Artificial intelligence (AI) investing is still the top place to be as an investor. AI hyperscalers are pouring billions of dollars into ensuring that they have the resources necessary to power this AI revolution, and it opens up a ton of investment opportunities.

I think there are still several compelling stocks to buy that are benefiting from the AI race, and investors should consider scooping them up in November. These stocks could rise to end the year as investors shift their portfolios to these names for expected success in 2026.

Image source: Getty Images.

Nvidia

What AI stock list would be complete without the king of AI investing, Nvidia (NVDA +0.04%)? Nvidia's graphics processing units (GPUs) have been the computing backbone for the AI technology that we've experienced to date, and that doesn't look to be changing. Nvidia recently announced that it has orders for $500 billion of its advanced data center chips over the next five quarters. We'll have to see if Nvidia can meet that demand, but if it can, it's slated to post monster growth.

NASDAQ: NVDA

Key Data Points

Over the past 12 months, Nvidia generated $165 billion in revenue. I think this makes the stock an excellent buy, even if it has already been one of the most successful AI stock picks so far.

Broadcom

Companies like Broadcom (AVGO 1.84%) are also competing in the AI space, but Broadcom has a unique approach. Instead of offering a general-purpose computing unit like Nvidia does, Broadcom is partnering with AI hyperscalers to develop custom chips that are designed to run their particular workloads. This can provide increased performance at lower cost, with the sacrifice of flexibility.

Broadcom's custom AI accelerators may not compete with Nvidia's GPUs, but they may be able to carve out a large market as clients look to maximize their data center capital expenditures.

Taiwan Semiconductor Manufacturing

Neither Broadcom nor Nvidia produce the semiconductors that go into their AI chips. That work is done by Taiwan Semiconductor Manufacturing (TSM 0.93%). TSMC is the world's leading chip manufacturer, and boasts several other big names outside of Nvidia and Broadcom. It has become the go-to item for getting chips manufactured by big tech companies, and this position will be extremely tough to challenge.

NYSE: TSM

Key Data Points

As long as demand for AI computing power continues to rise, TSMC will be a great investment. I think that's an easy bet to make, which is why TSMC is a fantastic stock to scoop up before 2026 arrives.

Alphabet

Alphabet (GOOG 1.94%) (GOOGL 2.00%) was left for dead just a few months ago. Everyone assumed that its primary property, the Google Search engine, would be replaced by generative AI. However, that hasn't occurred yet, and Google Search revenue is still growing at a rapid pace.

Additionally, its Google Cloud cloud computing business is running AI workloads for many other clients, giving the company another revenue stream to fund its AI endeavors. I think this makes Alphabet a great investment for November, as it is still valued at a bit of a discount to its big tech peers despite impressive results.

Meta Platforms

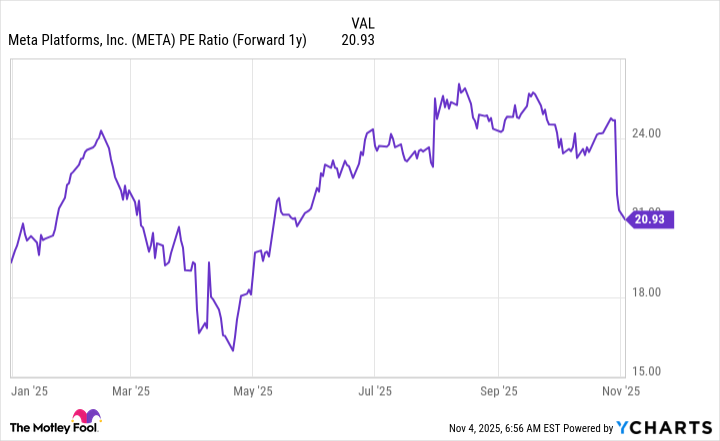

Meta Platforms (META +0.45%) finds itself in a similar position that Alphabet did just a few months ago. Meta, the parent company of social media platforms like Facebook and Instagram, has a massive amount of cash it can spend on AI. However, the market is growing a bit concerned about how Meta is spending, which caused the stock to fall after the announcement. Meta's stock is now trading for 21 times forward earnings, which is extremely cheap for the growth that Meta has put up and the quality of its business.

It may take a few months for the market to warm back up to Meta Platforms, but when it does, I expect the stock to produce impressive returns. If you're patient, Meta Platforms has the potential to be a huge winner throughout 2026 as market sentiment eventually changes around Meta's stock.