BigBear.ai (BBAI 8.70%) is a popular artificial intelligence (AI) stock pick due to its relatively small size. The idea behind this pick is that it's much easier for a smaller company to grow into a large one than a large one to grow into a behemoth. If BigBear.ai can develop a product that has widespread use cases, then it could easily grow into a large company, making investors a ton of money.

When looking for stocks that have millionaire-maker capabilities, I usually set the threshold at 100x returns, which would turn a $10,000 investment into $1 million. Does BigBear.ai have this capability? Or is there something that investors need to be aware of?

Image source: Getty Images.

BigBear.ai is focused on government solutions

BigBear.ai isn't targeting the civilian population with its products. Instead, it's looking at government and government-adjacent businesses (like airports) as potential clients. This can work, as Palantir got its start by offering artificial intelligence solutions to government entities. Its biggest contract is with the U.S. Army to create its Global Force Information Management-Object Environment system. This $165 million contract requires BigBear.ai to develop an application that allows the U.S. Army to ensure it has proper manpower, equipment, training, and resources for whatever task it is given.

That's a huge undertaking, but it raises a question: Will any other client be able to use this software? While you could make an argument that other military branches are potential clients, that's only a couple more contracts. That's a red flag for me, as BigBear.ai is more worried about developing custom, one-off solutions than creating a platform that can be deployed to multiple applications, like Palantir did.

NYSE: BBAI

Key Data Points

Another area where BigBear.ai is seeing some strength is airport security. This has a similar problem to the U.S. Army contract, as there are only so many airports as potential clients. Furthermore, security isn't necessarily a money-making industry; it's more of a necessity that airports aren't willing to pay an unlimited amount of money for.

One acquisition could change this issue with BigBear.ai.

In its Q3 earnings announcement, it reported that it would be acquiring Ask Sage, a generative AI platform that is made for the distribution of AI models and AI agents that are specifically built for defense and national security. This is a big deal because government employees and other secure industries couldn't use a standard generative AI browser in their work because those platforms utilize every input to train their model. If sensitive information was entered into the generative AI model, it could expose some national security data that shouldn't be in the public domain.

This acquisition is exactly what BigBear.ai needed to do, as it gives it more of a platform approach, rather than a consulting one. Furthermore, Ask Sage is rapidly growing at a greater than 500% year-over-year pace. BigBear's base business revenue declined 20% year over year to $33.1 million during Q3, so this acquisition is a welcome one for shareholders.

But is it enough to warrant buying the stock?

BigBear.ai has a margin problem

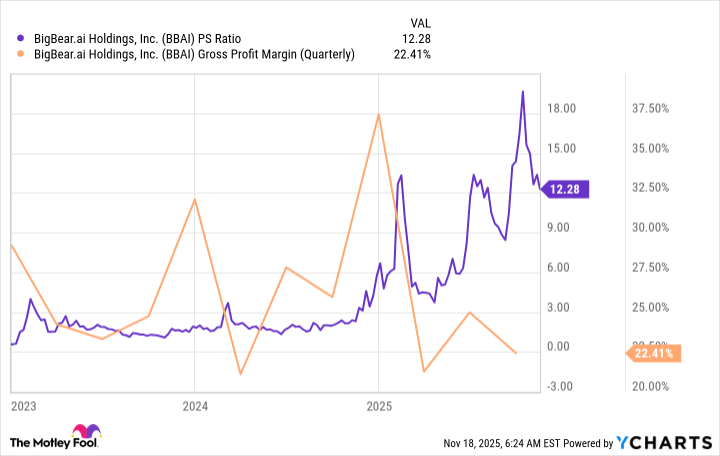

Unlike most software companies, BigBear.ai's gross margins are poor. This comes from needing to develop one-off solutions. Investors must be aware of these low margins, as they affect how the company is valued. Most software companies have gross margins between 70% and 90%, not the 20% to 30% range BigBear.ai often delivers.

BBAI PS Ratio data by YCharts

As a result, BigBear.ai should have about a third to a fourth less valuation than most software companies. With most software companies trading in the 10 to 20 times sales range, this makes BigBear.ai's stock far more expensive than it appears.

With the combination of declining revenue and an expensive price tag, BigBear.ai doesn't look like a successful stock pick. Although the Ask Sage acquisition is a step in the right direction, I don't think BigBear.ai has the capacity to become a millionaire-maker stock.