Annaly Capital Management (NLY 2.79%) attracts considerable attention from dividend investors due to its huge 12.7% dividend yield. For comparison, the S&P 500 has a yield of just 1.2%, and the average real estate investment trust (REIT) yields just 3.9% or so, using Vanguard Real Estate Index ETF as a proxy for the industry.

But don't rush in thinking you've found the dividend holy grail, because there are some very important caveats here if you need your dividends to help pay for your living costs.

What does Annaly Capital Management do?

Most real estate investment trusts purchase physical properties and then lease them out to tenants. That's what you would do if you owned a rental property, so property-owning REITs are fairly easy to understand. Annaly Capital is not a property-owning REIT; it is a mortgage REIT, a far more complex niche within the broader REIT sector.

Image source: Getty Images.

Mortgage REITs, such as Annaly, buy mortgages that have been pooled into bond-like securities. The value of the REIT is, essentially, the value of its portfolio of mortgage securities. That makes mREITs kind of similar to mutual funds. For example, mREITs report tangible net book value per share each quarter, a figure similar to the net asset value (NAV), which mutual funds report on a daily basis.

However, one significant difference is that mREITs can employ leverage fairly aggressively, with the portfolio of mortgage securities serving as collateral. Another key similarity between Annaly and a mutual fund is their focus on total return. That's the metric used to compare mutual funds, and it is basically the goal of Annaly, which explains its strategy is "designed to achieve durable risk-adjusted returns over various interest rate and economic cycles."

While dividends are a big piece of the story, they aren't the whole story. The catch for dividend investors is that total return requires the reinvestment of dividends.

Be careful what you wish for in a dividend stock

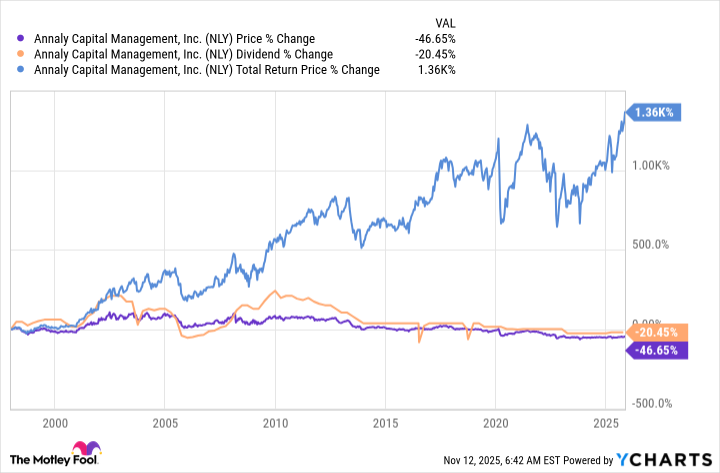

As the chart illustrates, Annaly has consistently provided investors with solid total returns over time (represented by the blue line). In fact, Annaly's total return is slightly better than that of SPDR S&P 500 ETF, which tracks the S&P 500 index and was also the first exchange-traded fund (ETF) ever created.

Data by YCharts.

The problem for dividend investors arises when examining the orange and purple lines, which represent the dividend and share price, respectively. Both of those lines have been highly variable over time, exhibiting a pronounced downward trend over the last decade or so.

Yes, Annaly has just increased its dividend, which is good news, but it hardly makes up for all the cuts that have taken place in recent years. If you bought Annaly and spent all the dividends you collected, you would have ended up with less income and less capital. That will not be viewed as a great outcome by most dividend investors.

NYSE: NLY

Key Data Points

From a broad perspective, Annaly will likely appeal most to investors focused on total return and asset allocation. For such investors, it could provide valuable diversification benefits.

That said, dividend investors could reinvest Annaly's dividend and then simply sell some Annaly stock to generate the income they need. That's a reasonable approach, but it will result in lower total returns over time, and you will have to be careful with the size of the stock sales you make.

For most investors, buying a dividend stock with a history of dividend growth, such as a Dividend King (which requires at least 50 consecutive annual dividend increases), is likely a better choice, even if it yields less.

Annaly's yield is huge, but it isn't really a dividend stock

If you are focused on buying dividend stocks as a way to generate income, Annaly probably won't be a good fit for your portfolio. That doesn't suggest that Annaly is a bad company, because it isn't. The problem is that your investment goal and Annaly's business goal may not align well if you are a dividend investor trying to live off the income your portfolio generates.