Stocks in the artificial intelligence sector have been hot over the past year, and one of the hottest is Palantir Technologies (PLTR +0.02%). Its shares have soared over 175% in the last 12 months.

Palantir's impressive share price performance is understandable. The company's business has been on fire thanks to its Artificial Intelligence Platform (AIP), which holds the potential to keep attracting customers over the next decade, given the anticipated growth in AI.

Do these factors make Palantir the best AI stock to own? A deeper dive into the company is necessary to answer that question.

Image source: Getty Images.

Palantir's outsize success

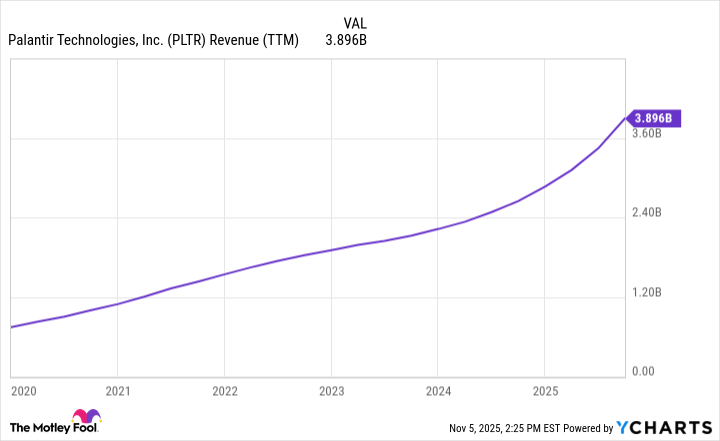

Palantir's share price boom is due to results like those in the third quarter, where revenue rose 63% year over year to $1.2 billion. The strong performance led to the company raising its full-year sales outlook to $4.4 billion, which would represent double-digit growth over 2024's $2.9 billion.

The company's third-quarter sales set a record high, and are the latest in a multiyear trend of consistently rising revenue.

Data by YCharts. TTM = trailing 12 months.

Even so, CEO Alex Karp says: "We are still at the very start of things. This remains the beginning, the first moment of a first chapter." It seems that from his perspective, the company's success can continue for many more years.

As Karp said about the third-quarter results, the company's U.S. commercial business "has now more than doubled in the last 12 months, growing 121% and generating $397 million in the last quarter."

This is significant because Palantir's roots lie in government work. Its outstanding expansion into the commercial sector shows that the company can tap a vast field of business customers to sustain its impressive revenue growth for years to come.

The tailwind behind Palantir's sales growth for the next decade

Adding to the company's accomplishments is the tailwind delivered by the AI sector's projected growth for the next decade. Industry forecasts estimate the AI market will expand from $273.6 billion in 2025 to $5.26 trillion by 2035.

Palantir is positioned to be a major player amid this market expansion. It recently announced a partnership with Nvidia to build what they call a "first-of-its-kind integrated technology stack for operational AI."

NASDAQ: PLTR

Key Data Points

Simply put, this means the two companies' technologies will be used to form a cohesive system that enables businesses to adopt AI on a large scale, moving beyond a collection of disparate, stand-alone tools. This collaboration with Nvidia could help to drive Palantir's sales growth in the future.

Weighing whether to buy Palantir stock

Given Palantir's many achievements and its growing position as a major AI player, the company is an excellent stock to own for the next decade. But is it the best AI stock?

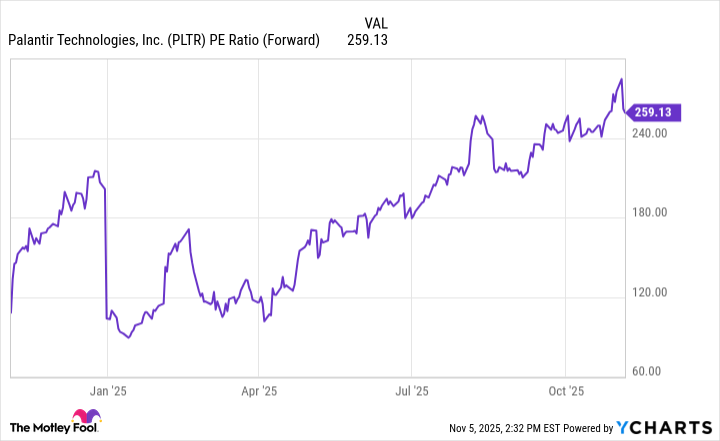

One factor making the purchase of Palantir shares a risky proposition at this time is its high valuation. Looking at the stock's forward price-to-earnings ratio (P/E) -- which tells you how much investors are paying for a dollar's worth of earnings based on estimates for the next 12 months -- reveals that this metric hovers near its peak for the past year.

Data by YCharts.

Investor excitement around Palantir's third-quarter earnings drove shares to an all-time high of $207.52 on Nov. 3. This contributed to the elevated forward P/E, which suggests Palantir stock is overpriced.

Nvidia's forward P/E of 30 is a fraction of Palantir's. This high valuation is one reason its share price fell in recent days.

But from Karp's perspective, "The reality is that Palantir has made it possible for retail investors to achieve rates of return previously limited to the most successful venture capitalists in Palo Alto."

Although he has a point, and Palantir is an excellent company deserving of a place in your portfolio, I can't call it the best AI stock.

Its sky-high valuation means investing at this stage harbors risk, and several prominent AI players, such as Nvidia, offer a more reasonable valuation combined with strong economic moats that knock Palantir off the top AI spot.