The definition of growth stock varies widely, but I think it should include all companies that are growing faster than the broader market. This sets the growth rate at about 10% or more, which is still a large section of the stock market. While growth stocks can be found in all corners of the market, the tech sector is a great place to look, as there are often some incredible companies with innovative technology rapidly taking market share.

I've got three fantastic growth stocks that look like excellent buys right now, and investors should consider scooping them up while they're still fairly cheap.

Image source: Getty Images.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (TSM +5.28%) is one of the primary beneficiaries of the artificial intelligence (AI) trend. Its chips are powering nearly every AI computing device right now, and that's unlikely to change anytime soon.

Taiwan Semiconductor has risen to this leadership position through constant innovation and best-in-class manufacturing practices. One new technology that's entering production is its 2nm (nanometer) chips. These chips consume 25% to 30% less power than previous generations when configured to run at the same speed. With energy consumption being a major concern in the AI arena, this development has the potential to be a true game changer.

NYSE: TSM

Key Data Points

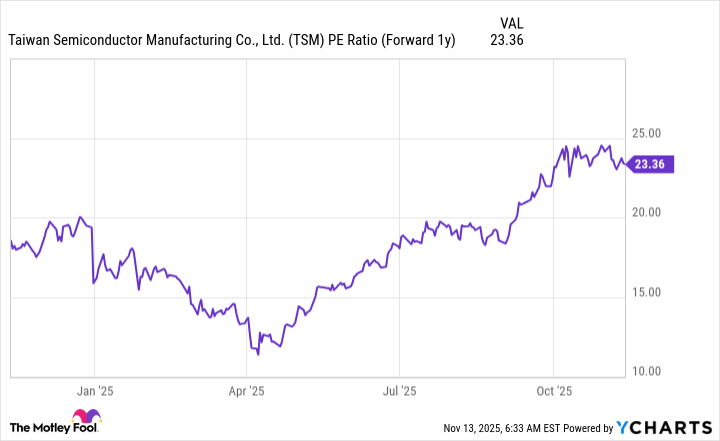

Even without it, TSMC is doing just fine. During the third quarter, its revenue rose 41% year over year in U.S. dollars. However, the stock isn't very expensive for that impressive growth, trading for 23 times next year's earnings.

TSM PE Ratio (Forward 1y) data by YCharts

That makes TSMC an excellent growth stock to buy now, and I think it could be slated for a monster run in 2026.

The Trade Desk

The Trade Desk (TTD 0.74%) has had a turbulent 2025. It has posted two quarters that weren't well received, which caused the stock to drop on two separate occasions.

The Trade Desk is an advertising technology company that helps ad buyers place their ads in the most optimal spot, whether that's on a podcast or on connected TV. This is a massive market that's continuously evolving, which is why The Trade Desk launched its next platform iteration, Kokai, which integrated AI features. However, this platform wasn't well received, and many clients have pulled back spending as a result.

This caused The Trade Desk's growth rate to drop, even though it still grew revenue at an 18% pace in Q3. The Trade Desk is improving its Kokai platform and looks to be righting its ship. However, the market hasn't given The Trade Desk the benefit of the doubt, and the stock trades for just 21 times next year's earnings.

That's a steal for this stock, and investors should be loading up on it while they still can.

MercadoLibre

MercadoLibre (MELI 2.01%) is often called the Amazon (AMZN 1.93%) of Latin America, but that also leaves out a key part of its business: payment processing. MercadoLibre also has a fintech wing, which allows it to incorporate aspects of PayPal into its business.

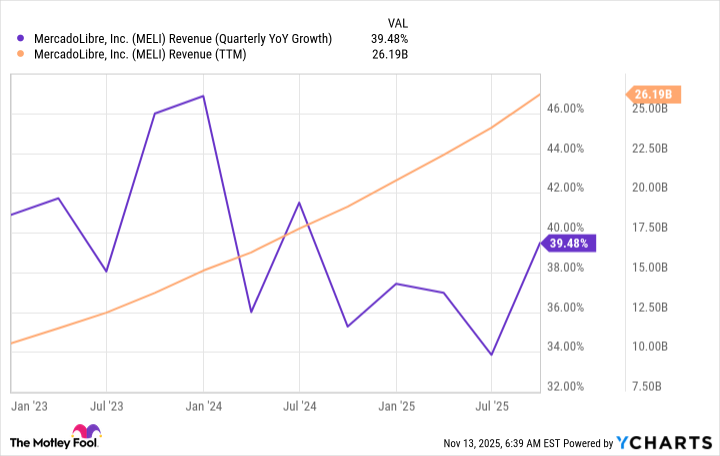

MercadoLibre has built a dominant e-commerce and payment processing empire in Latin America and has fended off several companies wanting to get involved in this space. It continuously posts excellent revenue growth, and that figure looks to be reaccelerating.

MELI Revenue (Quarterly YoY Growth) data by YCharts

An investment in MercadoLibre is a bet that Latin America will continue to shift more toward e-commerce -- a trend that has already played out in other parts of the world. With MercadoLibre down around 20% from its all-time high, it looks like an excellent growth stock to scoop up now before it returns to higher levels.

All three of these stocks could have an excellent 2026, and buying them now before next year arrives is a great investing move.