The artificial intelligence (AI) investment trend seemed to be on its way out in the middle of November, but has quickly rebounded. The reality is, AI investments aren't stopping, despite the market getting a bit tired of all the record-breaking capital expenditures being planned for 2026.

While this will cost the AI hyperscalers a ton of money, there are several companies that can capitalize on this spending spree. Two companies I believe will reap among the most rewards are Nvidia (NASDAQ: NVDA) and Taiwan Semiconductor Manufacturing (TSM 0.57%). Both stocks are excellent picks for December, as they could be primed to soar as the AI investment trend picks up steam heading into 2026.

Image source: Getty Images.

1. Nvidia

Nvidia has been the top stock pick in the AI realm over the past three years because its graphics processing units (GPUs) have become the go-to choice for nearly every company in the space, and that trend is unlikely to change anytime soon. The company grew its revenue by 62% during Q3 FY 2026 (ending Oct. 26), and also gave investors some incredible news during the conference call.

Management noted that they had visibility to $500 billion in Blackwell and Rubin (its flagship data center GPU products) between the start of calendar year 2025 and the end of 2026. Considering that Nvidia's trailing-12-month revenue total is $187 billion (which encompasses revenue from November 2024 to October 2025 and non-data center revenue), this indicates Nvidia could be in for monster growth in 2026.

NASDAQ: NVDA

Key Data Points

Looking beyond 2026, Nvidia expects annual global data center capital expenditures to reach $3 trillion to $4 trillion by 2030. That's an incredibly bullish projection, and has some investors questioning if that level of buildout is even possible. While I'm skeptical of the total dollar figure, I think the general direction is correct, which bodes well for Nvidia as an investment.

I think Nvidia is well-suited to be a winning stock pick throughout 2026. With many fund managers positioning their portfolios for 2026 in December, now is a great time to buy.

2. Taiwan Semiconductor

Nvidia and its competitors are known as fabless chip companies. This means they design the chip, but then outsource the work of producing it to a foundry like Taiwan Semiconductor. This places Taiwan Semiconductor in a neutral position in the AI arms race, as it benefits from increased spending regardless of whose computing units are being used.

NYSE: TSM

Key Data Points

Despite TSMC being in a neutral position, it has fantastic growth rates. In Q3, revenue rose 41% year over year in U.S. dollars. That's faster than nearly every large tech company (outside Nvidia), and that trend could continue as long as the AI hyperscalers continue to build out their computing capacity.

Additionally, if Nvidia's competitors start to steal market share, TSMC will still be OK, as it's most likely supplying them with chips as well. This makes TSMC a safer investment than Nvidia, yet its stock trades at a far lower premium.

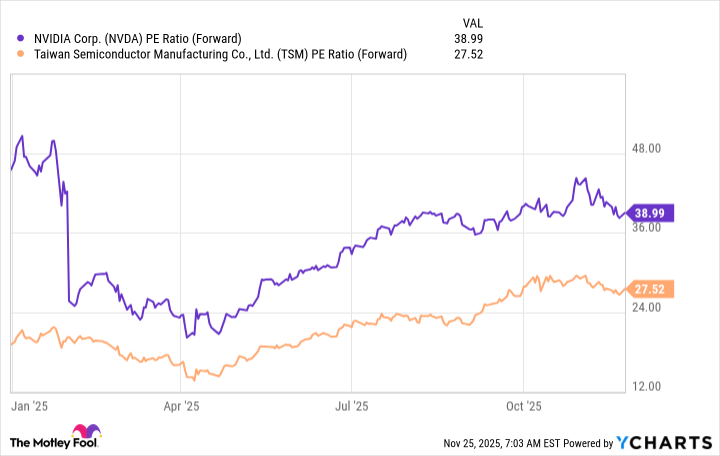

NVDA PE Ratio (Forward) data by YCharts

At 27.5 times forward earnings, TSMC is cheaper than Nvidia stock. However, I'm not going to make the argument that 27.5 times forward earnings is cheap in a broader market sense. However, with Taiwan Semiconductor's strong growth rates, this valuation is reasonable.

Another item that could boost Taiwan Semiconductor's results over the next few quarters is the launch of its 2-nanometer chip node. Management expects the 2nm chip node to consume 25% to 30% less power than previous-generation 3nm chips when configured to run at the same speed.

With energy availability becoming a huge bottleneck in the AI realm, this innovation will allow AI hyperscalers to increase their computing capacity while consuming the same amount of electricity. You'll see this new technology affect TSMC's finances later on in 2026, but I think it's smart to take a position now to capitalize on the massive growth Taiwan Semiconductor should put up over the next few years.