Billionaire Stanley Druckenmiller is known for delivering long-term results to investors. At the helm of Duquesne Capital Management, he delivered an average annual return of 30% over three decades -- and never posted a money-losing year. That's why it's worth watching his investing moves, and today you still can do so as Druckenmiller, after closing the fund, continues to invest through the Duquesne family office. There, Druckenmiller oversees about $4 billion in securities.

And over the past year, this star investor has made a few shocking moves. Druckenmiller closed out positions in three of the world's most successful companies. In the third quarter of last year, he sold all of his Nvidia (NVDA 0.72%) shares, and he did the same with Palantir Technologies (PLTR 3.47%) stock in the first quarter of this year. Finally, in the most recent quarter, Druckenmiller dumped all of his shares of Eli Lilly (LLY +1.18%) -- and he opened positions in the two cheapest Magnificent Seven stocks. Let's check out the details.

Image source: Getty Images.

Reporting on Form 13F

So, first, a bit of background on these three top stocks that Druckenmiller sold in recent times -- and how we know about these moves. Investors managing more than $100 million in securities must report their buys and sells quarterly to the Securities and Exchange Commission on Form 13F. This is helpful for the rest of us because it offers us a peek into the strategies of some of the world's most successful investors.

Nvidia is the leading artificial intelligence (AI) chip designer, and this position has helped the company generate double- and triple-digit growth, with revenue reaching records. Palantir sells AI-powered software platforms that help customers make better use of their data -- so, thanks to Palantir, these customers can immediately apply AI to their real-world situations.

Eli Lilly sells one of today's most sought-after products: weight loss drugs. Its blockbuster portfolio is driving revenue growth, and these drugs remain in high demand.

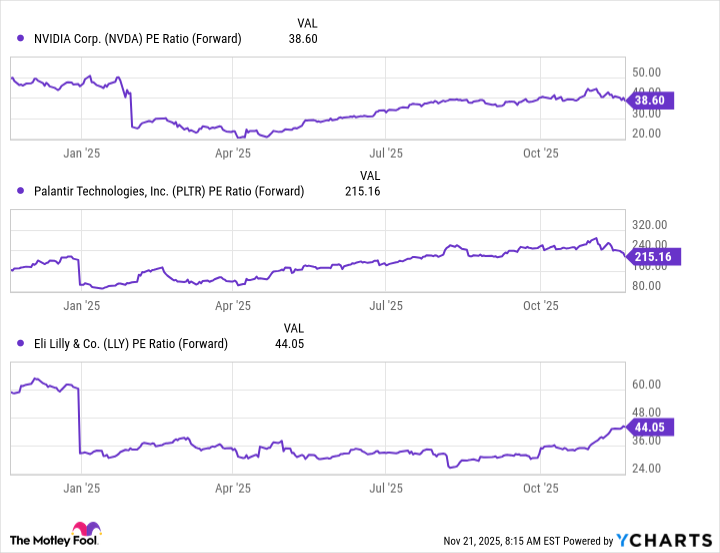

Over the past three years, Nvidia, Palantir, and Lilly have climbed 1,000%, 2,000%, and more than 180%, respectively. Valuations of Nvidia and Palantir have advanced in recent years, and Lilly's took off this year.

Druckenmiller, in an interview with Bloomberg last year, mentioned rising valuation as a reason for selling Nvidia shares. Though we don't know his reasons for selling Palantir and Lilly, it's possible that valuation played a role in those moves, too.

NVDA PE Ratio (Forward) data by YCharts

Druckenmiller's latest moves

Now, let's consider the stocks Druckenmiller bought in the third quarter:

- Druckenmiller opened a position in Alphabet (GOOGL 0.05%) (GOOG 0.02%), purchasing 102,200 shares. The stock is the 44th-biggest position out of his 65 stock holdings.

- The billionaire also opened a position in Meta Platforms (META 2.96%), buying 76,100 shares. The stock now is his 18th-largest position.

It's very possible that valuation may have been one of the reasons Druckenmiller scooped up these players -- they are the cheapest of the Magnificent Seven tech stocks that have driven market gains in recent years.

NASDAQ: GOOGL

Key Data Points

Meta trades for 22x forward earnings estimates, while Alphabet trades for 27x.

Companies that may benefit from AI

And for these prices, Druckenmiller gains access to two companies that may benefit from the AI boom. Meta, known for its social media apps such as Facebook and Instagram, is investing heavily in AI to boost the performance of these apps. The idea is to keep us on them longer. And the company is using AI to improve advertising results for advertisers across its platforms. All of this should result in higher ad spending, and this is key since Meta depends on advertising for growth.

Alphabet, like Meta, is using AI to keep advertisers -- its key source of revenue -- coming back. And Alphabet also offers AI products and services to customers through Google Cloud, its cloud computing business. This already is generating growth, pushing Google Cloud to a 34% revenue gain in the recent quarter.

So, should you follow Druckenmiller into Alphabet and Meta right now? If you're looking for potential AI winners at a bargain price, the answer is yes -- these companies have solid long-term earnings track records, which should reassure cautious investors, and the potential to supercharge your portfolio over time as the AI revolution reaches its next stages.