Shares of Dutch company ASML (ASML +0.35%) have soared in 2025. The stock is up by more than 50% this year through Wednesday.

This surge came thanks to the hot artificial intelligence (AI) market, which relies on advanced semiconductor chips that can only be produced with ASML's extreme ultraviolet (EUV) lithography equipment. ASML's share price growth has defied a tough geopolitical backdrop. In particular, the government of the Netherlands has restricted sales of lithography equipment to China, one of the biggest markets for such tools in the world.

But with ASML's impressive stock performance this year behind it, is this still a smart time to buy shares?

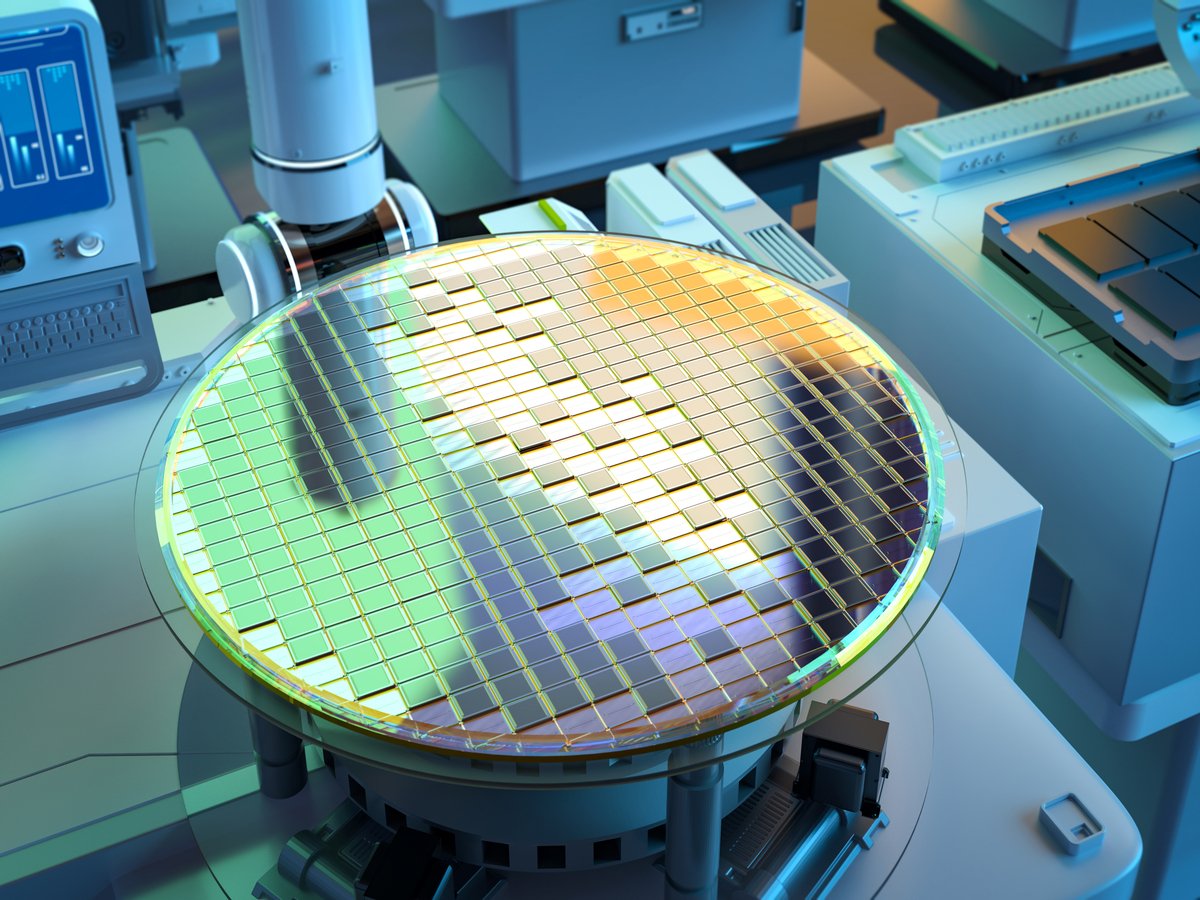

Image source: ASML.

How ASML's business is faring

The artificial intelligence boom has been beneficial for ASML because it's the only company in the world currently capable of offering EUV lithography systems. Its technological monopoly on these types of systems puts it in a strong market position, and its competitive moat has only widened with the introduction of its newest, most advanced systems: high-NA EUV machines.

EUV lithography accounted for a significant portion of ASML's net bookings in its fiscal third quarter, which ended Sept. 28, amounting to 3.6 billion euros out of total bookings of 5.4 billion euros. Net bookings represent customer orders, so this clearly demonstrates the demand among chipmakers for EUV systems.

As a result, the company booked revenue of 7.52 billion euros in fiscal Q3. While that wasn't much growth compared to the prior year's Q3 sales of 7.47 billion euros, management said it expects fiscal 2025's revenue to come in 15% higher than 2024's tally of 28.3 billion euros.

The company is on track to meet or exceed that target. Through the first three quarters, ASML's revenue totaled 22.9 billion euros, about 20% more than the 19 billion euros it made during the prior-year period.

This is impressive revenue growth, particularly considering the restrictions on the company's sales to China. Even so, the impact of trade restrictions on its business looks to intensify in the next fiscal year.

"We expect China customer demand, and therefore our China total net sales in 2026 to decline significantly compared to our very strong business there in 2024 and 2025," CEO Christophe Fouquet warned in the Q3 earnings release.

NASDAQ: ASML

Key Data Points

ASML's growth prospects

Despite the decline in sales to buyers in China, ASML is still positioned for years of business growth as the AI market expands. Artificial intelligence requires powerful computer processors to do its work, and those kinds of chips are not what populate most of the world's computing systems today.

Global X research analyst Tejas Dessai explained the implications: "AI needs specialized chips to run on, and trillions worth of processing chips will be up for replacement through this decade." Businesses and governments around the world are rushing to buy these chips, and demand still outstrips supply.

This situation is one of the reasons for ChatGPT creator OpenAI's recent deal with Nvidia to buy millions of these specialized chips. ASML has a tight partnership with the AI semiconductor chip leader, as exemplified by its adoption of Nvidia's cuLitho lithography software.

Considering foundries' plans to increase their production capacity to meet high chip demand, they'll certainly be buying more chipmaking equipment. And ASML's monopoly on the tech they require gives it a strong economic moat, and essentially assures that it will benefit.

To buy or not to buy ASML stock

Given its EUV monopoly and its rising revenue even with the loss of the China market, ASML is a worthwhile investment in the burgeoning AI sector. But is now the time to scoop up shares?

Consider the stock's price-to-earnings (P/E) ratio, which reflects how much investors are willing to pay for a dollar's worth of its trailing-12-month earnings.

Data by YCharts.

ASML shares hit a 52-week high of $1,086.11 on Oct. 30. That boosted its P/E multiple as well, and it's now hovering near its peak for the past year. This suggests ASML is on the pricey side.

Because of the stock's elevated valuation, now isn't the ideal time to make a purchase. Wait for the price to drop before buying ASML shares.