Dividends appeal to investors for various reasons. One big one is that dividends represent tangible cash flow from your portfolio, without having to sell shares. As your dividend income grows, it could eventually cover your living expenses. That means financial freedom to many people.

But you have to start somewhere. A $1,000 investment can kick-start your dividend portfolio, especially when invested in a high-quality monthly dividend stock such as Realty Income (O +0.00%). Here is how a stock like Realty Income can create a lucrative monthly dividend stream and how you can grow it over time.

Image source: Getty Images.

Why investors can count on Realty Income over the long term

Realty Income is a real estate investment trust (REIT), a company that acquires and leases real estate properties. Most REITs specialize in a particular type of property. Realty Income focuses on single-tenant retail properties, such as convenience stores, restaurants, grocery stores, and pharmacies. It's one of the world's largest REITs, with over 15,600 properties across the United States and parts of Europe.

Investors can rely on Realty Income's dividend for several reasons. First, it enjoys a strong tenant base that reliably pays its rent. Even during the COVID-19 pandemic in 2020, Realty Income's quarterly rent collection across its portfolio fell to 86.5% in the second quarter, but improved from there. It didn't stop Realty Income from increasing its dividend.

Expanding on that, Realty Income methodically raises its dividend. It has increased the dividend for 112 consecutive quarters and 32 straight years. The company has a stellar (A- rating) balance sheet and uses net leases, so its tenants handle the property's maintenance, taxes, and insurance costs.

You should never say never, but Realty Income's business model and strong financials make its dividend about as reliable as you'll find. Catastrophic events like the COVID-19 pandemic or the 2007-2009 financial crisis couldn't stop the dividend, let alone prevent Realty Income from raising it.

NYSE: O

Key Data Points

How much $1,000 in Realty Income will pay you

Most U.S. stocks pay dividends quarterly, making Realty Income relatively uncommon. The company is so famous for its monthly dividend schedule that it refers to itself as the Monthly Dividend Company.

Investing $1,000 in Realty Income stock will buy you 17 shares at its current share price. The company's most recently declared monthly dividend was $0.2695 per share, or $3.23 annualized. Doing the math, those 17 shares will pay you $4.58 monthly, or just under $55 annually.

I'll admit that it doesn't seem like much right now. But the magic is in what you do with those dividends. Realty Income is rare in that you have multiple ways to compound your money over time. For instance, Realty Income isn't just raising its dividend once a year -- it raises it each quarter.

The real magic comes from reinvesting those dividends to buy more shares. The dividends you'll receive in year one are roughly enough to buy an entire share of Realty Income stock, which will pay dividends of its own. If you do that year after year while adding new savings along the way, your dividend income from the stock will grow from a small snowball to a massive dividend boulder.

Image source: Getty Images.

How a dividend snowball can make you very wealthy

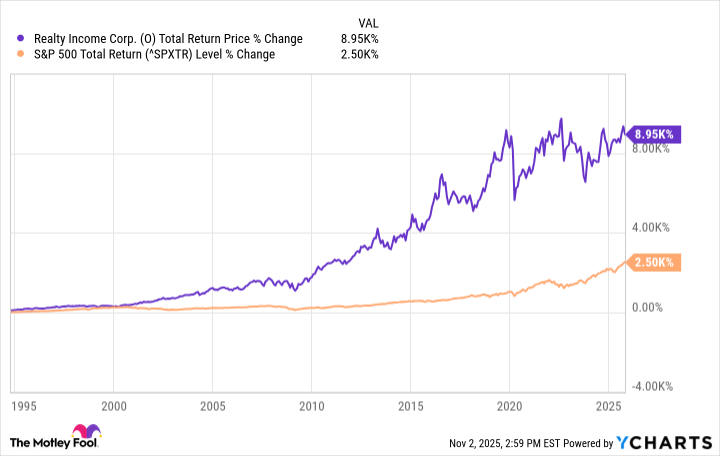

Don't dismiss how powerful the dividend snowball can be! Realty Income has historically grown at a low single-digit rate. The dividend's lifetime annualized growth rate is just 4.2%. Remarkably, the stock has trounced the broader market over its lifetime, despite its slow growth, thanks to all that additional compounding from dividends.

O Total Return Price data by YCharts

The company has executed a couple of expensive acquisitions in recent years, which have weighed on growth. However, funds from operations (FFO) per share look ready to head higher again, with management guiding for a big jump in FFO this year to about $4.25 per share. It prices the stock at under 14 times its guided 2025 FFO per share.

That means now could be the perfect time to lean into Realty Income and begin a dividend snowball in your portfolio.