I won't argue that artificial intelligence (AI) stocks have not been overhyped in general -- they have been. Nor will I say that some of them are not significantly "overvalued" -- they are. (I put overvalued in quotes because there is no single definition for this word. It's pretty subjective.)

AI-powered data analytics company Palantir (PLTR +2.48%) is experiencing fantastic revenue, earnings, and cash flow growth. I believe it will be a long-term winner. Nonetheless, it's difficult to justify the stock's sky-high valuation, regardless of the valuation metrics employed. That said, stocks can remain in what many consider an overvalued state for an extended period, and eventually "grow" into their valuation. Therefore, I don't think investors who own this stock should sell it, as long as they truly have a long-term investment horizon.

SoundHound AI (SOUN +0.34%) is a better example, as Palantir is at least delivering powerful financial results, while this conversational AI specialist is not profitable and burning through cash. On some financial sites, folks get attacked if they're not SoundHound cheerleaders. There are also plenty of stock market writers who have hyped this stock and seem to "conveniently" not mention that its recent strong revenue growth is heavily driven by acquisitions, which is important for investors to know. We have no information on its organic revenue growth, as it has not been disclosed.

I could provide additional examples, but I won't. The point is that there is likely a bubble of some sort in the AI space. But this does not mean that ALL AI-related stocks are overvalued. Lumping such a diverse group together seems silly.

So, I'll accept that there is an AI bubble of some sort, but comparing it to the dot-com bubble of the late 1990s -- which burst in March 2000 -- as some stock market writers are doing, has one huge flaw.

There is a critical factor that is widely considered to be one of the main causes of the dot-com bubble bursting, which does not exist today: rising interest rates.

Image source: Getty Images.

Rising interest rates were a primary factor in the dot-com bubble bursting

Rising interest rates make more speculative investments and so-called growth stocks less attractive because they increase the cost of borrowing money. They also make relatively safer investments, such as bonds and dividend-paying utilities, more attractive.

The Federal Reserve raised interest rates six times from mid-1999 through mid-2000, boosting the federal funds rate from about 4.75% to 6.50%.

- June 30, 1999: Increase of 25 basis points (0.25%) to 5.00%

- Aug. 24, 1999: Increase of 0.25% to 5.25%.

- Nov. 16, 1999: Increase of 0.25% to 5.50%.

- Feb. 2, 2000: Increase of 0.25% to 5.75%.

- March 21, 2000: Increase of 0.25% to 6.00%.

- May 16, 2000: Increase of 0.50% to 6.50%.

As the chart below shows, the Fed continued to raise rates even after the dot-com bubble burst in March 2000, leading to a significant decline in the stock market. Not only did the Fed increase rates in May 2000, but it also raised them by 0.50%, rather than the smaller 0.25% increases that preceded it. This was akin to adding fuel to a fire.

I think it's safe to say that many economists believe the Fed made an error in its actions. Granted, it aimed to curb what it considered excessive speculation in the stock market, but its actions were too aggressive. Those actions not only tanked the stock market but also led to a U.S. recession that started in March 2001. That recession technically ended in November 2021. (If you believe we are now heading for a recession, here are some recession-resistant stocks to consider.)

Data by YCharts.

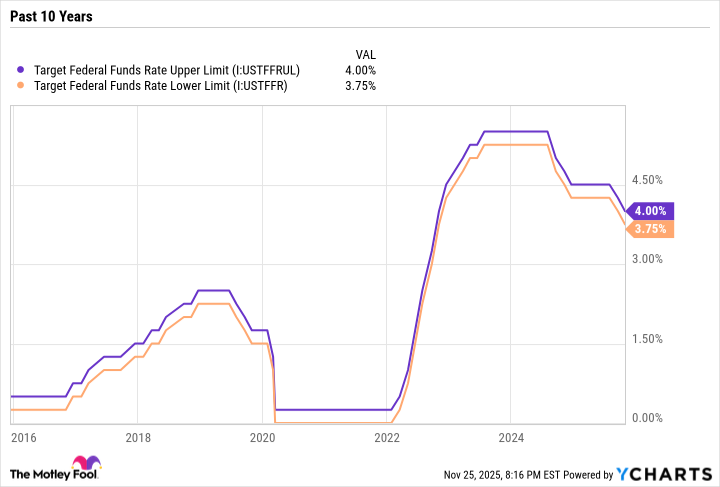

We are in a declining interest rate environment today

The Federal Reserve began lowering interest rates in 2024. It made these cuts in 2024:

- September 2024: Cut of 0.50% to target range of 4.75% to 5.00%.

- November 2024: Cut of 0.25% to 4.50% to 4.75%.

- December 2024: Cut of 0.25% to 4.25% to 4.50%.

So far in 2025, the Fed has lowered interest rates twice:

- September 2025: Cut of 0.25% to 4.00% to 4.25%.

- October 2025: Cut of 0.25% to 3.75% to 4.00%.

Data by YCharts.

The chart below provides a broader view of the federal funds rate target, spanning a decade of data. As you can see, rates are still relatively high compared to recent past rates, even if we exclude the extreme lowering of rates during the COVID-19 pandemic, enacted to help mitigate the risk of a recession.

Data by YCharts.

The probability of a Fed rate cut in December has significantly increased

A Federal Open Market Committee (FOMC) meeting is approaching soon. The Fed will meet on Dec. 9 and 10, and will announce its decision on interest rates on Dec. 10.

The good news for investors is that the odds of a Fed interest rate cut in December have increased significantly in just one week, partly due to comments from several Fed officials and the release of mixed labor market data.

On Monday, Nov. 24, the probability that the Fed will cut interest rates by 0.25% was 84.4%, with the probability of no change in rates at 15.6%, according to CME Group's FedWatch tool. Last Tuesday, Nov. 18, those numbers were 50.1% and 49.9%, respectively. (CME Group is the world's largest derivatives marketplace, providing futures and options trading for various asset classes.)