Warren Buffett may be heading into retirement soon, but that doesn't mean he's taking his foot off the gas. Berkshire Hathaway (BRK.A 0.30%) (BRK.B +0.00%) just released its Form 13F, revealing a new position that most investors weren't expecting: Alphabet (GOOG +0.96%) (GOOGL +1.02%).

Alphabet is a leader in the artificial intelligence (AI) space with its top-tier generative AI model, Gemini. This marks Berkshire's first investment in a company that's leading in the AI realm (Apple doesn't truly have a great AI strategy). I think it's a genius move by Buffett and Berkshire, as it checks many of the boxes for what Berkshire likes to invest in.

Image source: The Motley Fool

Alphabet is a perfect company for Berkshire to invest in

At its core, Alphabet is an advertising business. It gets the majority of its revenue through linking ad buyers and sellers through its marketplace, but the kicker here is that it is the one selling the ad space on its own platforms.

That business model was challenged in court, and while Alphabet recently had to make some concessions, it's still intact. It's an excellent business model that is an evolution of the advertising model that used to exist with newspapers, an industry Buffett has invested in before.

Berkshire Hathaway has historically invested in companies that have steady cash flows, in simple businesses with strong brands. Alphabet checks those boxes, but there are others it doesn't check.

NASDAQ: GOOGL

Key Data Points

One of Buffett's famous quotes is that a "ham sandwich" could run Coca-Cola (KO +1.64%). Essentially, the business is so bulletproof that anyone could run it and be successful.

I'm not sure Alphabet checks that box, as it's involved in several dynamic industries that require excellent leadership to navigate. Among the businesses Alphabet is involved in are self-driving cars (Waymo), cloud computing, and AI. All these require excellent leadership and strong thinkers, and this may open up a new possibility: Alphabet isn't a Buffett investment.

Buffett isn't the only one making investment decisions in Berkshire Hathaway. Ted Weschler and Todd Combs manage a part of Berkshire's portfolio, and they are known to invest in more tech-adjacent businesses than Buffett. In fact, one of Berkshire Hathaway's most successful investments of all time, Apple, was initially purchased by these two. Buffett likely supports this purchase, as he once admitted he "blew it" by not investing in it early on.

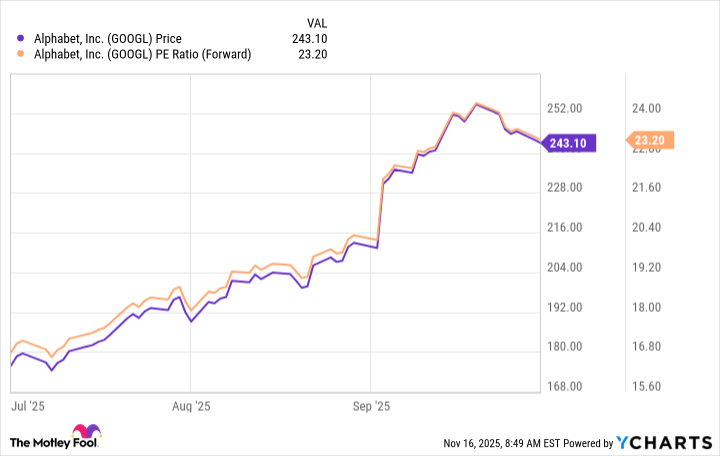

The last box most stocks have to check to become a Berkshire investment is the price tag, as they are well-known value investors. With the purchase coming between July 1 and Sept. 30, Berkshire likely scooped up Alphabet shares right before they soared.

Berkshire may have timed the purchase just right

Berkshire Hathaway and other companies that report their purchases on a Form 13F have up to 45 days to report their activity in the previous quarter. So, when investors hear about Berkshire investing in Alphabet, they must understand that it wasn't done yesterday; it was between July 1 and Sept. 30.

Until the announcement surrounding Alphabet's monopoly case and whether it may be broken up, Alphabet was trading at a cheap price tag. Once the judge presiding over its case announced the concessions Alphabet had to make and revealed that the company wouldn't be broken up, Alphabet's stock began to soar. We don't know exactly when Berkshire made its Alphabet investment, but given the company's past history of making value-based investment decisions, it's reasonable to believe that Berkshire might have gotten in before the stock took off.

The stock averaged about $200 per share during the quarter. That price corresponds to less than a 19 times forward earnings price tag, which would have been a great price to pay, especially because Alphabet is trading at 26 times forward earnings now.

Alphabet has proven that it will be a force to be reckoned with in the AI space. It also has successful businesses to fund its AI endeavors, and these cash flows are highly attractive to Berkshire. I think this was an excellent stock pick by the company, and investors can follow Buffett's lead and take a position in this dominant AI leader today.