The release of Berkshire Hathaway's quarterly 13F filing with the Securities and Exchange Commission is always an exciting moment for Warren Buffett's followers. This public filing details trades by his holding company during the quarter, making for some great table talk and food for thought among investors.

Berkshire continues to sell shares of Apple, which wasn't a big surprise. It sold nearly 42 million in the third quarter, or about $3.2 billion worth. The iPhone maker remains the largest holding in the conglomerate's equity portfolio, but instead of accounting for nearly half of it, which it did not too long ago, it now accounts for 21%.

There was only one stock added to the portfolio in the third quarter, and it was definitely a surprise: Alphabet (GOOG 0.73%), parent company of Google. Berkshire bought almost 18 million shares, worth $4.3 billion, a small but not-insignificant position that accounts for 1.7% of the portfolio, about double Amazon's place in the portfolio.

Let's check out how Alphabet fits into the Buffett model.

Image source: Getty Images.

It's a high-margin, low-cost business

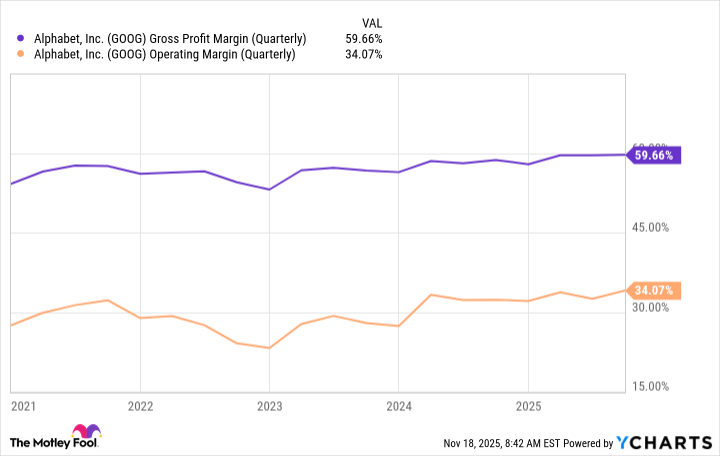

Buffett loves companies that don't need to spend a lot of money to make a lot of money. Alphabet has a low-cost model with a platform that can handle increasing demand without heavy investments, and it has strong gross margins and operating margins.

GOOG Gross Profit Margin (Quarterly), data by YCharts.

As Alphabet uses more artificial intelligence (AI) throughout its system, it's offering even more value for the millions of customers on its advertising platform, and revenue is increasing while AI is lifting more of the weight.

It has a moat

Everyone needs search services, and Google has a clear and dominant lead, providing the company with a robust economic moat. It is so far ahead of the competition that it wouldn't be possible for any challenger to get ahead in the near term, and management is investing in the company's AI and technology to stay ahead of the pack.

According to Statista, Google has more than 93% of search engine market share. It's leveraging that lead to make money through its advertising platform, but it also has a range of businesses, including a competitive cloud service and even devices like smartphones.

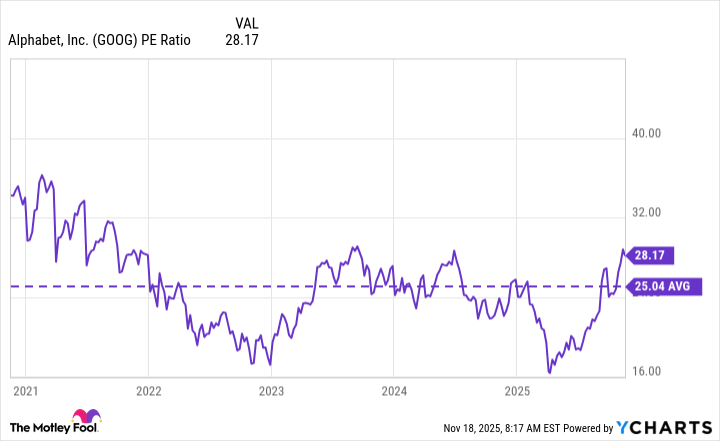

It's a good value

Alphabet stock trades at a price-to-earnings ratio (P/E) of 28, which could be attractive for new investors. There are a few things to keep in mind, though. First, it's above the company's three- and five-year P/E averages, which implies that now isn't the best time to buy.

GOOG PE Ratio data by YCharts.

Also, you'll note in the chart that it recently went higher. Berkshire Hathaway bought the stock somewhere between July 2 and Sept. 30, likely toward the beginning of that period when the market was still rebounding from the tariff plunge.

Average investors can buy at this price if they're holding for the long term. You can't time the market, although Buffett and his team are always looking to spot bargains, and that's something to emulate.

Apple vs. Alphabet

Buffett has lamented in the past that he didn't buy Alphabet earlier. "I made the wrong decision on Google," he said in 2018. He explained his prior reasoning: "I saw that Google was skipping past AltaVista [a popular early search engine], and then I wondered if anybody could skip past Google." But he says he should have noticed that its prospects were far better than the price indicated.

It's clear that Apple is still the favorite here. Buffett loves its ecosystem of devices, and unlike many tech investors, he likely prizes that it makes physical products. The new position was probably initiated by one of Berkshire's equity managers, Ted Weschler or Todd Combs, but Alphabet certainly fits the Buffett schema, and it could be a great choice for a solid and reliable tech stock.