The artificial intelligence (AI) boom has been driving the S&P 500 to new heights this year, but some investors are wary of an AI bubble. The eight most valuable stocks in the U.S. market are AI-related stocks, and they account for nearly 40% of the S&P 500, a weighted index. That means their movements largely dictate how the index moves, regardless of what's happening with the remaining 490-odd stocks in it.

After hitting multiple records leading up to Nvidia's (NVDA 3.24%) earnings report last week, the S&P 500 has begun to decline. It could move back up at any time -- there are always dips and troughs. But it could be a signal that the AI bubble is starting to burst.

Is it time for investors to heed Warren Buffett's warning?

Image source: Getty Images.

What is Warren Buffett's warning?

Buffett may be the most successful investor of modern times. He's certainly the most popular one to watch. Most of the time, followers dissect his trading activity and weigh the pros and cons of his choices.

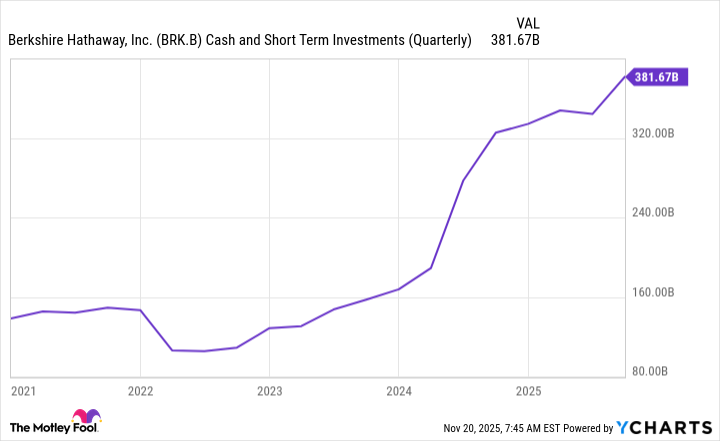

But there has been a significant change in his trading activity over the last two-plus years. He has built Berkshire Hathaway's (BRK.A 0.17%)(BRK.B +0.03%) cash stockpile to record levels, and it continues to rise. As of the end of the third quarter, Berkshire Hathaway has $382 billion in cash and short-term Treasury bills.

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts.

Buffett has indicated that there are not many great opportunities in the market today. This implies, or explains pretty directly, that the market is inflated.

The warning, as Buffett's cash reserve builds, is that it will eventually come down. It's pretty straightforward. It isn't something to fear; it's just the natural way the market moves over time. "That just happens periodically," he said of market crashes at this year's annual meeting. "The world makes big mistakes, and surprises happen in dramatic ways...That's part of the stock market."

NYSE: BRK.B

Key Data Points

Why is the S&P 500 falling?

The S&P 500 has been trending downward as concerns about an AI bubble intensify. Nvidia's impressive third-quarter earnings results alleviated some of those concerns, and the market rebounded following the release of the results. But it's still off its highs as companies pour trillions of dollars into AI and the market waits to see what happens next.

It could rebound, but any negative news could send it plummeting.

Should you invest today?

Buffett's cash build is something to take note of, but investors shouldn't interpret it incorrectly. Buffett is still buying. Not only did he buy more of some of Berkshire Hathaway's existing holdings in the third quarter, he also bought Alphabet stock for the first time. This AI stock is the third-most valuable company in the world.

I don't think Buffett would say to stay out of the market right now, or, frankly, ever. He frequently talks about his confidence in the U.S.'s future and says that the market is the greatest wealth-building machine on the planet.

NASDAQ: NVDA

Key Data Points

However -- and this also goes for investing at all times -- he counsels against buying overpriced stocks. The deafening warning signal is to be prepared for volatility and the possibility of a correction or a crash.

The silver lining is that with $382 billion available to invest, he likely anticipates some excellent buying opportunities for Berkshire Hathaway, which will be led by incoming CEO Greg Abel starting in January, should the market continue to head downward. Unlike some other investors, Buffett loves a market downturn because how else could he and his team get great values?

Buffett's still buying today, and every investor can find great bargains even in this market. Prepare your portfolio with strong value stocks that can withstand market volatility, and have some cash available to grab opportunities when they come up.