Before buying or selling a stock, it's important to consider your own investment style instead of following the crowd. But this doesn't mean you shouldn't look around at what others are doing -- especially if they are investors who have proven their abilities over time. You won't follow their every move, but certain ones could offer you inspiration.

Two such investors are Michael Burry and Warren Buffett. Burry took the spotlight when he bet against the U.S. housing market prior to the subprime crash -- and made more than $700 million for clients of his hedge fund. The story was brought to the silver screen in the movie The Big Short a few years ago. As for Buffett, he's been wowing the market for nearly 60 years. Over that time period, at the head of Berkshire Hathaway, the billionaire has delivered market-beating returns -- and his words of wisdom have guided investors through any market environment.

Burry could be seen as more of an aggressive investor, while Buffett as more cautious, but these two market stars have one thing in common. They don't follow the crowd. And in recent times, that's led them both to invest in a dirt cheap but troubled stock. Now, the question is: Should you follow their lead? Let's find out.

Image source: Getty Images.

A leader in its industry

The company Burry and Buffett have invested in is one that's a leader in its industry but has suffered a few setbacks over the past year. I'm talking about UnitedHealth Group (UNH 0.49%). The biggest U.S. health insurer reported disappointing earnings in the first two quarters of this year, unexpectedly lost its chief executive officer, and faced a Department of Justice probe into its Medicare billing processes.

Still, in the second quarter of the year, Burry and Buffett opened positions in UnitedHealth. Burry purchased 20,000 shares and also bought 350,000 in call options -- this type of option, allowing the investor to buy the stock at a certain price before a set time, is a bet that the stock price will rise. Buffett bought 5,039,564 UnitedHealth shares in the quarter.

NYSE: UNH

Key Data Points

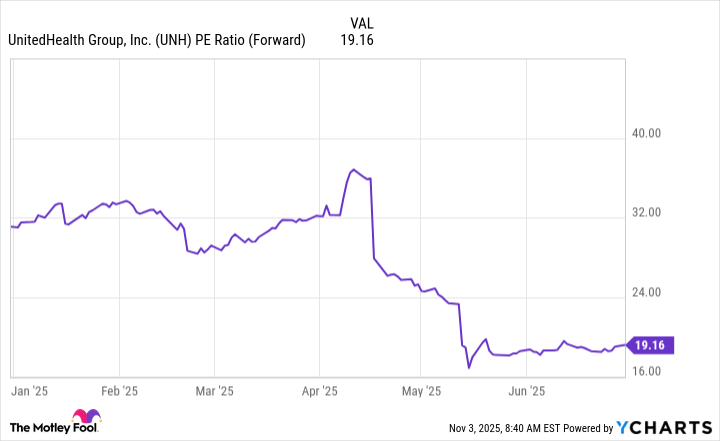

UnitedHealth saw its valuation drop during that three-month period, so it's possible these investing experts bought shares at an interesting price.

UNH PE Ratio (Forward) data by YCharts

And, today, trading at 20x forward earnings estimates, the stock could be considered dirt cheap -- if we're optimistic about the company recovering from current troubles and returning to growth.

Identifying problems and taking action

So now the question is: Should we be optimistic about the UnitedHealth recovery story and follow Burry and Buffett into the stock? Though it will take some time for UnitedHealth to turn things around, the good news is the company has spotted the problems, is addressing them, and already is making progress. UnitedHealth said earnings weakness mainly has been due to mispricing and market positioning -- the positive point here is these are two elements the company can control.

In the recent earnings report, UnitedHealth said repricing within the insurance business -- UnitedHealthcare -- should drive operating earnings growth next year. The company says its efforts to boost the Optum business -- which provides services such as pharmacy care -- will show results next year and thereafter. For example, in Optum Health, the company aims to narrow the provider network, which had grown too wide.

Raising 2025 guidance

As a result of UnitedHealth's recent moves, the company reported double-digit revenue growth to more than $113 billion and net income that surpassed analysts' estimates. The company also lifted its 2025 guidance to at least $14.90 per share. That's up from an earlier forecast of $14.65 per share.

UnitedHealth is showing that it's on the right path to recovery and growth, and at the same time, the stock is very reasonably priced at the moment. It's important to remember that the company is a dominant player in the U.S. and the combination of its insurance and services businesses represents a moat or competitive advantage. All of this offers us reason to be confident about this player's long-term story.

Both Burry and Buffett earlier in the year recognized UnitedHealth's potential -- and the good news is that now it's not too late for other investors to follow them into this healthcare stock.