After decades of stagnation, nuclear energy stocks are riding a new wave of enthusiasm.

Startups like Oklo and NuScale Power, for instance, have shot up triple digits on the promise of supplying energy to AI data centers with small, modular reactors.

One company that doesn't get nearly enough press isn't a start-up but a well-established supplier of uranium -- Cameco (CCJ +7.73%). The stock has already climbed over 60% on the year, but with uranium demands expected to surge, this stock might be just getting started.

The coming surge in uranium demand

Cameco is one of the largest providers of uranium fuel for nuclear energy in the world, with operations that stretch from mining to refining to actual fuel services.

A uranium conversion facility in Port Hope, Ontario. Image source: Cameco.

In 2024, Cameco produced about 17% of the world's uranium, a figure second only to Kazakhstan company Kazatomprom (21%). The next closest company (Orano) produced about 11% of the world's uranium, which highlights the domination of the two companies on top.

Market control puts Cameco in a strong position to benefit off secular growth. Demand for uranium is expected to surge about 28% by 2030 and 100% by 2040, according to the World Nuclear Association (WNA), both of which could affect Cameco's top line.

NYSE: CCJ

Key Data Points

Uranium demand is one reason to get excited, but so is the White House's current support of nuclear energy. At the end of October, the reactor producer Westinghouse, which Cameco co-owns with Brookfield Asset Management (BAM +2.02%), inked a $80 billion deal with the U.S. government to make new reactors. Again, Cameco could see significant growth from this initiative.

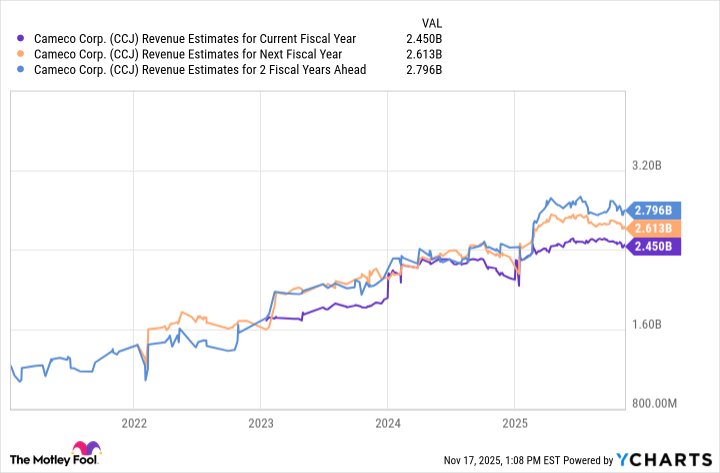

The backdrop is clearly favoring Cameco, but it's important to look at the full picture. At today's price, the stock trades at about 62 times next year's earnings, which is expensive. Meanwhile, revenue is expected to grow modestly over the next two years, but not explosively.

CCJ Revenue Estimates for Current Fiscal Year data by YCharts

Still, with the White House bullish on nuclear power, Cameco is one to watch. Less aggressive investors who want to capitalize on this trend might go for a nuclear energy exchange-traded fund (ETF) instead.