November could be a critical month in the AI investment realm. Several important companies report earnings during November, and the picture they paint will provide an important insight into what 2026 could hold for the industry. While there have been talks of an AI bubble forming, I still think there's plenty of room for this industry to run for multiple reasons. All of this will add up to boosting one of the best-performing AI stocks since the AI arms race began in 2023: Nvidia (NVDA 3.18%).

Nvidia has been a key part of the AI arms race, and could have several positive catalysts affect its stock during November. I think it's well positioned to soar heading into 2026, and now could be a great time to scoop up shares.

Image source: Getty Images.

Nvidia has a few key events going on in November

Nvidia makes graphics processing units (GPUs), which excel in high-performance computing applications. Historically, GPUs have been used for tasks ranging from processing gaming graphics to engineering simulations to mining cryptocurrency. Their biggest use case so far has been artificial intelligence computing applications, and Nvidia's GPUs have excelled in this realm.

Recently, a few of its competitors announced deals with OpenAI, the makers of ChatGPT. This has led to some investors wondering if Nvidia is losing its dominance, but I think we'll get that answer on Nov. 19, when Nvidia reports its fiscal 2026 Q3 results. Nvidia is expected to report strong growth once again and will likely outperform Advanced Micro Devices (AMD 17.31%), one of the companies that announced a deal with OpenAI. Nvidia is still the go-to solution for AI computing hardware, but even if it loses some market share, it will be OK.

NASDAQ: NVDA

Key Data Points

In the company's last earnings call with analysts, Nvidia estimated that current global data center capital expenditures will total about $600 billion in 2025. However, CEO Jensen Huang expects that total to expand to a range of $3 trillion to $4 trillion by 2030. That's a huge pie, and Nvidia can afford to lose a bit of market share and still be a successful investment.

Another factor that's less discussed is that Nvidia still hasn't been granted an export license to resume sales of its H20 chips that were purpose-built to meet export restrictions set by the U.S. government. After the Trump administration revoked that license earlier this year, Nvidia lost an important client base. While Nvidia has discussed paying an export tax for these and getting a license, it has still not been granted. Nvidia could get positive news surrounding this subject soon, as this license may be being used as a bargaining chip between ongoing U.S. and China trade negotiations. If Nvidia's chips are allowed to be shipped to China, this would be a massive boost for Nvidia's business, and the stock will respond positively as a result.

Nvidia has a lot of potential catalysts to boost the stock throughout November, and despite some notions, it really isn't all that expensive.

Nvidia's stock isn't cheap, but it's still not expensive considering its growth

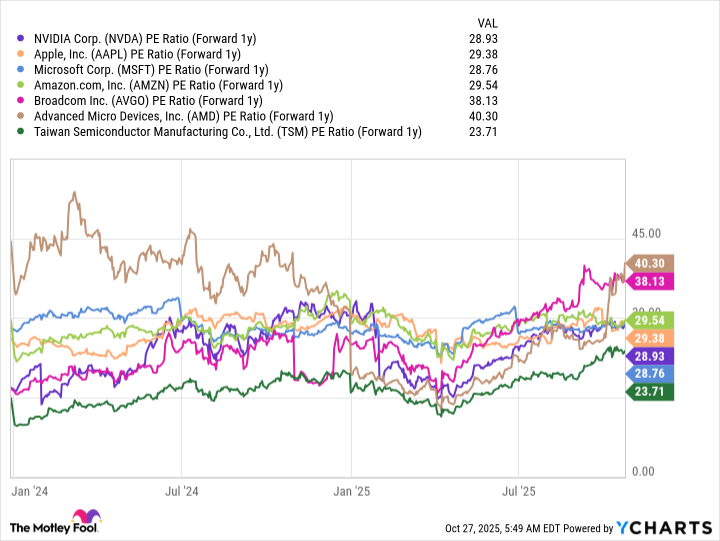

Nvidia's stock from a forward price-to-earnings basis isn't the cheapest on the market at 29 times next year's earnings. However, when you compare Nvidia's valuation to its peers, it gets lost in the mix.

NVDA PE Ratio (Forward 1y) data by YCharts

Nvidia is right in the middle of its big tech peers in terms of valuation, showcasing that it isn't really all that expensive when you account for future growth.

I still think Nvidia has a ton of room to run, and it could receive some positive news during November that helps the stock along. Although it has already had several successful years, I believe the AI arms race is far from over, and Nvidia will still be a money-making investment for years to come.