Nvidia (NVDA +1.02%) has become one of the most popular stocks on the planet over the past few years -- and that's due to the company's leadership in the game-changing field of artificial intelligence (AI). But the tech giant isn't just involved in AI in an insignificant way. Instead, it's carved out a key role as the player powering the industry.

This is because Nvidia designs the highest-performance chips, and considering AI customers' desire to win in the field, they've been flocking to Nvidia for their projects. All of this has led to soaring revenue reaching record levels, and it's also helped the stock roar higher. Over the past three years, for example, Nvidia shares have advanced 1,400%.

The AI boom is far from over, so in spite of Nvidia's massive gains, investors still look to get in on the stock. And with a potential catalyst right around the corner, now could be the moment. Should you buy Nvidia before Nov. 19? Let's find out.

Image source: Nvidia.

From video games to AI dominance

Before diving in, though, let's consider Nvidia's path from mainly serving the video game industry to ruling the world of AI. This more than 30 year old company in its early days primarily supplied its graphics processing units (GPUs) to gaming customers, but when it became evident that the GPU could be valuable elsewhere, Nvidia took steps to make that happen.

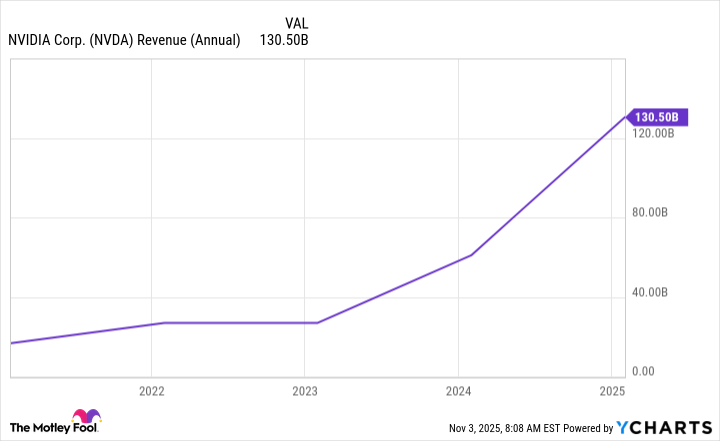

The company designed a parallel computing platform, CUDA, to broaden the market for its GPUs, and as AI emerged as a potential game-changing industry, Nvidia actually tailored its GPUs to serve AI needs. All of this has been transformational for the company, as we can see through revenue growth over the past few years.

NVDA Revenue (Annual) data by YCharts

Since Nvidia got in early on the AI market, the company has established a leadership position -- and its commitment to innovation may keep it there. Nvidia says it will update its GPUs on an annual basis, and it's set out a roadmap through 2028 so investors know what to expect. Just recently, the company said total cumulative shipments of its Blackwell and Rubin systems as well as networking products have reached $500 billion in sales for 2025 through 2026.

More success ahead

All of this supports the idea of more success for Nvidia -- and its investors -- down the road. Now, let's consider whether you should rush to get in on this top AI stock ahead of its next big moment -- on Nov. 19. What's set to happen then? Nvidia is scheduled to report third-quarter earnings for the 2026 fiscal year.

NASDAQ: NVDA

Key Data Points

For reference, Nvidia has a solid track record of earnings performance, reporting double-digit gains in recent quarters. And the company has surpassed analysts' estimates in each of the past four quarters. Strong demand for chips reported by Nvidia's chip manufacturer Taiwan Semiconductor Manufacturing as well as AI customer demand reported by Nvidia customers such as Alphabet also offer us reason to be optimistic about Nvidia's upcoming report.

Time to buy?

Does this mean now is the time to scoop up shares and potentially benefit from a post-earnings gain? Not necessarily. I consider Nvidia a great stock to buy and hold on to for the long term, but whether you buy it today or in a few weeks, you probably will record the same performance over a period of five or 10 years. Short-term fluctuations in price won't make much of an impact on long-term performance, and this means you don't have to worry about timing the market to buy the stock at a particular moment.

An exception to this would be if the stock had fallen to a dirt-cheap level -- this happened earlier this year when declines in tech stocks pushed valuations lower and Nvidia traded for just over 20 times forward earnings estimates, down from more than 40 times. In that case, investors may scramble to scoop up a stock for a bargain price.

Today, though, Nvidia stock has returned to about 44 times forward earnings estimates -- a level that isn't cheap but remains reasonable considering the Nvidia growth story so far and the one ahead. And I wouldn't expect its valuation to fluctuate greatly unless Nvidia or the general market surprises investors with something significant -- for example, Nvidia's valuation suffered this spring as investors worried about the impact of import tariffs on companies and the economy.

So, considering all of this, Nvidia remains a buy -- but one you don't have to rush into before Nov. 19.