One of the most important tenants of value investing is the ability to identify legitimate bargains and value traps. Think of it as separating the value wheat from the chaff.

Fortunately, spotting value trap hallmarks is easy. They include depressed price-to-earnings multiples, lumpy earnings trends, questionable moves by management, and difficulties containing costs, among other factors.

Altria stock is on a sale, but that doesn't mean it's a good deal. Image source: Getty Images.

The jury is still out, but it's possible tobacco behemoth Altria (MO 1.76%) could morph into a value trap over time. It could also prove to be the credible bargain some equity income investors have been searching for.

Altria has some highlights

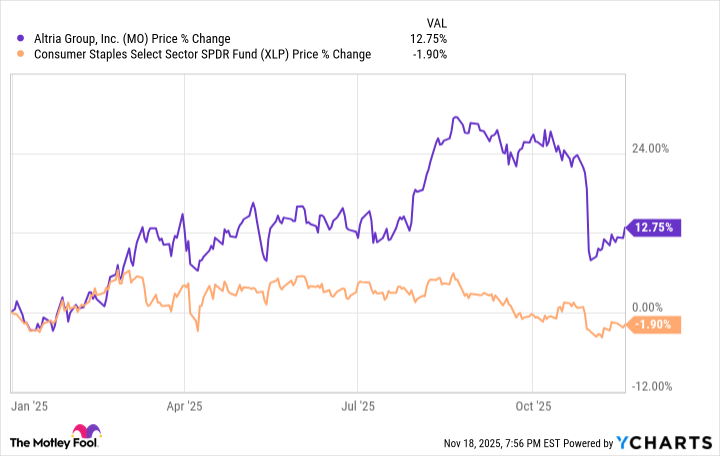

Altria, the company behind Marlboro cigarettes -- one of the tobacco industry's most iconic brands -- does have some compelling traits that shouldn't be ignored. For example, even after a 15% share price drop last month -- arguably stunning for a consumer-packaged goods (CPGs) name -- the stock still trounces the marquee exchange-traded fund (ETF) dedicated to that sector.

Data by YCharts.

That shows that Altria is performing admirably in a sector that's largely out of favor with investors. Plus, there's no denying the stock is inexpensive, as it trades at just 13 times earnings, and it maintains its status as a Dividend King (a company that has raised its dividend payout annually for 50 years in a row or more). The royal label is well-deserved, as Altria has boosted its payout 60 times in 56 years. As of Nov. 18, the stock yields 7.29%, or more than six times what investors earn with an S&P 500 ETF.

The good news for dividend investors is that Altria can likely support the payout because the company isn't overly leveraged. As of the end of the third quarter, its debt/consolidated earnings before interest taxes, depreciation and amortization (EBITDA) ratio was 2x. That's where Altria wants it to be, and if the company opted to direct more free cash flow to paring debt, that ratio would decline further.

Altria also gives investors reasons to be concerned

So as things stand today, it might be a stretch to say Altria is a value trap, or that the stock is on the cusp of slumping into a long-term bear market. That doesn't mean things are perfectly sanguine with this name, because they're not. Third-quarter results prove as much.

During the September quarter, Altria's net revenue dipped 3% as Marlboro shipments slipped 11.7% and overall U.S. cigarette volume tumbled 8.2%. Those are relevant data points because smokable products are expected to drive more than $8 of every $10 in Altria sales over the next several years.

No, Altria isn't dependent on cigarettes for 100% of its revenue, and yes, the company has made efforts to diversify its revenue stream. Problem is, those efforts have fallen flat. So much so that investments in Canadian cannabis producer Cronos were written down or, in the case of vape company Juul Labs, exited outright.

Those missteps are in the past, but they may give investors pause about Altria management's ability to guide the company into higher-growth categories, which is essential because in the U.S., cigarettes offer scant growth opportunities.