One effective way to earn solid, long-term returns is to invest in dividend-paying stocks since reinvesting the payout can help boost stock performance. However, they aren't all created equal, and while some might lead to superior returns over the long run, others will be wealth destroyers.

In which category does AbbVie (ABBV 0.31%), a pharmaceutical giant, belong? Can the stock set investors up for life? Let's find out.

Image source: Getty Images.

A terrific track record

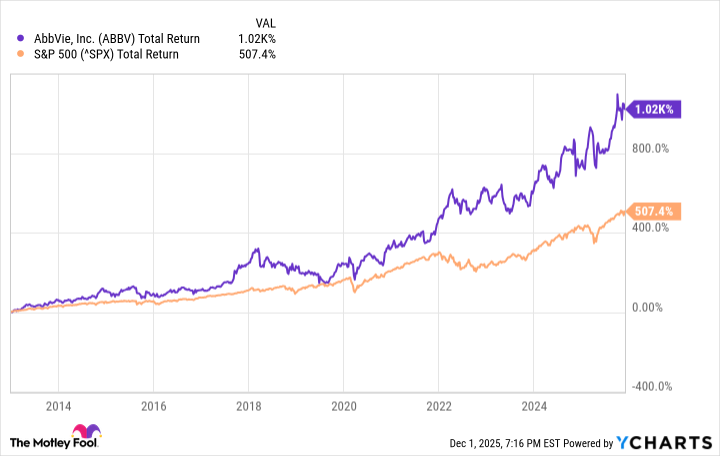

AbbVie split from its former parent company, Abbott Laboratories, and became public in 2013. Since then, the company's returns have beaten those of the S&P 500.

ABBV Total Return Level data by YCharts

Here are four factors that led to this strong performance. First, AbbVie successfully protected its most important medicine, immunology drug Humira, against biosimilars. AbbVie kept cheaper copies at bay by filing additional patents and winning patent-related lawsuits.

Second, AbbVie innovated. It launched new products that took over once Humira eventually hit a patent cliff. The most important were Skyrizi and Rinvoq, two other immunology medicines. Third, AbbVie resorted to acquisitions to bolster its lineup and pipeline.

Finally, thanks to a solid underlying business, AbbVie significantly grew its dividends, and shareholders who reinvested those saw significantly stronger returns.

NYSE: ABBV

Key Data Points

Why AbbVie can pull it off again

AbbVie is a Dividend King, a company that has raised its payouts for at least 50 straight years, including the time it spent under Abbott. There is little chance the pharmaceutical giant will stop hiking its dividend anytime soon. Furthermore, AbbVie continues to generate excellent returns and boost its guidance, largely thanks to Skyrizi and Rinvoq, which are expected to support top-line growth until the mid-2030s.

Lastly, AbbVie has a deep pipeline of products across multiple therapeutic areas and is, no doubt, already planning for life after its current main growth drivers. AbbVie possesses many of the qualities necessary to generate superior long-term performance, as well as a dividend that can help enhance returns. The company can help investors establish a solid foundation for their financial future as part of a well-diversified portfolio.