Shares of Intuitive Surgical (ISRG 0.77%) have rallied over 30% in a month, vastly outdistancing the S&P 500 index's 4% gain over the same span. Should you sell shares of this surgical robotics company after its huge outperformance? Before you dump the stock, you need to ask yourself why you really bought it in the first place.

What does Intuitive Surgical do?

Intuitive Surgical is a medical device company that makes surgical robots. Its da Vinci system was one of the first to market and is very well accepted globally.

At the end of the third quarter of 2025, there were 10,763 da Vinci systems in place around the world. That was up from 9,539 a year earlier, which represents a 13% increase. And yet there were 20% more surgical procedures performed with da Vinci robots year over year, showing the strong demand for the technology.

Image source: Getty Images.

It is unlikely that the company has reached its full potential, which is immense for surgical robots, given the benefits they offer patients. They tend to be less invasive, and the outcomes are generally very positive.

In the longer term, a surgical robot could be controlled from anywhere in the world. That would enable the highest quality healthcare to be provided anywhere a da Vinci system is available. And then there's the potential of procedures performed with the assistance of artificial intelligence, which could become a huge market in its own right.

Intuitive Surgical is really a growth story. And it's a fairly attractive one at that, since every new da Vinci system that is installed increases the market for the company's instruments and accessories, which need replacement constantly, and its services business. These are annuity-like income streams that are the real flywheel for the company's future. Combined, they account for around 75% of the top line.

The problem is that Wall Street is aware of the growth story here and has left Intuitive Surgical shares with a lofty valuation. Currently, the price-to-sales ratio (P/S) and price-to-earnings ratio (P/E) are both above their five-year averages, hinting at an expensive stock. Looking at the actual numbers is just as telling, with the P/S multiple at nearly 22 and the P/E multiple at a lofty 76. Those numbers are exceptionally high on an absolute basis.

Drawdowns happen and will likely happen again

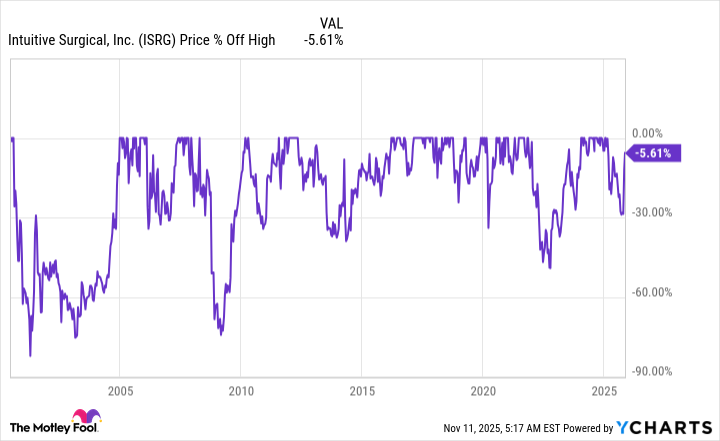

What's interesting here is that the stock has experienced eight drawdowns of roughly 30% or more. It's working its way back from just such a sell-off in 2025. That's why the gain has been so large over the last month. A single good earnings report is all that was needed to get investors back on board with the stock.

Whether or not you should sell it at this point really depends on why you bought it. If you had the luck of buying near the bottom of the current downturn in the hope that the share price would recover, well, it has. And you might want to lock in your quick profits and move on. That would be a very short-term play. And if all you were thinking about was an eventual rebound in the stock price, there's not much reason to stick around, either.

NASDAQ: ISRG

Key Data Points

But if you bought Intuitive Surgical because you believe in the long-term growth story behind surgical robots, the sell decision is very different. The good quarter that got Wall Street excited about the company again basically did so because it supported the long-term story.

In other words, this growth stock is still a growth stock. If you added Intuitive Surgical to your portfolio because of that opportunity, there's probably no reason to dump out now.

Intuitive Surgical's pattern is normal

The fact is, nothing on Wall Street goes up or down in a straight line. Price charts are almost always jagged and saw-toothed. So the recent drawdown and recovery in Intuitive Surgical's shares aren't at all unusual.

If you plan to own this stock for the long term, you'll need to have the fortitude to stick around through more such periods. But if that's too much of an emotional strain? Well, that's another good reason to sell the stock.