Stock splits are exciting events that occur from time to time. While they're not nearly as common as they used to be due to the rise of the ability of retail investors to buy fractional shares, companies still perform these financial maneuvers, and for good reasons. First, stock splits open up investment opportunities to those who don't have access to fractional shares. Second, when a company has a lower share price, its stock can be used as a form of compensation for employees more easily, especially with options.

When companies announce splits, their shares often do experience a bit of a boost, as these moves generate extra enthusiasm among investors. They're also a bullish signal that management expects the conditions that boosted the share price in the first place will persist. But fundamentally, a split does nothing to increase the real value of the underlying company.

It has been a long time since Microsoft (MSFT 1.48%) has engaged in a stock split, but another one could be coming soon.

Image source: Getty Images.

Microsoft used to make a habit of stock splits

Microsoft last split its stock in 2003. That was a 2-for-1 split, when the stock was trading at a pre-adjusted price of $50 per share. With Microsoft's stock price close to 10 times that level now, it could be due for another stock split based on time alone.

Prior to 2003, Microsoft seemed to be splitting its stock every other year, with eight occurrences between 1987 and 1999. A few of those were 3-for-2 splits, but the most common was a standard 2-for-1 split. In those days, fractional shares didn't exist, so maintaining an affordable stock price was important, as it allowed companies to attract a broader group of investors.

That's not as critical now as fractional shares are available through nearly every brokerage; however, the ability to buy them is less common in international markets. Another factor that could drive Microsoft to split its stock may relate to stock options, which companies commonly use as part of their compensation packages for higher-level employees. Standard stock option contracts are for 100 shares, and 100 shares of Microsoft stock are worth about $48,000 now. But if the stock was $48 (as it would be after a 10-for-1 split, based on the current price), that options contract would be worth $4,800. That would give the company much more flexibility in using this form of compensation.

I don't know if a stock split is coming soon or not, even if Microsoft is long overdue for one. However, there are more fundamental reasons why Microsoft could be a great buy right now.

Microsoft's business is executing at a high level

During Microsoft's fiscal 2026 first quarter (which ended Sept. 30), its revenue grew by 18% to $77.7 billion. That's impressive. Even though Microsoft is one of the largest companies in the world, it can still grow at rates that make it a compelling investment.

It also became more efficient, with operating income increasing at a faster pace than revenue -- 24% year over year. Most of Microsoft's outsized growth came from its cloud computing division, which saw revenue rise 28% to $30.9 billion. Cloud computing infrastructure providers are huge beneficiaries of the artificial intelligence trend because many companies that want to make use of the technology are not well positioned to build and operate the hardware it requires. So, they rent data center capacity from a cloud computing provider like Microsoft.

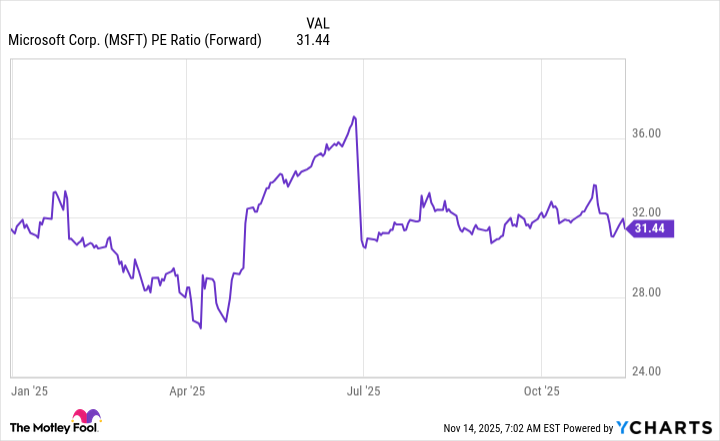

One issue some investors take with Microsoft is that it isn't the cheapest stock in the world. It's trading for about 31 times forward earnings, which isn't historically a cheap price tag.

MSFT PE Ratio (Forward) data by YCharts.

As a result, Microsoft could be at risk of a sell-off, particularly if there's a stock market correction driven by a loss of enthusiasm for AI-related investments. However, in my view, Microsoft would be bound to recover from an event like that due to its strong AI offerings and fantastic management. I think Microsoft is still a compelling investment right now, whether a stock split is coming or not.