Among Wall Street's most prominent money managers, Berkshire Hathaway's (BRK.A +0.51%)(BRK.B +0.76%) billionaire CEO, Warren Buffett, sits on a pedestal of his own. When you've outperformed the benchmark S&P 500 (^GSPC 1.12%) by approximately 5,738,000%, including dividends paid, over a 60-year period, you're going to draw the attention of professional and everyday investors.

The investing community is particularly keen on Berkshire's Form 13F filings. This is a required filing due no later than 45 calendar days after the end of a quarter for institutional investors with at least $100 million in assets under management. Its purpose is to allow investors to see which stocks Wall Street's savviest fund managers (including Warren Buffett) are buying and selling.

The grim reality investors have come to terms with of late is that the Oracle of Omaha has been doing far more selling than buying. While much of this has been outlined in Berkshire's 13Fs, these filings fail to tell the complete and frightening story about Warren Buffett's favorite stock.

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

The Oracle of Omaha has been a relentless net-seller of stocks for three years

To preface the coming discussion, let me make clear that Berkshire Hathaway's billionaire boss is an unwavering long-term optimist who won't bet against America. But just because he believes in the long-term expansion of the U.S. economy, it doesn't mean he's always a buyer of equities.

Berkshire Hathaway's quarterly operating results provide to-the-dollar consolidated cash flow statements detailing how much was spent purchasing and selling equity securities. For 12 consecutive quarters, Buffett has been a net-seller of stocks, to the cumulative tune of $183.5 billion. It's a stunning realization for a leader who's turned Berkshire into a trillion-dollar business by acquiring and investing in other companies.

The catalyst for this net-selling activity looks to be the historical priciness of the stock market.

For example, the aptly named "Buffett Indicator" hit an all-time high last week. This valuation measure, which divides the aggregate value of all publicly traded companies by U.S. gross domestic product (GDP), has averaged a reading of roughly 85% when back-tested to 1970. Last month, it peaked at north of 225%!

While some of Warren Buffett's unwritten investing rules are subject to being broken, Berkshire's soon-to-be retiring CEO is an absolute stickler when it comes to valuation.

NYSE: BRK.B

Key Data Points

Warren Buffett has gone cold turkey on a stock he spent $78 billion buying

But what investors might be surprised to learn is that the entirety of Buffett's investment activity isn't found in Berkshire's quarterly filed 13Fs. For detailed information about the Oracle of Omaha's favorite stock to buy, you'll need to dig into his company's quarterly operating results.

On the final page of each report, just prior to the executive certifications, you'll find monthly buying activity for Warren Buffett's favorite stock (drumroll)... Berkshire Hathaway.

Prior to mid-July 2018, Berkshire's chief could only repurchase his company's stock if shares fell to or below 120% of book value (i.e., no more than 20% above book value, as of the most recent quarter). With shares never falling to or below this threshold, Buffett was never able to reward his company's shareholders with buybacks.

This changed on July 17, 2018, which is when the company's board of directors amended the rules governing buybacks to allow its CEO more freedom to take action. As long as Berkshire Hathaway has at least $30 billion in combined cash, cash equivalents, and U.S. Treasuries on its balance sheet, and Buffett believes shares are intrinsically cheap, share repurchases can be made with no particular ceiling or end date.

Berkshire's billionaire boss took full advantage of this change and spent nearly $78 billion, in aggregate, buying back shares of his own company for 24 consecutive quarters (July 2018 – June 2024). Reducing Berkshire's outstanding share count has had a decisively positive impact on its earnings per share, thereby making its stock more attractive to investors.

But over the last 16 months (June 1, 2024 – Sept. 30, 2025), Berkshire's quarterly operating results show its billionaire boss has gone cold turkey and hasn't spent a dime to retire a single Class A (BRK.A) or B (BRK.B) share.

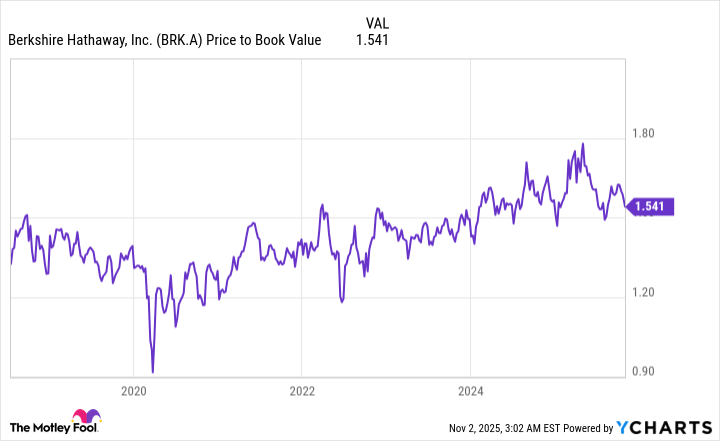

BRK.A Price to Book Value data by YCharts. Price-to-book history from July 17, 2018, to Oct. 31, 2025.

Although there's no company Warren Buffett has more confidence in over the long run than his own, the likely reason why he suddenly won't buy shares of Berkshire Hathaway stock is its valuation.

Between July 17, 2018, and May 31, 2024, Berkshire stock primarily vacillated at 30% to 50% above book value. Yet over the 16-month stretch where the Oracle of Omaha hasn't repurchased a single share, Berkshire's stock has hovered at a 60% to 80% premium to book value.

In other words, not even Warren Buffett's favorite stock gets a pass when it comes to valuation. If Berkshire's boss won't even buy shares of his own stock with a record amount of cash at his disposal, imagine how difficult it must be to find a good deal on Wall Street right now.

Being patient has consistently paid off for Buffett and Berkshire Hathaway's shareholders

Considering that Berkshire Hathaway's long-term growth has been dependent on Warren Buffett investing for the future, seeing him sit on his hands and sell more stocks than he's buying for three consecutive years, as well as go cold turkey on his own company's stock, is probably irritating to some investors.

On the other hand, being patient is a formula that's worked wonders for the Oracle of Omaha spanning more than a half-century.

Image source: Getty Images.

As we've established, Berkshire's boss isn't willing to chase stocks higher when he doesn't feel as if he's getting a good value for his purchase. But he's also aware that stock market corrections, bear markets, and elevator-down crashes are normal, healthy, and inevitable events on Wall Street. Waiting on these events to occur, and prudently deploying Berkshire's capital at opportune moments, have led to eye-popping gains for Buffett.

One of the more recent examples of this patience paying off handsomely for Buffett and his company's shareholders is the $5 billion invested in Bank of America (BAC +1.79%) back in August 2011. While BofA wasn't asking for capital handouts, Buffett saw this post-financial crisis weakness as an opportunity to snag Bank of America preferred stock, along with BofA stock warrants, at an amazing deal.

Six years later, Berkshire Hathaway exercised these 700 million common stock warrants at $7.14 per share and recognized an (unrealized) windfall of $12 billion, which has since grown considerably larger.

Opportunistic events like this don't grow on trees. While it's unlikely that Berkshire's $381.6 billion treasure chest will be deployed in any meaningful way before Buffett retires from the CEO role at the end of the year, it does set up successor Greg Abel to pounce with confidence when the next shock event leads to price dislocations.