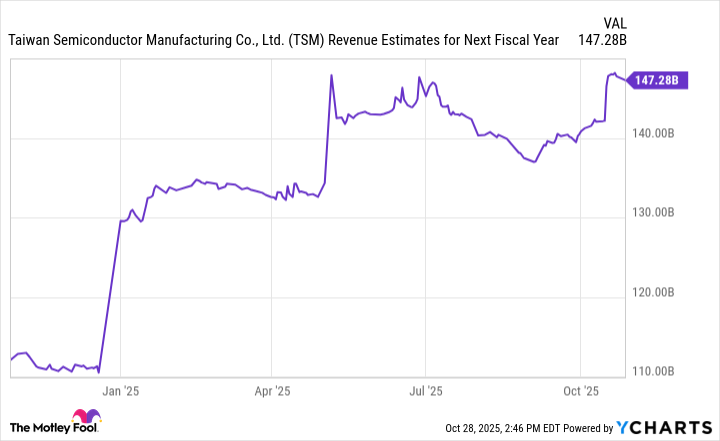

Those are dynamic numbers -- and I have a lot of confidence that they will continue. So does Wall Street, as TSMC's revenue estimates have steadily risen through the year. Next year's revenue is expected to be more than $147 billion.

TSM Revenue Estimates for Next Fiscal Year data by YCharts.

If you're looking for a company that can beat Nvidia for the next three years, look to the company that's making their chips -- as well as their competitors'. That's TSMC.