Many businesses are battling for supremacy in the rapidly evolving field of quantum computing. Two promising pure plays in the space are Quantum Computing Inc. (QUBT 2.50%), which also refers to itself as QCi, and Rigetti Computing (RGTI 1.35%).

Both companies' tech capitalized on the principles of quantum mechanics to build machines that can, as Rigetti says, "solve problems of staggering computational complexity at unprecedented speed."

Because of the fundamentally different approach they take to processing data and solving problems, in a host of unusual use cases, quantum computers should be able to produce answers dramatically faster than even the most powerful traditional supercomputers.

At the heart of any quantum computer are quantum bits, aka qubits. But there are numerous technological ways to create a quit, and QCi and Rigetti are making use of different ones. The question for investors looking to choose between the stocks may come down to

By delving into each business, investors can assess whether one of these companies is a worthwhile long-term investment in the exciting field of quantum computing.

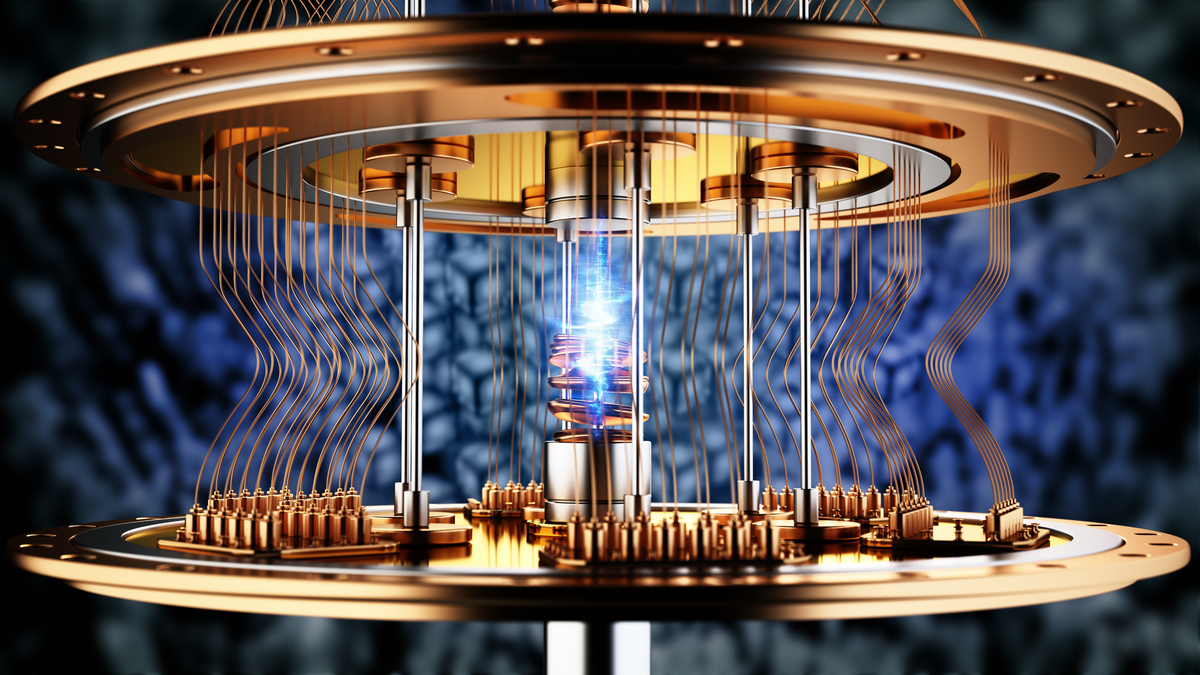

Image source: Getty Images.

A look into Quantum Computing Inc.

Quantum Computing Inc.'s tech creates photonic qubits -- in other words, it uses particles of light (photons) to hold and process data. That approach offers several advantages compared to rival technologies.

A big one is that photonic quantum computers can operate at room temperature. Rigetti's approach, which utilizes superconducting qubits, requires special cryogenic equipment to bring the computer's temperature down to close to absolute zero -- around negative 459 degrees Fahrenheit. That alone takes a lot of energy.

