After ascending 133% over the past 12 months, shares of Archer Aviation (ACHR 3.14%) lost some altitude last week. The stock dropped 27% following the company's third-quarter earnings release and news that the electric air taxi maker is buying an airport in Los Angeles.

Emerging technology stocks like Archer Aviation are prone to sharp price swings, and last week's turbulence came amid a broader pullback in the stock market. Still, investors might be wondering if the sell-off in Archer stock was warranted, or if the market was simply overreacting.

If you're thinking about starting or adding to a position in Archer Aviation, here are three things you should know.

Image source: Archer Aviation.

Archer is on a mission to reimagine urban commuting

Launched in 2018, Archer Aviation is developing electric vertical takeoff and landing (eVTOL) aircraft that will allow well-heeled commuters to rise above terrestrial traffic jams. Archer's flagship eVTOL aircraft, Midnight, is designed to reach speeds up to 150 mph, potentially cutting an hour-long ground commute down to minutes for up to four passengers per trip.

Worsening traffic congestion, advancements in electric propulsion technology, and growing demand for greener air transportation are among the tailwinds behind Archer's business model. Also, a recent executive order from President Donald Trump calls for the Federal Aviation Administration to establish a pilot program to accelerate eVTOL development. According to a forecast from Grand View Research, the value of the global urban air mobility market could grow from $3.6 billion in 2023 to $29.2 billion by 2030.

Archer already has some powerful partners, most notably United Airlines. In 2021, United placed a pre-order for up to $1.5 billion of Archer aircraft, and the two companies have unveiled plans to establish electric air taxi networks in Chicago and New York City. United, Stellantis, and Cathie Wood's Ark Investment Management are among Archer's investors. The company also has inked agreements with Korean Air, Ethiopian Airlines, and Abu Dhabi Aviation to deploy the Midnight in their respective markets.

NYSE: ACHR

Key Data Points

Archer is betting big on Los Angeles

The eyes of the world will be on Los Angeles -- and Archer Aviation -- when the city hosts the Olympic and Paralympic Games in July 2028. Archer has been selected as the official air taxi provider of the LA28 Games. With 15 million visitors and billions of TV viewers expected, it should be a great opportunity for the company to showcase its eVTOL technology on a global stage.

Archer's acquisition of Hawthorne Municipal Airport in Los Angeles gives the company a strategically located, purpose-built proving ground to launch and scale eVTOL service ahead of the 2028 Olympics. Beyond that, the 80-acre site will serve as the operational hub for Archer's L.A. air taxi network. Archer also plans to use the airport as a testbed for next-generation aviation technologies such as artificial intelligence (AI)-powered air traffic and ground operations management.

During Archer's third-quarter earnings call, CEO Adam Goldstein explained why the company is going all-in on L.A. "We're especially focused on winning Los Angeles because if we can prove electric air taxis work in one of the world's most congested, complex, and highly regulated cities, I believe we can subsequently scale the product across the U.S. and the world," Goldstein said.

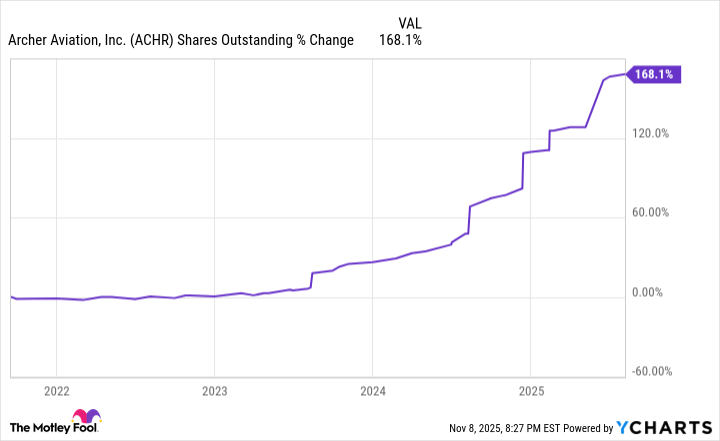

Investors are fretting over share dilution and competition

Last week, Archer disclosed a registered direct offering of common stock worth $650 million. The company plans to use $171 million to fund its acquisition of Hawthorne Airport, and the rest for "general corporate purposes." This seemed to stoke investors' angst over share dilution -- a legitimate concern with emerging tech start-ups like Archer Aviation, as you can see from the chart below.

ACHR Shares Outstanding data by YCharts

Last week's debut of BETA Technologies on the New York Stock Exchange likely added to investors' anxiety. Amazon-backed BETA is developing eVTOL and fixed-wing electric aircraft and building a charging infrastructure across North America. Meanwhile, another competitor, Joby Aviation, said it's getting closer to FAA certification, despite the ongoing government shutdown.

Still, I think investors are overlooking the big picture here. Archer Aviation is poised to be a leader in an emerging market that's on the verge of liftoff. The company has a strong pipeline of business, powerful partners in United Airlines and Stellantis, and a balance sheet that boasts over $2 billion in total assets after the most recent capital raise.

In my opinion, Archer's acquisition of a fully functioning airport in the heart of L.A. was a brilliant maneuver that provides real-world infrastructure for the start-up to prove and scale its business.

With shares trading under $10, I think Archer Aviation is an intriguing stock that could generate outsize returns for patient investors. However, if you're thinking of picking up some shares, expect prolonged patches of turbulence until Archer can reach its cruising altitude.