Investors are served four golden opportunities on silver platters four times a year -- chances to find out the latest investment moves of the world's most successful investors. Quarterly, managers of more than $100 million in securities must declare these to the Securities and Exchange Commission on Form 13F, and the latest deadline rolled around on Friday.

With this information, investors can gain inspiration from those who know the market best, such as investing legend Warren Buffett. The billionaire has propelled Berkshire Hathaway to market-beating gains over nearly 60 years, so his moves are ones to watch -- and sometimes follow.

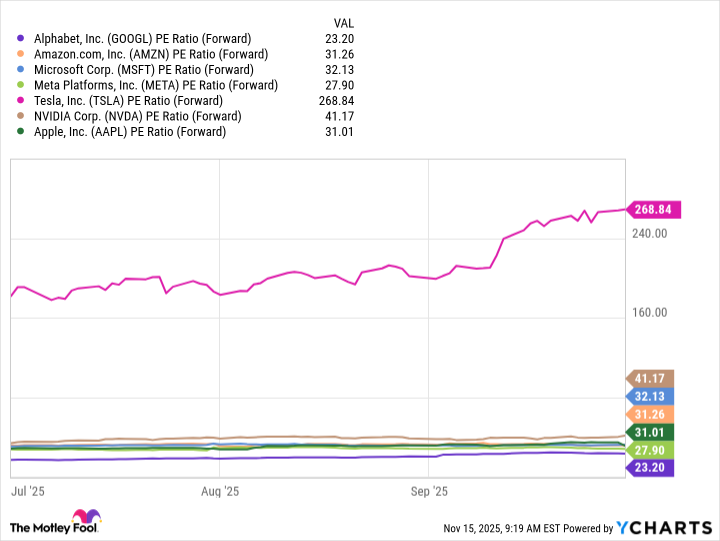

Buffett is known for his focus on value stocks, or those that trade for less than they're actually worth. And that is one factor that has limited his investments in technology companies. These players often trade at higher valuations than those in other industries, such as healthcare or consumer goods, for example. This happens as investors get excited about tech innovation and quickly pile into the opportunity, driving stock prices to high levels in relation to earnings.

But even in the tech world, bargains can be found, and Buffett landed a big one in the third quarter of this year. He opened only one new position in the quarter -- and it was the cheapest of the "Magnificent Seven" tech stocks. Let's zoom in for a closer look.

Image source: Getty Images.

Well-established tech players

So, first, a quick bit about the Magnificent Seven. I'm not talking about the 1960 Western but rather a group of technology players that have driven the S&P 500 higher over the past few years. They are well-established companies specializing in various areas of technology, from social media to cloud computing.

As mentioned, the value-conscious Buffett has never rushed to get in on tech stocks, but he does hold two key tech players: Amazon and Apple, with the latter actually being his biggest holding. He will open a position in such a company when he has faith in the long-term story, believes the company has a solid moat, and can get in on the stock at a good price.

This was the case in the latest quarter, concerning a tech company that most of us rely on daily for an important task: internet search. Buffett and his team decided it was time to buy Alphabet (GOOG 0.68%) (GOOGL 0.79%), owner of the world's most popular search engine, Google Search.

In the quarter, Buffett bought 17,846,142 shares of Alphabet, representing 1.6% of his $267 billion portfolio. Alphabet now is Buffett's 10th-biggest position.

NASDAQ: GOOGL

Key Data Points

Growth over the long run

Buffett, in his past purchases of tech stocks, may not have gotten in on the story at the earliest point, but he's still seen them generate significant growth over time. At the May Berkshire Hathaway shareholder meeting, he even congratulated Apple's chief, Tim Cook, for delivering so much growth. Buffett opened his Apple position in the first quarter of 2016, and since then, the stock has soared about 900%. So, even getting in on a tech giant well into its growth story could bring great rewards.

Getting back to Alphabet, an important note here is that Buffett and his team clearly saw value in this player at its price. During the third quarter, it was the cheapest of the Magnificent Seven stocks. It finished the period trading at 23 times forward earnings estimates.

GOOGL PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio.

Now, you might be wondering whether Alphabet continues to be a bargain buy today, and the good news is yes -- the stock, trading at 26 times forward earnings estimates, is the second-cheapest of the bunch, after Meta Platforms.

Reasonable valuation, a solid moat

It's fair to say the valuation likely appealed to Buffett, as did Alphabet's solid moat in internet search and the company's growing strength in cloud computing. This has helped it win in the billion-dollar artificial intelligence (AI) market, and that trend looks set to continue for quite some time.

So, should you follow Buffett into this rare-for-him technology buy? The answer is yes, as Alphabet has what it takes to suit both cautious and aggressive investors. The company has proven its ability to increase earnings over time, and AI may drive a new phase of growth in the coming years. Meanwhile, the stock is trading for a bargain price, making now the perfect time to get in on this Buffett-approved tech company.