Although 2025 isn't quite over yet, most fund managers have already shifted their focus to 2026, and are adjusting their portfolios for the future. There are plenty of great growth stocks that look reasonably priced now and positioned to do well next year.

Here are six in particular that I think retail investors should consider taking positions in now, in case there is a Santa Claus rally to end the year.

Image source: Getty Images.

Nvidia

No list of good growth stocks would be complete without Nvidia (NVDA +1.08%). It has been the poster child of the artificial intelligence (AI) trend since the technology began to go mainstream in early 2023, and nothing has changed between then and now. Nvidia's graphics processing units (GPUs) are still the most popular hardware to run AI workloads on, and its financial results reflect that.

NASDAQ: NVDA

Key Data Points

During its fiscal 2026 third quarter, which ended Oct. 26, its revenue rose 62% year over year to $57 billion. Growth at that pace is unheard of for a company of Nvidia's size, and it doesn't look like its sales will slow down anytime soon. Nvidia told investors during its conference call that it has visibility of $500 billion in Blackwell and Rubin chips sales (its flagship data center GPUs) from the start of the calendar year 2025 to the end of 2026. For the remaining five quarters of that period, those expected sales amount to about $307 billion. Considering that Nvidia's trailing-12-month revenue total is $187 billion, that points to healthy growth again next year. As a result, I think it's a great stock to buy now.

Broadcom

GPUs are the best general-purpose accelerated computing units, but what if you know that some of your chips will only see one type of workload during their service? That's where custom AI chips from Broadcom (AVGO 2.82%) excel. The company develops its application-specific integrated circuits in direct consultation with the AI hyperscalers that will buy them to maximize performance for particular workloads, which reduces their cost.

NASDAQ: AVGO

Key Data Points

Among the best examples of this are the Tensor Processing Units that it collaborates with Alphabet (GOOG 0.88%) (GOOGL 0.92%) to make. Historically, Alphabet has used these chips for its internal computing needs or rented capacity on them to its cloud infrastructure clients through Google Cloud. However, Meta Platforms (META 1.01%) is reportedly now considering buying a quantity of them, which would be a bullish indicator for Broadcom.

2026 could be a huge year for Broadcom, making it a top stock to buy now.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (TSM 0.84%) manufactures the high-end chips designed by Nvidia, Broadcom, and their peers. This places the foundry leader in a neutral position in the chip space, making it a safer bet than either Nvidia or Broadcom.

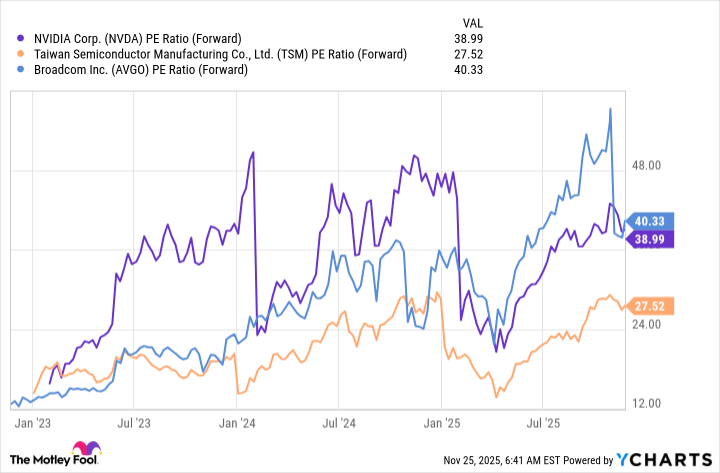

However, just because it's safer doesn't mean it's growing slowly. In Q3, TSMC's revenue rose by 41% year over year in U.S. dollars. Despite this trend and its neutral positioning, Taiwan Semiconductor actually trades at a discount to Nvidia and Broadcom, which I think makes it a compelling buy.

NVDA PE Ratio (Forward) data by YCharts.

Meta Platforms

Meta Platforms' stock has sold off sharply in the past month, partly in response to its high capital expenditure plans for 2026. The company is entering into some less-than-ideal financing agreements, including a complicated off-the-books joint venture deal, to fund its data center build-out plans. The market doesn't like any of this, which is why Meta's stock is down close to 20% from its all-time high.

While the market may not appreciate its capital expenditure plans, the company is actually delivering incredible results. In Q3, its revenues rose 26% year over year. I think the market will eventually come back around to Meta stock, making it a great one to invest in now.

Alphabet

Alphabet has quickly turned from an AI loser to an AI winner. Investors are starting to realize that its generative AI model is among the best available, and the company is integrating it seamlessly into its product ecosystem, including the Google Search engine. This has allowed Alphabet to deliver strong results, with revenue rising 16% year over year in Q3 and diluted earnings per share (EPS) rising 35%.

There's also the potential for Alphabet to start selling its TPUs directly to other companies. Sales of its AI accelerators to other data center operators could open up a brand new revenue stream for Alphabet in 2026, making it one of the more intriguing stocks to consider buying now.

Amazon

Amazon (AMZN +0.21%) hasn't had quite as successful a year on the market as most of its big tech peers. The stock is only up by around 5% for the year, while the S&P 500 is up by around 16%. However, that doesn't mean Amazon isn't growing.

NASDAQ: AMZN

Key Data Points

In Q3, Amazon's revenue rose 13% year over year on the back of a strong cloud computing business and an emerging advertising service segment. Both of these divisions are seeing strong tailwinds, and will continue to be difference makers in 2026. I think the market will come back around to Amazon's stock next year, making it a great stock to scoop up in December.