Shopify (SHOP 5.93%) stock soared 17% in October, according to data provided by S&P Global Market Intelligence. The e-commerce software provider benefited from improving market sentiment about tariffs, and that was followed up by a fantastic third-quarter earnings report yesterday, although the market wasn't impressed.

Image source: Getty Images.

Commerce services for every retailer

Shopify is known for its e-commerce services, but it's increasingly moving over to a full commerce platform, offering all kinds of financial and operational management services for retailers. Gone are the days when its business was setting up e-commerce websites for small businesses; while that's still a major part of its model, it has a much wider business now, providing payment options of all types, artificial intelligence services, and more to businesses big and small.

Since it's a global company, there had been fear about how tariff changes might affect it, despite it continuing to report high growth and improving profitability. As the tariff situation stabilizes, the market has become more optimistic overall and specifically about companies that are in its direct line.

However, the market was less enthused about Shopify's third-quarter earnings, which were released on Nov 4. At first glance, it's hard to see why. Revenue increased 32% year over year, a fabulous showing, and free cash flow increased 20% over last year with an 18% margin. Operating income increased 21% with a 12% margin. Gross margin was slightly lower year over year, which management attributed to a higher mix of merchant solutions revenue, a lower-margin business.

NASDAQ: SHOP

Key Data Points

The commerce provider of the future

Shopify has been having incredible success servicing the enterprise retailers that are starting to become a bigger part of the business. Every quarter, it adds some new big names, including e.l.f. Beauty and Estee Lauder in the third quarter. President Harley Finkelstein says that all of these companies want to be part of the agentic AI revolution, and they're choosing to partner with Shopify, which is making the investments to make it work for its clients. Management sees this opportunity as just getting started.

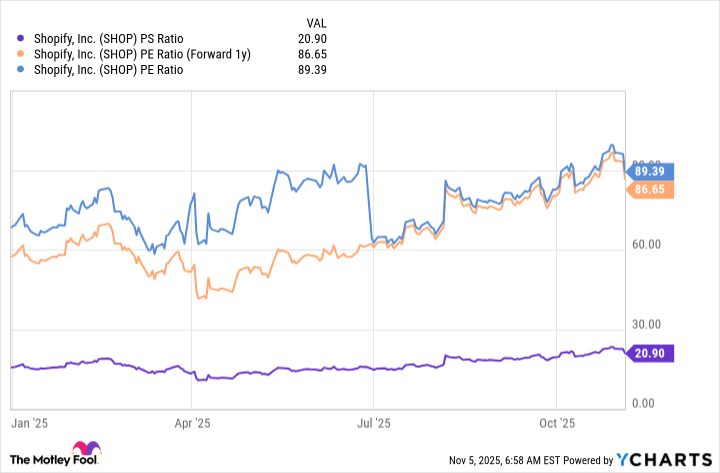

Shopify stock fell after earnings, though. Analysts were looking for better margins. That's the issue with stocks that trade at premium valuations -- if there's anything the market doesn't like, the price is likely to fall.

Even at the current price, Shopify still isn't cheap.

SHOP PS Ratio data by YCharts

Shopify has a great long-term opportunity, but it's susceptible to further falls on any bad news.