Shares of Sweetgreen (SG 1.48%) were among the losers last month, even as there was no major news out on the fast-casual salad slinger.

Instead, a growing sense of malaise around consumer spending in the economy and downbeat reports from peers like Chipotle Mexican Grill pushed the stock lower. Wall Street also took a dimmer view of the stock over the course of the month.

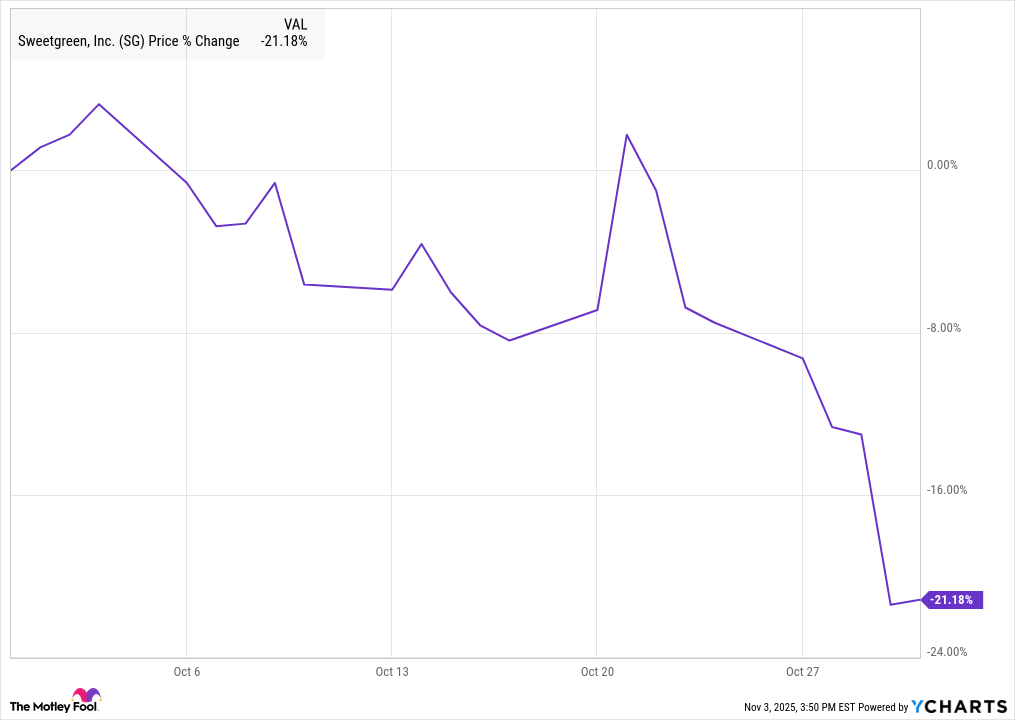

According to data from S&P Global Market Intelligence, Sweetgreen shares finished the month down 21.2%. As you can see from the chart, the pullback came mostly at the end of the month as data showed consumer sentiment weakening, and it fell after Chipotle's earnings report came out, which served as a warning sign for the broader fast-casual industry.

Sweetgreen continues to wilt

By the end of the month, Sweetgreen was approaching its all-time low of $6.10, which it hit in March 2023 in the wake of the bear market that followed the pandemic.

Through the first half of the month, Sweetgreen stock drifted lower, though there was little company-specific news out. The biggest impact on the stock came when Bank of America downgraded it from buy to neutral, as analyst Sara Senatore noted that consumer spending among low-wage earners was weakening, which is a problem for chains like Sweetgreen that depend on younger office workers. She also lowered her price target from $18 to $9.50, and the stock fell 3.8% on Oct. 6, the day the report came out.

At least three other analysts lowered their price target on the stock, though the market's reaction was more muted to those updates.

After a brief pop on Oct. 21, which could have been related to the short-lived surge in Beyond Meat stock, Sweetgreen resumed its decline, falling 4% on Oct. 28 in response to consumer confidence hitting a six-month low, and then 9% on Oct. 30 after Chipotle posted flat comparable-store sales and warned that younger customers were struggling to afford its food.

Image source: Sweetgreen.

What's next for Sweetgreen?

The fast-casual operator will report earnings on Thursday, Nov. 6, and investors have low expectations. The analyst consensus calls for revenue to increase just 2.5% to $177.8 million, and for its adjusted loss per share to fall from $0.07 to $0.10.

Investor attention will likely be on guidance and management's forward outlook. The market can stomach another quarter of weak results, but the question of whether Sweetgreen can eventually rebound is still unanswered.

There's a good argument that the stock is oversold at this point, with a market cap under $1 billion and a price-to-sales ratio just over 1, but Sweetgreen needs to convince investors it can at least stabilize the business, if not return to growth, in order for the stock to start to bounce back.