Moreover, QCi's machines are capable of quantum communication over long distances, allowing for computer networking. Rigetti's tech isn't as well suited for this, so it would require additional hardware (and spending) to enable them to network in the same way.

On the surface, QCi's photonic quantum computers appear to be the superior technology of the two. However, photonic qubits are even more difficult to control and preserve. As a result, they frequently produce errors that require correction.

Consequently, QCi's sales have been slim so far. In the third quarter, it generated about $384,000 in revenue. Since QCi is still building up its business, that minuscule top line wouldn't be a problem if not for its cash burn.

In Q3, the company's operating costs totaled $10.5 million, nearly double the $5.4 million it spent in the prior-year period. With relatively large and growing operating expenses compared to its revenues, QCi needed to procure more funding to keep the lights on. It did that with an equity offering in October that raised $750 million.

NASDAQ: QUBT

Key Data Points

How Rigetti Computing's business is faring

Rigetti's superconducting qubits require costly cryogenic equipment, but its quantum computers can currently perform more complex calculations than QCi's photonic machines. This means Rigetti's solution makes for better quantum computer processors capable of solving problems that its rivals' offerings would struggle with.

Moreover, Rigetti has adopted artificial intelligence leader Nvidia's NVQLink platform, an interface that allows quantum computers to connect with AI supercomputers. Such hybrid systems could accelerate the development and potency of AI.

As validation of its technology's appeal to customers, Rigetti produced $1.9 million in revenue in the third quarter, significantly more than QCi did. Rigetti also secured two purchase orders in September totaling $5.7 million. It expects to deliver those Novera quantum computing systems in 2026.

But Rigetti also isn't profitable, and it, too, is operating with a high cash burn rate. Its Q3 operating loss totaled $20.5 million. So Rigetti also engaged in an equity offering this year, selling stock to raise about $350 million. As of Nov. 6, the company held cash, cash equivalents, and investments of about $600 million on its books.

NASDAQ: RGTI

Key Data Points

Picking between Quantum Computing Inc. and Rigetti

Both companies' cash balances will provide them some time to ramp up sales as they continue to strengthen their respective technologies. So investors trying to weigh which is the better quantum computing stock to buy should next turn to comparing their share price valuations.

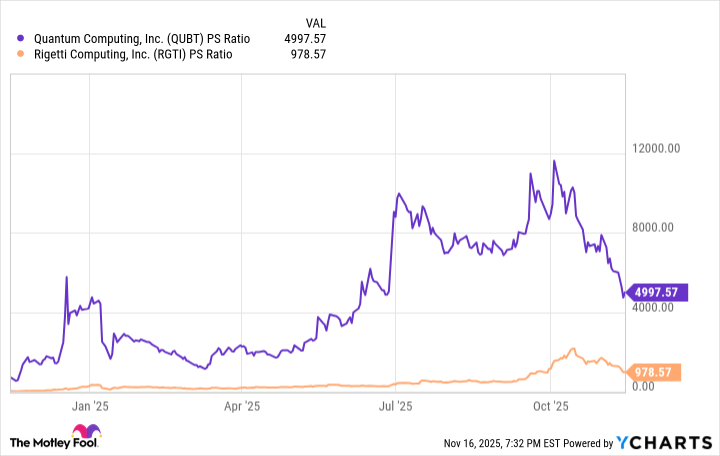

As neither has any earnings to measure, the most obvious metric to look at would be the price-to-sales (P/S) ratio, which indicates how much investors are willing to pay for every dollar of revenue a company has generated over the past 12 months.

Data by YCharts.

As the chart above shows, QCi's P/S multiple is dropping, but remains far greater than Rigetti's, which suggests QCi shares are vastly overpriced. While QCi's photonic quantum computers appear to hold great potential, the company's low sales suggest few customers are feeling compelled to buy them. Rigetti's revenue is far higher, and its recent purchase orders are an encouraging sign.

Given its lower stock valuation and higher sales, Rigetti looks like the superior quantum computing company to invest in over QCi at this time. Yet considering that both of their technologies are still in the early stages -- and both companies are burning through far more cash than they're bringing in -- buying either stock would only be an appropriate move for investors with a high risk tolerance.