Watching what Warren Buffett and Berkshire Hathaway (BRK.A +0.16%) (BRK.B +0.28%) are doing is a popular investing strategy. While the CEO is stepping down at the end of the year and handing the reins to this trillion-dollar company to Greg Abel, he's still making investment moves.

At one point in time, Apple (AAPL 1.64%) made up over half of Berkshire's investment portfolio. However, management has sold off that position to raise cash and invest in some other businesses. During the third quarter, Berkshire continued this trend, selling nearly 42 million shares of Apple, reducing its holdings by about 15%. Still, Apple is its largest position and makes up over 20% of Berkshire's investment portfolio.

That sale allows Berkshire to add a new position to its investment portfolio: Alphabet (GOOG 1.11%) (GOOGL 0.77%). Alphabet is another trillion-dollar business and has been a long-term successful stock pick. I think this is a genius move, as Apple has been struggling to grow for years while Alphabet continues to grow even as its business has matured.

Image source: The Motley Fool.

Alphabet's long-term prospects are brighter than Apple's

Apple's product lineup mostly consists of consumer hardware, although it's making some waves in the streaming business. Alphabet's business revolves around advertising, but it also has other investments like cloud computing, self-driving vehicles (Waymo), consumer hardware, quantum computing, and generative artificial intelligence (AI). While Apple's business has been wildly successful, it revolves around trying to upsell to a consumer who's already strapped for cash. It hasn't released a new device that opens another market for Apple, and its artificial intelligence offering has largely been unsuccessful.

NASDAQ: GOOGL

Key Data Points

Alphabet's business units have been successful, even if they've reached full maturity. The Google Search engine has been around for decades, and many investors were worried about Google losing market share to AI earlier this year. However, Google has proven time and time again that it's a force to be reckoned with, and it won't quietly fade away. It has integrated AI search overviews into the search engine, seamlessly combining generative AI into traditional search -- the best of both worlds. Alphabet's cloud computing platform (Google Cloud) has also been a stalwart, and Q3 revenue rose 34% year over year.

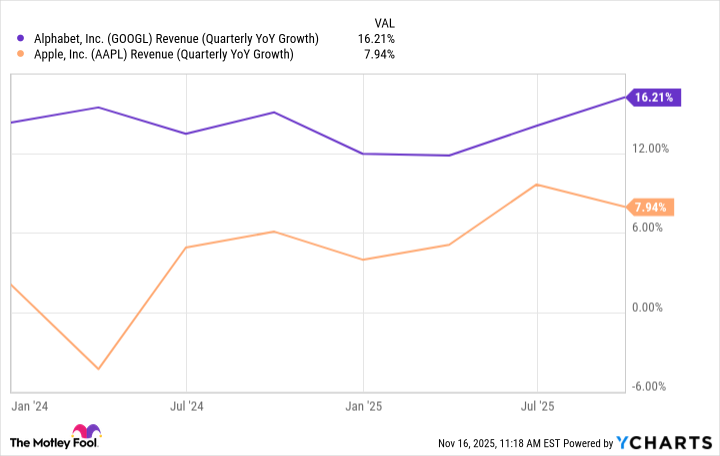

The strength and growth of Alphabet's business are apparent when compared to Apple's.

GOOGL Revenue (Quarterly YoY Growth) data by YCharts

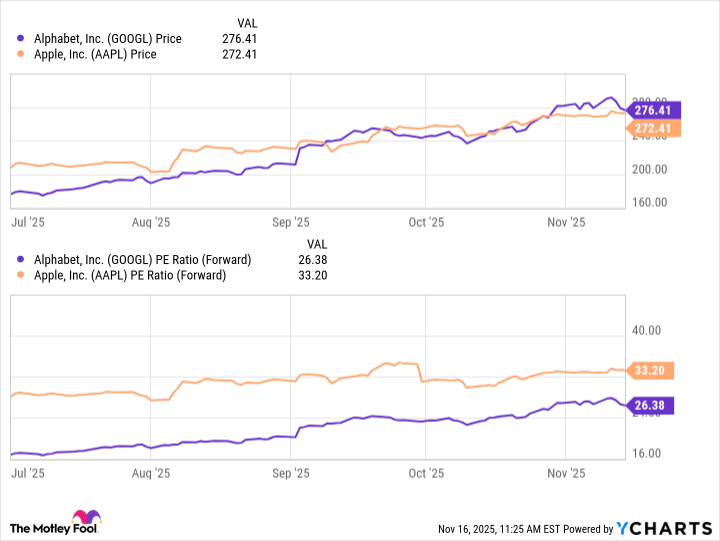

Alphabet has long posted stronger growth than Apple, and that pattern is unlikely to change unless Apple can launch a new innovative product. Despite this stronger growth rate, Alphabet's stock was far cheaper.

Berkshire's Alphabet purchase came a few months ago

Any company with more than $100 million in investments must file a Form 13F that discloses its moves. This information is made available to the public 45 days after the quarter ends. So, the price Berkshire paid for Alphabet and sold Apple at isn't what you can buy and sell them for today. This is something to keep in mind, as Alphabet's prices between July 1 and September 30 were generally much lower than they are now.

For instance, when Alphabet traded for $200 per share during August, it had a bargain price tag of about 19 times forward earnings. Now, it's more expensive at 26 times forward earnings. That's still a cheaper price tag than Apple despite significantly stronger growth and a brighter future.

As a result, I think investors can make the move to sell Apple stock and buy Alphabet, much like Berkshire did during Q3. However, you won't get quite as good a deal on Alphabet's stock as the market has gotten quite a bit more bullish on it since its monopoly court case was resolved, and investors have realized that Alphabet is an AI leader, not an AI loser. Alphabet is one of the top stocks to buy in the market, and this move by Berkshire proves it.