I set out to answer the headline question, which is no easy task since artificial intelligence (AI) exchange-traded funds (ETFs) have been popping up rapidly recently. Of course, that's because AI is the hottest stock space today, and so fund owners and managers are looking to cash in.

To build my list, I searched for ETFs that included the terms "AI" or "artificial intelligence" in their names. I also added one ETF that does not have either of these in its name: VanEck Semiconductor ETF (SMH +3.66%). I added this ETF because I have researched and written about it before, and I believe it's a good way for ETF investors to get exposure to AI. Semiconductors, also known as chips, are a crucial component of the AI revolution.

I also deleted three ETFs that had total assets under management (AUM) of less than $200 million, which is relatively small for an ETF and suggests the funds are probably very new.

My list may be missing some ETFs, but it should be pretty comprehensive.

Image source: Getty Images.

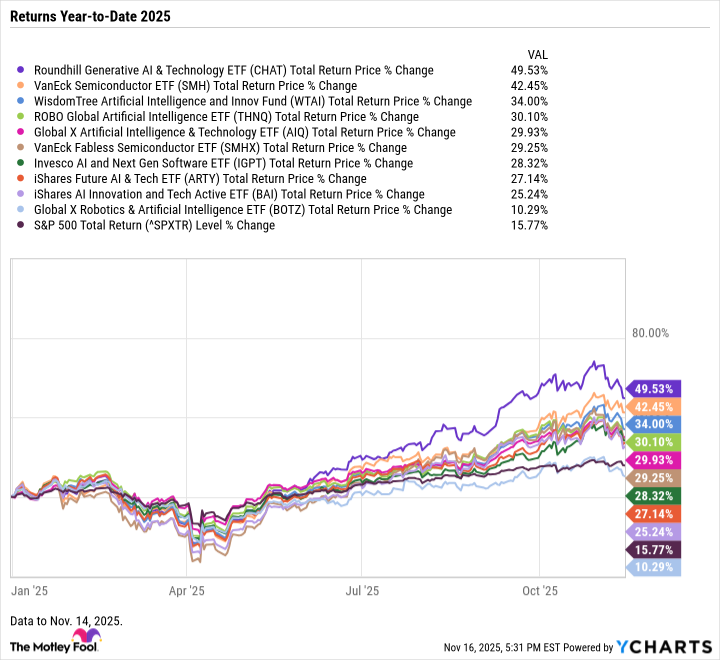

The chart below shows the year-to-date 2025 returns for 10 AI-focused ETFs, all of which have AUM exceeding $200 million. Most have an AUM of much more than that.

Data by YCharts.

The five best performers so far this year are Roundhill Generative AI & Technology ETF (CHAT +2.25%), VanEck Semiconductor ETF, WisdomTree Artificial Intelligence and Innovation Fund (WTAI +1.48%), ROBO Global Artificial Intelligence ETF (THNQ +1.42%), and Global X Artificial Intelligence & Technology ETF (AIQ +1.12%).

It's great that these funds are having a terrific 2025. But long-term investors also care about an ETF's (or stock's) performance over periods longer than just under a year. Let's examine the performance of these five ETFs over more extended periods.

| AI-Focused ETF | 1-Year Return | 3-Year Return | 5-Year Return |

|---|---|---|---|

| Roundhill Generative AI & Technology ETF | 51.9% | N/A | N/A |

| VanEck Semiconductor ETF | 39.6% | 222% | 264% |

| WisdomTree Artificial Intelligence and Innovation Fund | 39.2% | 90.7% | N/A |

| ROBO Global Artificial Intelligence ETF | 31.4% | 131% | 81.3% |

| Global X Artificial Intelligence & Technology ETF | 30.9% | 141% | 103% |

| S&P 500 Index | 14.7% | 77.8% | 102% |

Data source: YCharts. Data as of Nov. 14, 2025.

Based on the chart above, what ETFs look most promising to you?

I think the VanEck ETF appears to be the most attractive. However, the Roundhill ETF's powerful one-year performance also piques my interest. So, it seems worth watching.

Now, let's look at an overview and the top five stock holdings of the VanEck Semiconductor ETF and the Roundhill Generative AI & Technology ETF.

