The S&P 500 (^GSPC 1.66%) continues to flourish late into 2025, surging by more than 37% from its low point in April earlier this year, as of this writing. But investors have mixed feelings about what the future holds.

While 38% of investors feel "bullish" about the market's next six months, according to the most recent weekly survey from the American Association of Individual Investors, just over 36% feel "bearish." The S&P 500's phenomenal returns over the last few years may inspire optimism, but they may also lead to concern that there's nowhere to go but down.

To be clear, it's impossible to say where the market may be next week, next month, or even next year. But if you're on the fence about whether to buy now or wait, history has a decisive answer.

Image source: Getty Images.

With a long-term outlook, there's no bad time to buy

If you're concerned that we're at a tipping point and that the market could plunge in the near future, it's tempting to hold off on buying until prices dip. After all, buying at record highs just before a downturn seems like one of the worst moves an investor could make.

History says otherwise, however. In fact, if previous downturns can teach us anything, it's that you're better off buying now -- no matter what lies ahead for the market.

For example, say you had invested in an S&P 500 index fund immediately before the market plummeted into the Great Recession. The S&P 500 had only recently begun reaching new all-time highs after recovering from the dot-com bear market, and investing in late 2007 would have meant buying at the highest prices since the early 2000s.

In the short term, your investment would have struggled. But within 10 years, you'd have earned total returns of more than 78%. By today, those returns would have skyrocketed to 362%.

The risk of waiting too long to buy

Of course, looking back on the Great Recession, it's easy to see that the objectively ideal time to invest would have been any period in 2008 or 2009 -- when prices were at rock bottom. But in the moment, it's impossible to know whether the market has bottomed out or there's still more room to fall.

One of the most common investing traps is waiting so long for the perfect moment to buy that you miss out on valuable time to let your money grow. Time in the market is far more important than timing the market, and buying at even the seemingly worst moment can help you earn more than waiting for the ideal buying opportunity.

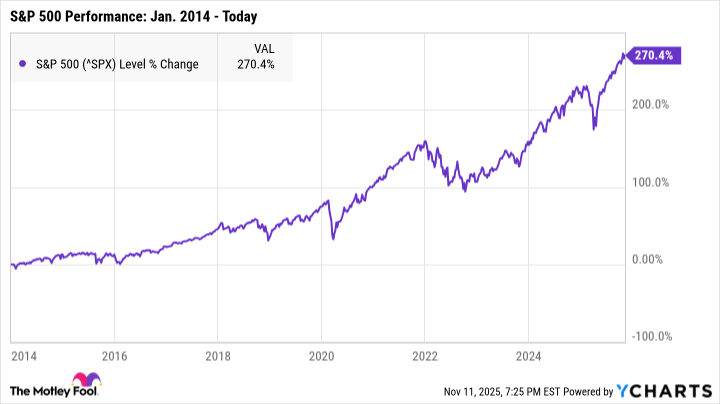

For instance, let's say that instead of investing in 2007, you'd waited until 2014 to buy. At that point, the S&P 500 had only recently begun reaching new all-time highs, officially entering bull market territory. Although it might have seemed like a much safer time to invest, by today, you'd only have earned total returns of around 270%.

The future is uncertain -- and that's OK

The stock market will always be prone to short-term volatility, and there's no way to know whether those fluctuations are just minor dips or whether we're headed toward a full-scale recession. The last couple of years alone have proven that panic-selling can be costly.

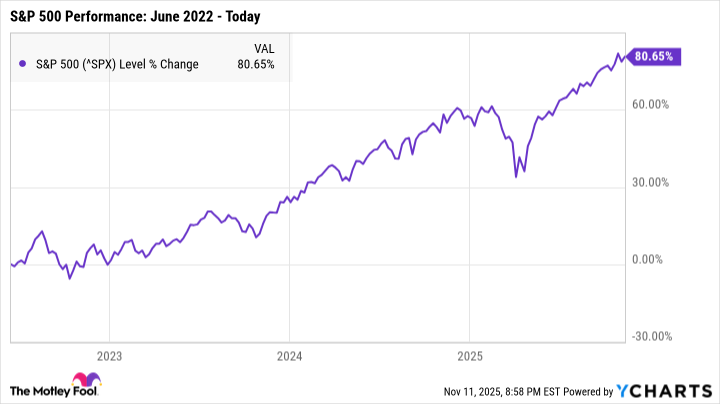

In June 2022, for example, analysts at Deutsche Bank predicted a "near 100%" chance that a recession would hit in the next 12 months. Not only did that recession never arrive, but the S&P 500 has surged by more than 80% since that forecast.

Trying to predict where the market will go can be risky at best, and incredibly expensive at worst. You might sell your stocks only for the market to surge, foregoing lucrative gains. Or you could wait so long to buy that you miss out on valuable time to build wealth.

Rather than trying to decide on the ideal time to buy, it's often safer and more profitable to keep investing consistently regardless of what the market is doing. If you end up buying at an expensive time, simply wait it out. Over the long term, the S&P 500 is all but guaranteed to climb higher.