Shares of the artificial intelligence-powered robotics company Symbotic (SYM +8.82%) have been on a tear in 2025. The stock is up nearly 200% this year through the week ending Nov. 7.

The share price performance comes on the heels of the company's growing business. Symbotic reports earnings for its fiscal fourth quarter on Nov. 24. Should you buy its stock before it releases Q4 results?

The short answer is to wait for the stock price to drop. Here's why that's a prudent approach at this time.

Image source: Getty Images.

Symbotic's success and its share price

Symbotic looks like a compelling investment. It went public in 2022, and its sales have grown every year since. That continues to be the case in 2025.

For its fiscal third quarter ended June 28, Symbotic's sales came in at $592.1 million, up from $470.3 million in Q3 the previous year. Through three quarters, revenue totaled $1.6 billion compared to $1.2 billion in fiscal 2024.

Its key customer is Walmart. At the end of Q3, Walmart accounted for about 84% of Symbotic's sales. The company's relationship with the retailer looks solid, especially after buying Walmart's robotics business in January. This signals the retail giant's desire to let Symbotic handle the automation of its warehouses.

NASDAQ: SYM

Key Data Points

These positives contributed to Symbotic's share price appreciation. Now, the stock's valuation is looking pricey, especially after hitting a 52-week high of $84 on Nov. 3.

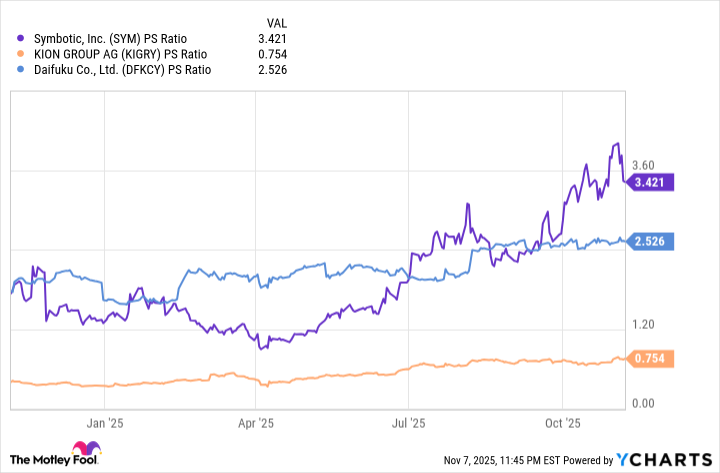

Symbotic had a net loss of $31.9 million in Q3, so its share price valuation can be assessed using the price-to-sales (P/S) ratio, and comparing it to competitors in the space such as Daifuku and KION Group.

Data by YCharts.

The chart shows Symbotic's P/S multiple is elevated compared to where it's been for most of the past year, as well as to the competition's. This suggests its stock price is steep, so it's best to wait for a dip before deciding to buy.