NASDAQ: SMH

Key Data Points

VanEck Semiconductor ETF

The VanEck Semiconductor ETF launched in 2011. It's an index fund designed to track the performance of an index that contains global companies involved in the entire semiconductor value chain from design to production. It has 25 stock holdings, all of which are listed on a major U.S. stock exchange. Its expense ratio is 0.35%, which is relatively reasonable for an index-based fund focused on an industry or theme.

|

Holding No. |

Company |

Market Cap |

Wall Street's Projected Annualized EPS Growth Over Next 5 Years |

Weight (% of Portfolio) |

3-Year Return |

|---|---|---|---|---|---|

|

1 |

Nvidia (NVDA +1.14%) | $4.6 trillion | 41.4% | 18.30% | 1,070% |

|

2 | Taiwan Semiconductor Manufacturing (TSM +5.17%) |

$1.4 trillion | 30.2% | 9.41% | 311% |

|

3 | Broadcom (AVGO +0.44%) | $1.6 trillion | 35.7% | 7.98% | 602% |

|

4 | Advanced Micro Devices (AMD +4.35%) | $402 billion | 44% | 6.75% | 236% |

|

5 | Micron Technology (MU +10.52%) | $277 billion | 37.1% | 6.61% | 306% |

|

Total top 5 |

N/A | N/A | N/A | 49.05% | N/A |

|

Overall ETF |

N/A |

Total net assets of $35.8 billion | N/A |

100% | 222% |

|

N/A |

S&P 500 |

N/A | N/A |

N/A | 77.8% |

Data sources: VanEck Semiconductor ETF, finviz.com, and YCharts. EPS = earnings per share. *Portfolio weights as of Nov. 13, 2025. All other data as of Nov. 14, 2025.

This ETF's top five holdings are all chipmakers, except for Taiwan Semiconductor Manufacturing Co. (TSMC), which is the world's largest chip foundry. It manufactures chips for companies that contract out their chip production.

Nvidia and AMD manufacture graphics processing units (GPUs), with Nvidia's GPUs holding the dominant market share and being in particularly high demand for enabling AI in data centers. Broadcom's custom AI chips, which are application-specific integrated circuits (ASICs), are also experiencing strong demand. Micron primarily manufactures memory chips, which are also experiencing an increase in demand driven by AI.

Roundhill Generative AI & Technology ETF

The Roundhill Generative AI & Technology ETF launched in May 2023. Unlike the VanEck Semiconductor ETF, this ETF is an actively managed fund. Its holdings are companies "actively involved in generative AI." This type of AI is currently experiencing significant growth. Its capabilities came to the attention of company executives and consumers when OpenAI released its ChatGPT chatbot in late 2022.

The Roundhill Generative AI & Technology ETF currently has 44 holdings. Its expense ratio is 0.75%, which is more than double the VanEck Semiconductor ETF's 0.35%. However, a higher expense ratio is to be expected for an actively managed fund.

|

Holding No. |

Company |

Market Cap |

Wall Street's Projected Annualized EPS Growth Over Next 5 Years |

Weight (% of Portfolio) |

3-Year Return |

|---|---|---|---|---|---|

|

1 |

Nvidia | $4.6 trillion | 41.4% | 6.90% | 1,070% |

|

2 | Alphabet (GOOG +0.48%)(GOOGL +0.69%) | $3.3 trillion | 16.7% | 6.55% | 191% |

|

3 | SK Hynix | Approximately $309 billion | N/A | 4.28% | 534%* |

|

4 | Microsoft (MSFT 2.21%) | $3.8 trillion | 17.8% | 3.95% | 117% |

|

5 | Advanced Micro Devices (AMD) | $402 billion | 44% | 3.89% | 236% |

|

Total top 5 |

N/A | N/A | N/A | 25.57% | N/A |

|

Overall ETF |

N/A |

Total net assets of $1.05 billion | N/A | 100% | N/A |

|

N/A |

S&P 500 |

N/A | N/A |

N/A | 77.8% |

Data sources: Roundhill Generative AI and Technology ETF, finviz.com, and YCharts. EPS = earnings per share. *Return in Korean won currency. Data as of Nov. 14, 2025.

Like the VanEck ETF, this ETF's top five holdings also include Nvidia and AMD, which I previously discussed.

Microsoft and Google's parent company, Alphabet, are heavily involved in generative AI. Both companies offer gen AI training and deployment capabilities through their cloud computing services. Both are also infusing gen AI into their product offerings. Moreover, Microsoft has a strategic partnership with OpenAI that involves owning a significant stake in the privately held company.

SK Hynix is a South Korean company that's listed on the Korean Stock Exchange. It does not trade on a U.S. exchange. It produces memory chips.